Key points

This article is part of our Environmental, Social and Governance (ESG) series. See more material here

China’s Energy Paradox

By Ben Buckler, China investment specialist

China poses a conundrum when it comes to climate change.

The country is the biggest emitter of greenhouse gases, its energy mix is heavily skewed towards fossil fuels, and it used more cement between January 2019 and December 2020 than the US did in the entire 20th century.

But a large part of China's energy use results from making goods for other countries that have effectively 'offshored' the associated emissions.

Moreover, China leads the globe in terms of renewable energy investment and is home to some of the most important companies laying the foundations of a net zero future.

So, emissions offender or climate saviour – how should we characterise China?

1. Carbon culprit…

China is the world’s biggest emitter of carbon dioxide

Source: Global Carbon Atlas. Friedlingstein et al. (2021), Andrew and Peters (2021)

China emitted more metric tonnes of carbon dioxide in 2020 than the US, EU and India combined.

Calculated on a per capita basis, China's emissions rose by 178 per cent between 2000 and 2020, outpacing a global increase of 9 per cent.

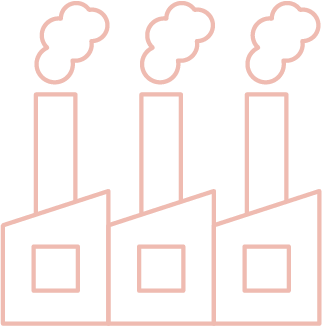

However, on this measure it still ranks below dozens of other nations.

Per-capita carbon emissions in 2020 (tCO₂/person)

…but shifting to a

greener energy mix

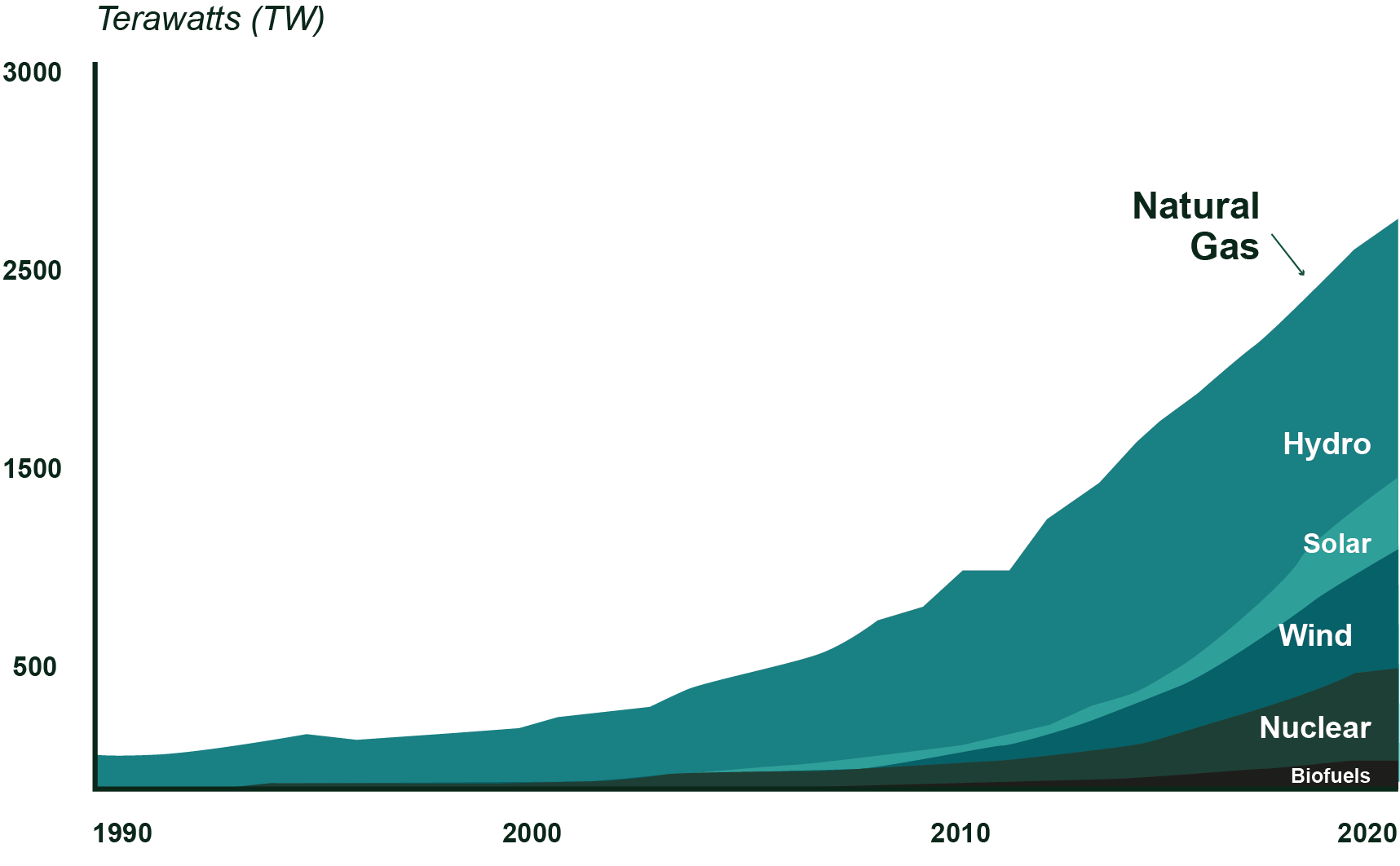

Renewables and nuclear form a growing share of China’s energy mix, as does natural gas, the cleanest of the fossil fuels.

China’s electricity generated by renewables, nuclear and gas

Source: IEA World Energy Balances (All rights reserved)

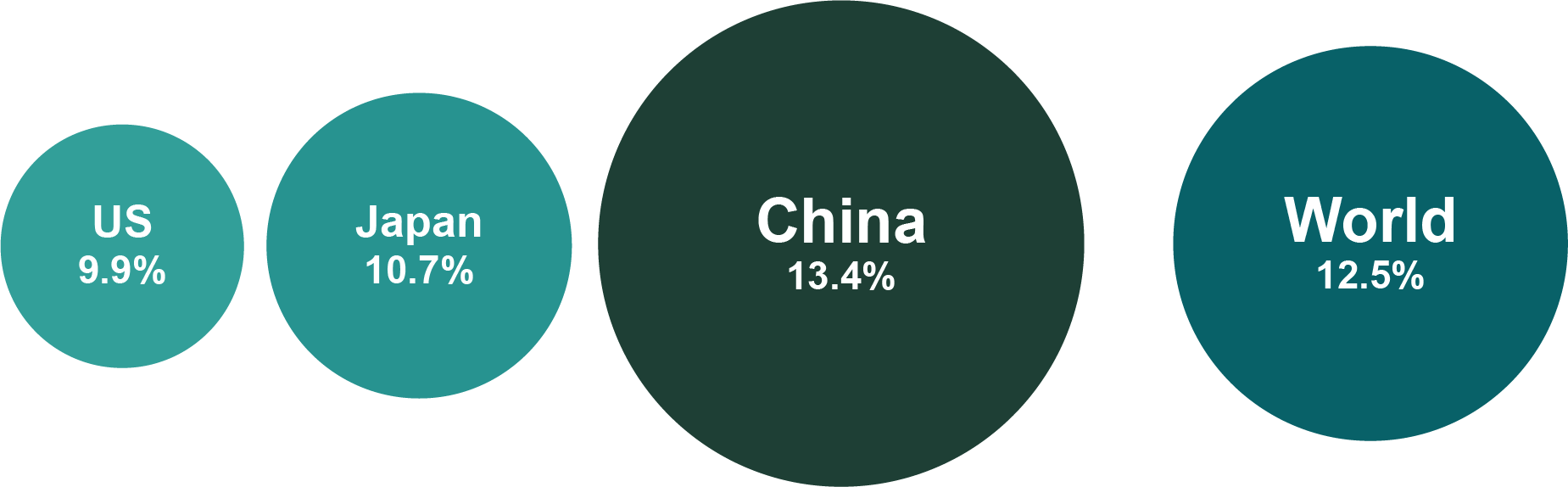

China sources a higher proportion of its energy supply from renewables than the world's other two largest economies and also surpasses the global figure. But there is still a long way to go.

Percentage of primary energy consumption

provided by renewables in 2020

Source: BP Statistical Review of World Energy 2021

Following China’s pledge to be carbon neutral by 2060, the International Energy Agency (IEA) has forecast that renewables may provide 60 per cent of the country's ‘primary energy’ supply by that date and nuclear a further 15 per cent.

Primary energy refers to energy in its original form, before any conversion or transformation to another state - such as being turned into synthetic gas, petrol, battery storage or electricity.

2. Coal dependent…

Much of China’s emissions come from coal-fired power plants – coal is the worst of the fossil fuels in terms of CO₂ per unit of energy. And many of the facilities are relatively young, suggesting they could stay in service for decades yet.

CO₂ emissions from coal-fired power plants in China by age of plant

…but net zero pioneer

However, China is exploring ways to re-engineer some of its coal boiler infrastructure to convert the facilities into nuclear reactors.

While that remains at an experimental stage, China also leads the way in other forms of net zero energy production, including wind.

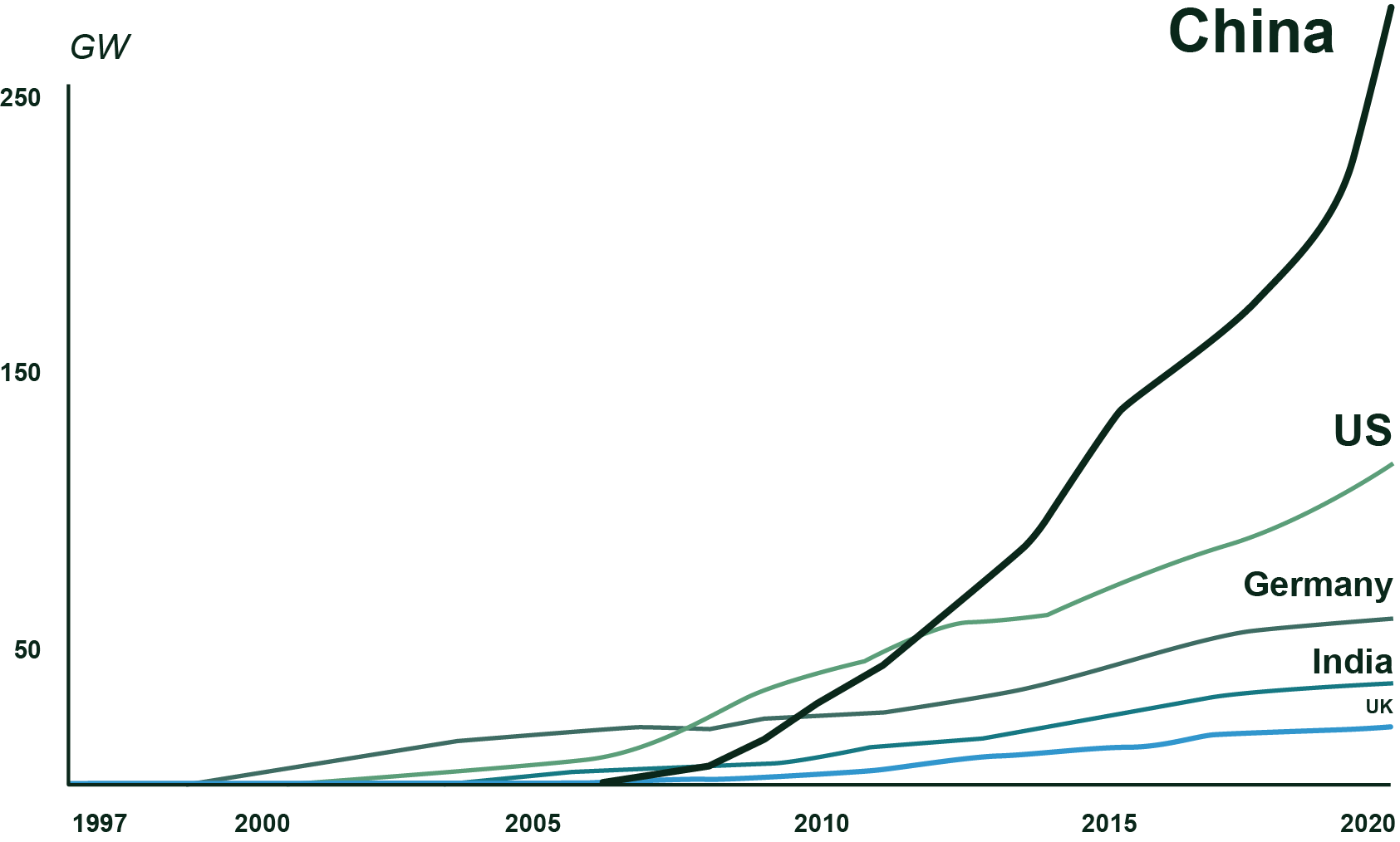

Installed wind energy capacity

China has long had more onshore wind-power capacity than any other country. But until recently, the UK led in terms of turbines based offshore.

That changed in 2021, when China built more offshore capacity in 12 months than the rest of the world had achieved in five years, securing it the top spot in both categories.

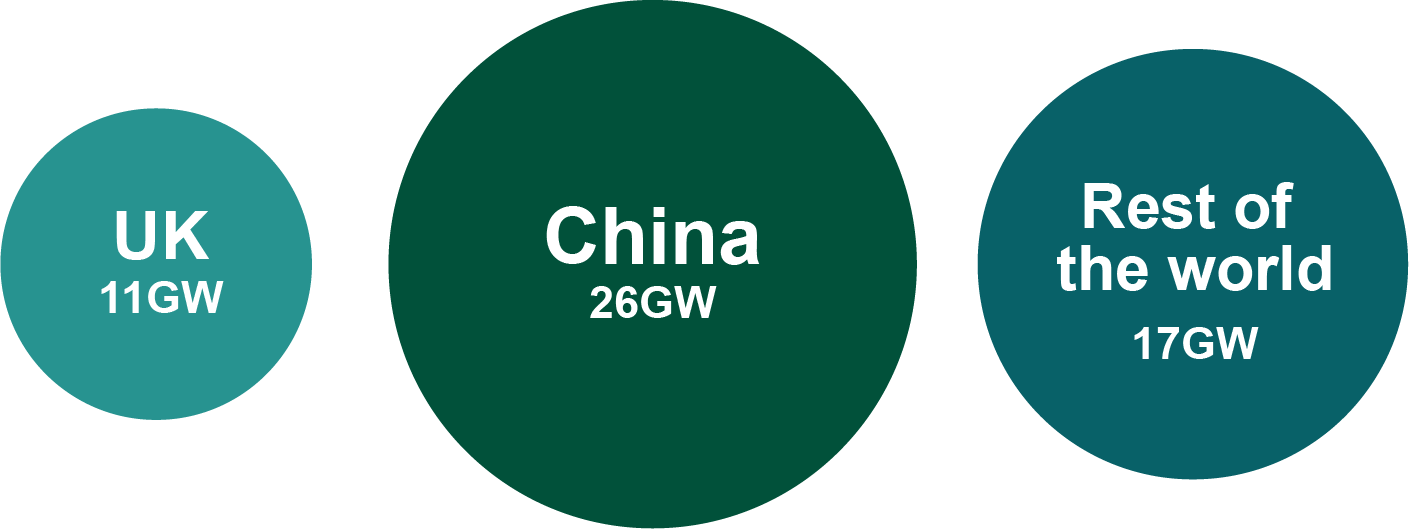

Offshore wind power capacity in early 2022

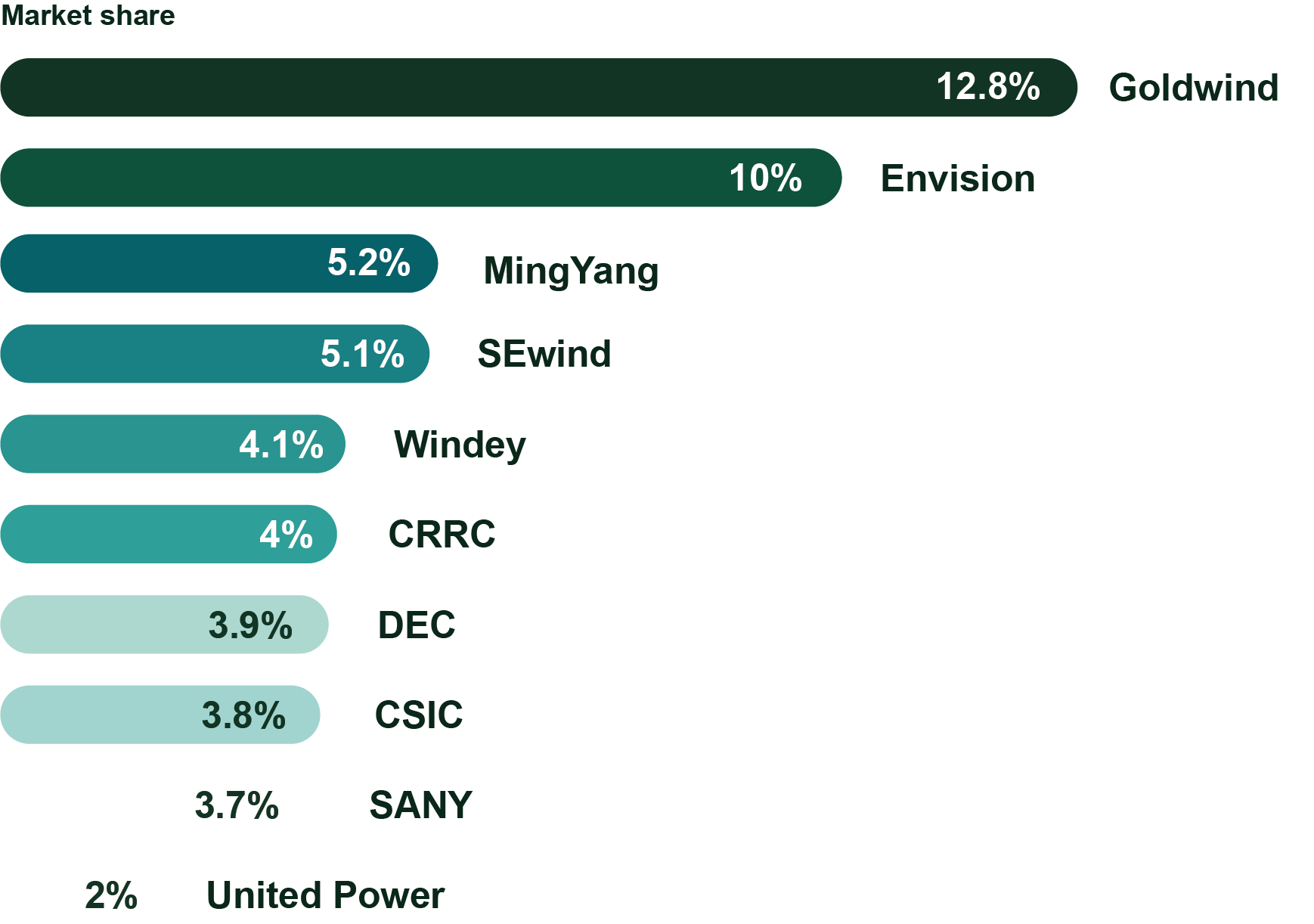

In terms of global market share, Chinese wind turbine makers dominate the sector.

Ten of the 15 top companies were Chinese in 2020, accounting for 58 per cent of global installations.

Wind turbine manufacturers' market share in 2020

Chinese wind turbine makers

Non-Chinese wind turbine makers

3. Energy importer…

China’s consumption of oil and gas has been growing faster than domestic production, making it more reliant on imports.

The growing gap can be used to calculate an ‘imports dependency rate’ for each type of fuel. It does not take account of China’s energy exports or reserves, but gives an indication of its increasing reliance on overseas suppliers.

China’s reliance on fossil fuel imports

Crude oil

Natural gas

…but big spender on

eco-friendlier solutions

Decarbonisation is China's strategic opportunity to deliver comprehensive industrial, financial, technological and geopolitical leadership.

It is already spending more on the shift to renewables and related low-carbon solutions than any other nation by a wide margin.

Energy transition investment in 2021 ($bn)

China’s low-carbon transition spend was 60 per cent higher in 2021 than in 2020. A breakdown reveals that the bulk of the investment went into renewable energy and electrified transport. But significant sums were also directed to sustainable materials, which include bioplastics and recycled products.

A breakdown of China’s energy transition investment in 2021

4. Construction challenge…

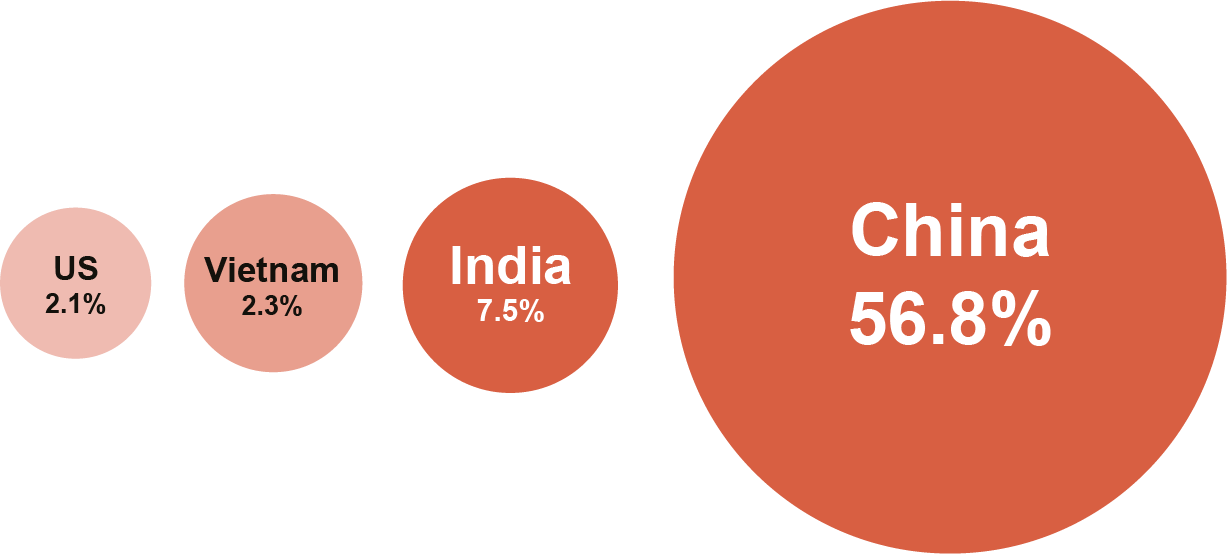

China leads the way in cement – a major source of carbon emissions.

It is both the world’s largest cement producer and consumer, and in each year of the 21st century to date has manufactured more of the substance than the rest of the world combined.

Share of world's cement production in 2021

…but solar power champion

China also dominates manufacturing of a more eco-friendly product: solar cells. These convert sunlight into electricity and form the basis of solar panels mounted onto buildings or arranged into large grids on the ground.

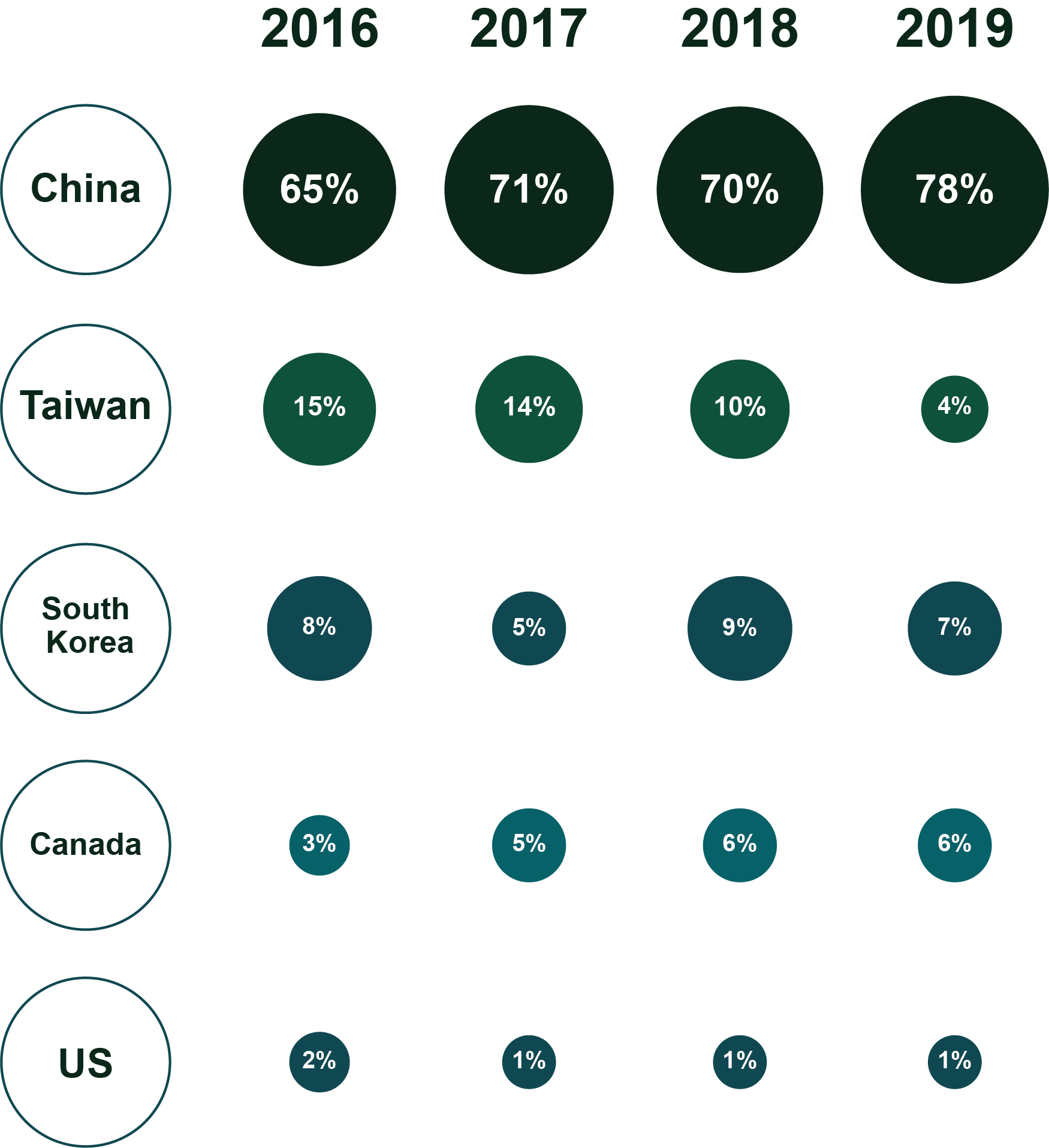

Share of global solar cell production

5. Petrol guzzler

There has been a big rise in China’s transport-related energy use, partly because more people are living in cities. Most of the vehicles involved remain dependent on petrol or diesel.

China’s transport energy consumption

…but electric car trailblazer

China is leading the world in terms of putting more electric vehicles (EVs) on the road. Sales there nearly tripled in 2021 and were greater than the entire world’s tally in 2020.

Electric vehicle registrations in 2021

Source: IEA, Global sales and sales market share of electric cars, 2010-2021, IEA, Paris

China is also enabling other parts of the world to switch to EVs thanks to its deep investment in car battery technologies.

Five of the world’s 10 biggest EV battery makers are based in the country, including CATL. It has outranked its rivals for five years in a row in terms of installed battery capacity.

Top 10 electric vehicle battery makers’ share of global market in 2021

6. Major miner…

China’s investment in renewables and energy storage technologies means it has a voracious appetite for the minerals required to build them.

Forecasts suggest global demand for some mined substances will soar over the coming decades.

Projected increase in global annual demand for minerals from energy technologies between 2018 and 2050

Forecast based on countries aiming to limit global warming to a 2C rise by 2100 over pre-industrial levels

China’s domestic mining industry leads production of many of these energy transition minerals. But for some – including cobalt, nickel and manganese – the country is more reliant on imports.

Whether at home or overseas, the production and processing of these substances contribute to global warming, as well as other environmental and social issues.

These include dangerous working conditions, hazardous waste, water scarcity, loss of biodiversity and corruption.

China’s share of global mining production in 2021 (estimated)

…but readying for recycling

Among the UN’s Sustainable Development Goals is an aim to increase the circular use of resources, including cutting electronic waste by developing advanced recycling techniques.

Spent electric vehicle batteries will soon pose one of the biggest challenges – and opportunities.

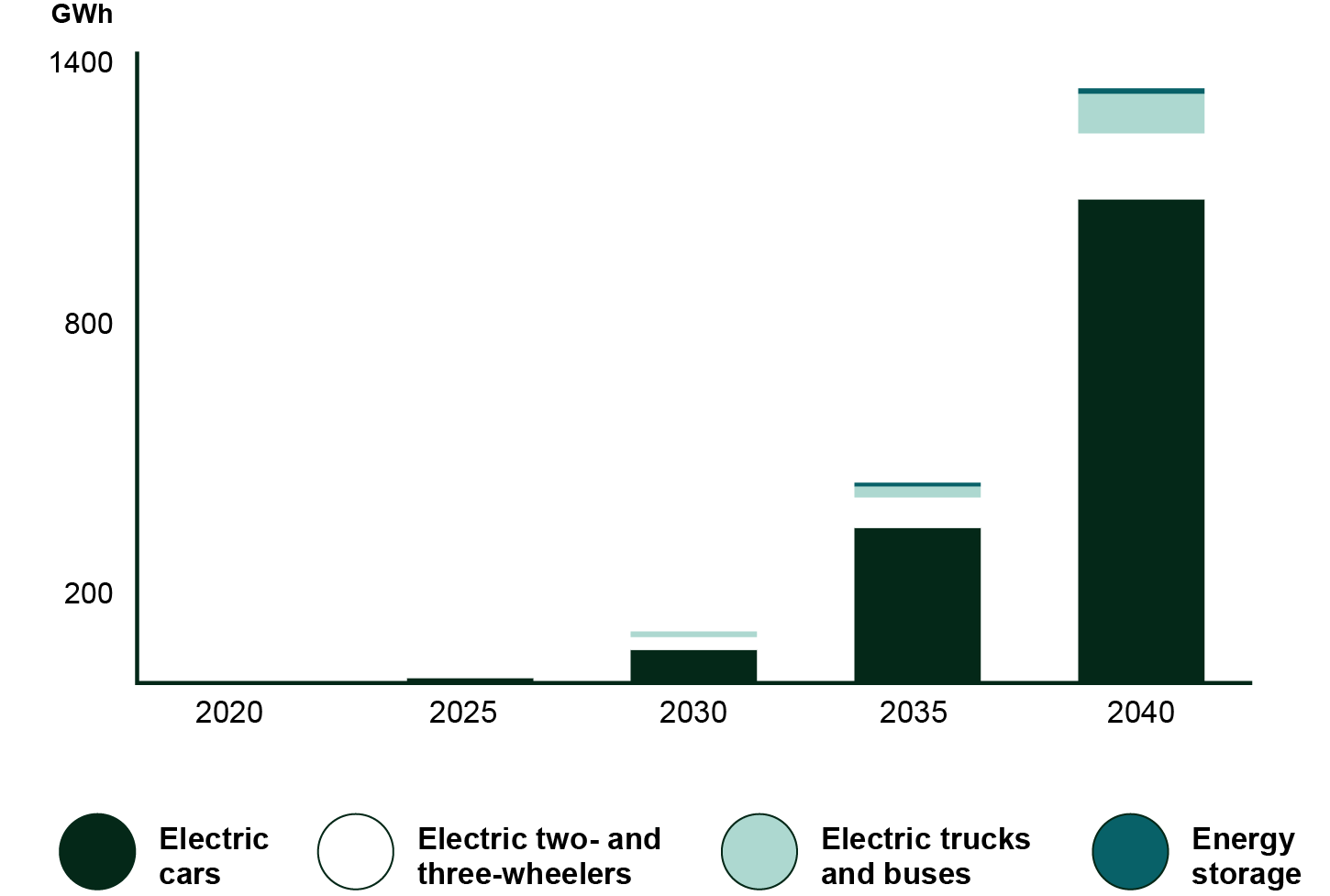

EV and other storage batteries reaching first end-of-life measured in terms of energy

Source: IEA (All rights reserved)

Based on World Economic Outlook 2021 Sustainable Development Scenario

China’s regulators were among the first to act on this. They introduced rules in 2018 making EV makers responsible for collecting and recycling their batteries. They have since issued further directives specifying minimum mineral recovery rates, among other details.

This has encouraged investment into the sector, including CATL’s recent announcement of a $5bn battery material recycling facility in the central province of Hubei.

But even before the firm revealed that plan, China already led the crowd.

Existing and announced lithium-ion battery recycling capacity in 2021

Conclusion

We hear much about China’s carbon emissions, coal dependency, energy needs and construction activity.

But absolute numbers and broad generalisations can blind us to the speed of change – the country is making giant strides to tackle emissions by investing in renewables and related eco-friendly innovations, many of which can benefit decarbonisation efforts worldwide.

For China, this is an opportunity to take a leadership position in solving one of the biggest 21st-century challenges. And a growing number of Chinese companies are becoming global champions in relevant industries.

As investors focused on long-term growth opportunities, we are excited and optimistic about the role they might play in creating a greener, more sustainable future.