Key points

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Modern art comprises many movements. Impressionism led to expressionism, then cubism. Banal objects were turned into pop art by Warhol and Lichtenstein. Banksy made the streets his canvas.

The art world and the investment world have much in common. Entrepreneurial business leaders are like artists: driven visionaries creating long-term value out of nothing. The team at Long Term Global Growth see ourselves as curators, hand-picking the companies we judge likely to be widely admired over time. Like the artists themselves, the curators appreciate the colours, composition and form of a canvas, or the materials and textures of a sculpture. However behind every choice is a myriad of influences which produce the end result.

For the ‘artist’ business leader, these influences determine the type of enterprise they pursue and the values they adhere to. For the investment ‘curator’, what matters most is the choice of works to put on display, when, and for how long. We call this the art of ‘portfolio construction’, and it is more art than science. There’s no formula, any more than there’s a single number that captures a valuation or a degree of risk.

Avant-garde thinking

Like the art world, the investment world sees ‘movements’ come and go. In 2004, Long Term Global Growth led Baillie Gifford’s charge to transformational growth. The aspiration was to create a concentrated portfolio of companies, managed by a decision-making team that saw the whole picture, ultimately producing compelling returns for clients. This was in sharp contrast to the benchmark-clinging, stalwart-seeking portfolios then in vogue.

Our belief was that the industry could no longer deal with the behavioural and emotional challenges of today’s capital markets. Why? Noise and lots of it. We are besieged by news, data and opinion, spurring rapid, usually pointless, action. The average holding period for companies on the NYSE is around eight months. In the 1950s and 60s it was eight years. We wanted to ensure we stayed patient, ready to benefit from the outsized returns of extraordinary company progress.

Rather than risk being hypnotised by the incessant noise, it’s more useful to think about the underlying changes impacting our world in the next decades. Knowing that most information doesn’t matter in the long-term, we try to escape the markets’ echo chamber and seek other sources of insight. Far more valuable, we think, than regurgitating Bloomberg clickbait.

Then there’s optimism. You might think a Scottish firm would struggle with this, given our ‘dreich’ cultural environment. But the attraction of equities is that the upside is theoretically unconstrained. Returns will always be driven by the handful of investments where things have gone right. At LTGG we were certain that long-term success required risk-taking and ambition, not caution and focus on the downside.

Rather than risk being hypnotised by the incessant noise, it’s more useful to think about the underlying changes impacting our world in the next decades.

Principles and guidelines

From the short, quick brushstrokes of Monet and the impressionists, to the abstract geometry of cubists such as Picasso, each artist gives subtle clues to their inspiration. Creativity can roam free, but movements are defined by their own principles and guidelines.

When Mark Urquhart and James Anderson conceived Long Term Global Growth 16 years ago, they saw an opportunity to invest with total freedom. But they believed passionately in following a few principles from day one.

These principles led them to:

1. Identify revenue and earnings growth (as share prices follow fundamentals)

2. Ignore large chunks of the index (most companies don’t matter)

3. Stop apologising for short-term underperformance (it’s inevitable, and volatility doesn’t equal risk)

4. Avoid trading a lot (it’s expensive and erodes returns)

5. Stop worrying about economic and market forecasting (it’s meaningless)

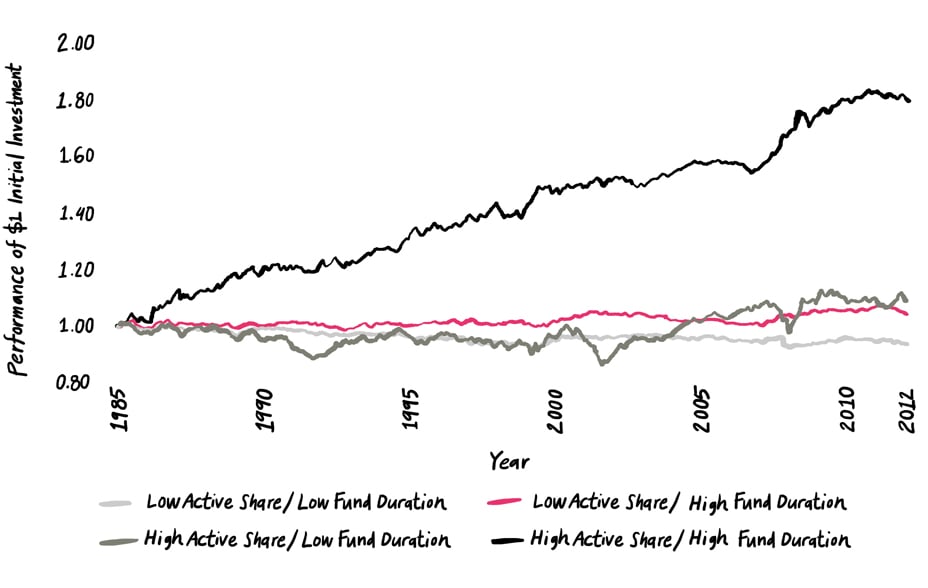

Since that time, academic work has strengthened our beliefs. Portfolios that differ from the index, most commonly measured as those with a high ‘active share’, combined with long holding periods, achieve consistent outperformance. The recent work of Professor Hendrik Bessembinder inclines us to ignore large chunks of the index. Why worry about broad coverage when most companies are unambitious and vulnerable to disruption?

Our guidelines determine concentration. We must always have 30–60 stocks in the portfolio, though we’ve been at the lower end of this range throughout LTGG’s history. The required exposure to at least six countries and six sectors ensures further sensible diversification. When new companies enter the portfolio, their starting position tends to be between 1–2 per cent. We can add as our conviction rises, but we passionately believe in running our winners, especially after Prof Bessembinder confirmed our hunch that outsized returns have always been driven by the few, not the many. Inertia is the long-term investor’s friend.

Curators and critics

A good curator is inspired by an artist’s body of work, and knows how to select pieces that will please the public. If it’s still admired, it stays on show.

Over the years, a few LTGG companies have received such acclaim. This means that the stock is held for an extended period, and that our maximum 10 per cent in any one company is reached. The success of these companies has often been extraordinary, but we feel we can congratulate ourselves for not trimming holdings during their ascent. The indirect benefit of reaching the 10 per cent limit is that we can redistribute capital to fund newer positions. Our holdings in Cloudflare and Carvana, potentially the next generation of top holdings, were funded by one such redistribution. As a result, our portfolio weightings never precisely match our convictions and are more an organic expression of companies’ past progress, twinned with our current enthusiasms.

A common trait of wealth-creating companies is their entrepreneurial spirit and adaptability in adversity. We added the question ‘is it adaptable?’ to our 10 Questions (10Q) framework a few years ago to reflect this. This adaptability gives us confidence in letting our winners run. A company exhibiting extraordinary operational progress, along with a growing opportunity set, improves the probability of an extreme payoff.

Hence our puzzlement at the industry’s preoccupation with ‘reversion to the mean’ and why we don’t muse much over price/earnings (P/E) ratios. Instead, we continue to spend our time dwelling in the future.

Admittedly it’s hard to comprehend what a company can truly become. Most investors fail miserably to imagine this. We beat ourselves up most when we’ve failed to grasp a company’s potential. We did this with Netflix, passing up the opportunity to invest in 2011, but we realised our mistake four years later. These failings are inevitable, as we struggle to comprehend the impact of growth rates faster than 10–15 per cent p.a. In the realm of exponential growth, outstanding progress over short periods is regularly underestimated.

Despite the lessons learned, we continue to underestimate company progress. Our optimistic research predictions for Apple undershot the company’s actual progress by a couple of hundred billion dollars. In our initial research on Tesla (2013), we felt that it becoming a $50 billion company by 2028 would represent significant success. More recently, our long-term, blue sky scenario for Chinese commerce moving online was reached within just two years. The lesson here is not to lambast ourselves for failure of imagination in these rare cases, or to blindly construct wild company scenarios, it’s more to acknowledge evidence that supports the case for inertia.

A common trait of wealth-creating companies is their entrepreneurial spirit and adaptability in adversity.

Mounting masterpieces

Curators are judged on the artworks they select. Some timeless pieces should be permanently on show. Others deserve a short period in the spotlight. Some will never find favour.

A company with a rising share price, a growing opportunity set, a deepening competitive ‘moat’ keeping challengers at bay – all resulting in a favourable probability-adjusted payoff profile – will be supported as it climbs the portfolio rankings. These types of companies comprise the ‘top 10’ portfolio weightings. These are companies that have exhibited exceptional growth and have ‘earned their spurs’, but still inspire optimism about their long-term growth prospects.

The ‘middle 10’ have likely been owned for a shorter period, but conviction about them could be growing, even with competitive advantages that are not fully developed. Glucose monitoring equipment maker Dexcom was purchased in 2016 with a favourable market position, but the competitive dynamics of that sector were still in flux. Established players like Medtronic and Abbott Laboratories were worthy competitors and younger companies in private markets were employing innovative techniques to treat type 2 diabetes as well. Since our first purchase, the case for continuous glucose monitoring and the dynamics of the market have become clearer, making our optimistic scenario more believable.

The ‘bottom 15’ showcases our newer ideas – the seeds of future growth if you will. These companies don’t warrant a large initial position and it would be arrogant of us to have such conviction at the start of our ownership journey. As we learn more, our conviction can increase.

Hermès, the French luxury goods company, has been a holding since LTGG day one. Our attraction to Hermès stems from the longevity and durability of its brand, as compelling today as it was in 2004. With an insatiable demand for its products, twinned with founding family involvement going back to 1837, Hermes' revenues have ticked up with metronomic regularity over long periods. Other holdings like L’Oréal, HDFC and AIA have similar profiles.

A continual review of holdings is vital as a company’s future returns potential can quickly dissipate. Eroding competitive advantages, atrophying cultures, even technical progress elsewhere can all render extreme returns unlikely. We invested in Baidu in 2009, and it became the largest holding in 2012, but from 2017 we trimmed the holding several times, eventually selling in 2019. Our diminishing conviction came from the rapidly evolving Chinese internet landscape, with Tencent’s WeChat app as well as ByteDance’s Toutiao and Douyin/TikTok apps bypassing traditional search. We felt that Baidu founder Robin Li could have been more adaptable, especially as the founding engineers of ByteDance came from within his own company.

Our near decade-long holding in eBay ended similarly. Initially purchased in 2005, we were excited by the potential of PayPal to disrupt the payments industry. However, instead of being a disruptive force, PayPal priced similarly to incumbents like Visa and Mastercard, even hiring a former American Express executive after CEO David Marcus moved to Facebook. We sold in 2014 disappointed, knowing that the payments industry offered vast opportunities to disruptors. Fast forward to 2020 and new portfolio holding Adyen is attempting to do just what PayPal failed to: untying payments from the legacy banking infrastructure and, ironically, replacing PayPal as eBay’s primary payments provider.

Atlas Copco was another of our largest holdings back in 2007, but we reduced the holding in subsequent years, eventually selling in 2019. We still admired the operational excellence of Atlas, but with continued competition for capital, there were more compelling ideas elsewhere. Inditex, another recent sale in 2020 was a similar story. A company with a legacy bricks-and-mortar store network will struggle to compete with ecommerce growth rates.

Although we are by no means frequent traders, the ability to add and reduce holdings remains an important tool in our toolkit. NVIDIA has seen both since our initial purchase in 2016. More recently, we added twice to the digital fitness company Peloton, shortly after its IPO in 2019. At the time, the market was treating all new listings with disdain, not helped by the failed IPO of WeWork. Peloton's cause wasn't helped by a poorly received Christmas advert. Regardless, we were enthused by Peloton's potential to disrupt the traditional fitness industry providing `fitness as a service' to a growing customer base, despite market short-termism.

Conclusion

For Long Term Global Growth, portfolio construction will always remain an artistic endeavour rather than a science, subject to a set of systematic laws. Each of the companies discussed above tells its own unique story and our portfolio decisions will always be driven by the progress of each individual company, while considering the broader portfolio and the current enthusiasms of the team. Avoiding ‘best practice’ formulae for calculating the size of an investment has served us well for the past 16 years. We continue to believe that creativity and imagination are the long-term investor’s most useful attributes.

Risk factors

The views expressed in this communication are those of the authors and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2020 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock examples

Any stock examples and images used in this communication are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This document is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions ('FinIA'). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a 'wholesale client' within the meaning of section 761G of the Corporations Act 2001 (Cth) ('Corporations Act'). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a 'retail client' within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited ('BGO') neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman.BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman.The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 12369 10000556