Listen to this article

This audio is generated using AI

As with any investment, your capital is at risk. Past performance is not a guide to future returns.

As active investment managers, the above question is existential for us. One of our Shared Beliefs states that ‘Our style of active investment management will add material value over the long term’. This isn’t just a soundbite or a nice-to-have, and it’s no coincidence it’s the first Shared Belief. It’s the reason our clients pay us.

Investors can access the market return by buying index funds, which are available at very low cost because it requires no research to invest in everything. If we don’t add material value above those index funds, and against competitor active managers, our future will hold some serious challenges.

The reason to not ‘just invest in the index’ is because there are a few good active managers out there who have shown themselves able to achieve better-than-index investment returns over long periods and, therefore, better outcomes for savers.

Baillie Gifford is one of those managers. This post is not a defence of active management generically - that would be pretty hard to do - it’s a defence of the thoughtful, real-world, fundamental deployment of capital by companies, generating growing cashflows over long periods, and thereby investment returns for their shareholders.

How do we stack up?

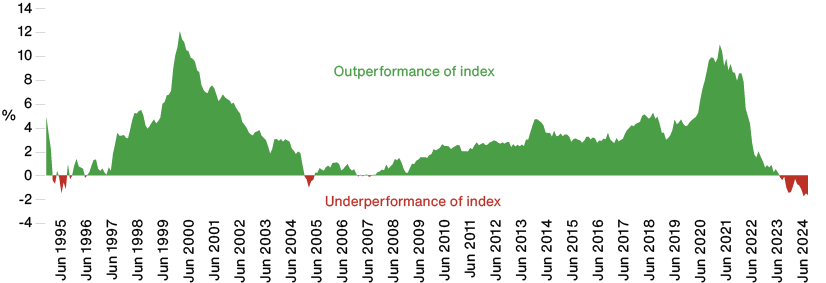

The good news is that over rolling five-year periods, which is a sensible period over which to measure success, Baillie Gifford’s approach very commonly adds value for clients.

Source: StatPro Composites, Revolution and relevant underlying index providers.

Rolling 5 year average annualised relative returns are calculated using the overall average of arithmetic relative, 5 year annualised, gross composite performance of our unconstrained equity only composites. In charting this, we looked at each composite's outperformance (or underperformance) compared to the composite's relevant index over five-year periods for each quarter since that composite's inception. Data excludes composites that include Fixed Interest, Multi Asset and Investment Trust portfolios and any portfolios that invest in Private Companies. The returns presented above are gross of fees. The results do not reflect the deduction of investment management fees; the return will be reduced by the management fees and any other expenses incurred in the management of the account. For example, an account, paying a 0.8% annual fee, with a given rate of 5% annualised over a 10-year period would result in a net-of-fee return of 4.2% p.a. Overall, the chart demonstrates a clear pattern of historic performance against the relevant investment measure for each composite. For more details about performance please visit the Baillie Gifford website. Past performance is not a guide to future returns.

The vast majority of the time, we outperform the market for those who measure success over the same timeframe that we do. For periods of less than five years, the consistency of added value is progressively less. Why is this? It’s because many, many participants in stock markets are speculatively trading against each other.

These ‘investors’ (they’re not really investors) don’t care about the real-world progress of the companies they’re buying and selling, they simply see shares as vehicles for betting against others in some giant game of bluff. Only in the long term can we confidently say that share prices tend towards their intrinsic value – that is, the present day value of expected future cashflows from the underlying companies.

Trusting the process

Right now, we’re not on average outperforming over five years for our clients. This puts us in a tough spot, but it’s one that we can explain. Sometimes the market values of certain categories of companies get really far out of kilter, as they have for growth stocks in recent years, first on the upside and more recently on the down.

Occasionally, even five years isn’t enough to remove the noise. But our clients expect us to stay committed to our investment style—they have other managers who offset our ups and downs and clear expectations of the role we play in wider portfolios. The worst thing we can do is flip-flop our investment style.

However ‘just wait longer until we come back into fashion’ isn’t a terribly persuasive argument, even if it’s in large part true. We also need to constantly revisit our analysis of individual companies, checking our assumptions and expectations about what those companies might achieve.

We meet the management of those companies to reassure ourselves that they see the same opportunities that we envisage, and are working ambitiously towards achieving them. We consider whether anything in the wider environment has changed the outlook for the companies we favour, and we determinedly stay focused on the long-term direction of travel even as others drive share price volatility.

These are the hallmarks of successful active managers: the rare academic studies that don’t just lump all active managers together show that those with low turnover and high tracking error (that is managers who have conviction and who don’t fixate on short-term share price movements) have a much higher chance of outperforming in the long run.

Looking beyond the horizon

The index is often said to be backwards-looking, whereas more imaginative investors are forward-looking and can identify undervalued securities. This is an over-simplification: the index is forward-looking too. Prices are set by the balance of opinion of where people think the share price is going next. Nobody invests at yesterday’s share price.

The more nuanced and more valid point is that most investors just aren’t good at looking very far ahead, and in particular identifying change. Speculators aren’t even thinking about that – they’re just betting with each other. Up or down? Some can do this, but few are right consistently. More thoughtful investors try harder, but find it very difficult to embrace the uncertainty that comes from investing in companies that have new technologies or business models, or are just in a good place to take market share.

So, it’s not that the index is backward looking, it’s that most investors don’t look very far forward and avoid uncertainty.

Baillie Gifford is not the only good investment company. We try to be among the best, and we structure our whole company to allow us to stick to our long-term approach. Being worker-owned is an incredible luxury as it means we don’t have outside interests with time horizons that don’t align with our values.

Others may be structured differently, but the common thread among the best investment firms is the ability to think long-term, seek constant improvement and be unwavering in our investment styles.

Is it only about investment performance?

Errrr... kind of? There are many other things we do that add value – excellent client service ensures that clients understand how we’re doing, and that we’re always acting in their best interests. This helps us through more difficult times. We don’t just invest – we act as engaged owners of companies, holding management to account and encouraging them to be ambitious.

Some of our strategies deliver not just investment returns but also focus on controlling risk and volatility for clients to whom that is important. In private companies we might offer access to investments that clients simply can’t get anywhere else. We report to and help clients with the challenges they face, such as emissions reporting and regulatory returns. We work very efficiently with clients’ other service providers including custodians, auditors and others. So, it’s not only about performance, but none of those things in the end are enough if we don’t deliver after-fees returns that beat the index.

Going back to the question at the start: why not invest in the index? The answer to this is because it’s possible to do better. But pay careful attention to our Shared Belief: it is our style of active management that will add value in the long term. Others may approach it differently and that’s up to them.

Our job is to persuade and reassure investors that by working with us there is the opportunity of better than index returns. We can't rely on our past successes to tell us what returns will be in the future, but we do aim to make history repeat itself.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

127119 10051468