Investors should carefully consider the objectives, risks, charges and expenses of the Fund before investing. This information and other information about the Fund can be found in the prospectus and summary prospectus. For a prospectus or summary prospectus please visit our website at https://usmutualfund.bailliegifford.com. Please carefully read the Fund’s prospectus and related documents before investing. Securities are offered through Baillie Gifford Funds Services LLC, an affiliate of Baillie Gifford Overseas Limited and a member of FINRA.

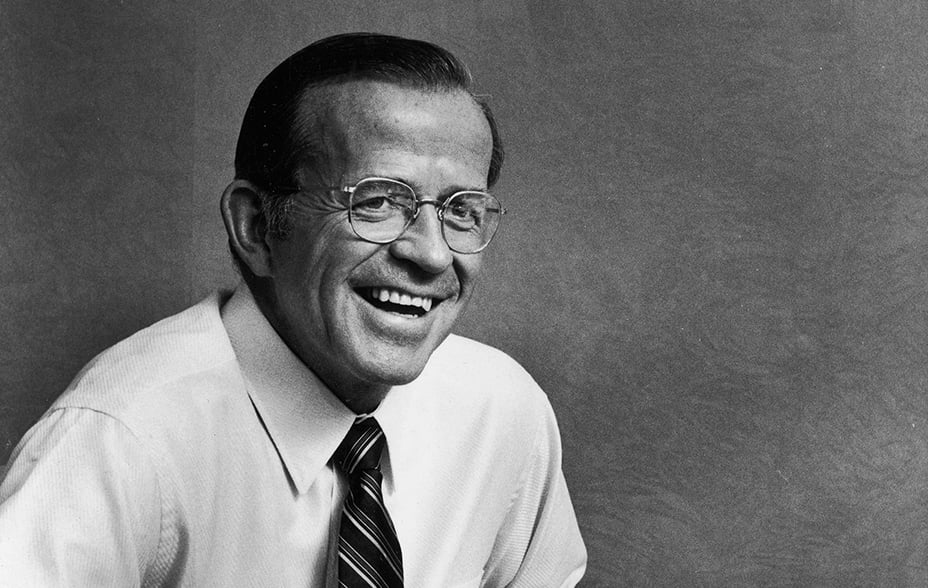

I first stumbled across Dee Hock, the founder of Visa, when I was researching the US payments industry late last year. Hock has written extensively on organisational structure and is an advocate of what he calls ‘chaordic’ organisations – firms which combine elements of both chaos and order. I found his autobiography, One from Many, thought-provoking and believe his chaordic concept could provide a useful model for thinking about how culture and organisational structure can interplay to make businesses more innovative and adaptable.

Hock is relatively unknown, which is surprising because what he achieved with Visa was extraordinary. Visa has its roots in the BankAmericard credit card system. In the 1960s, Bank of America decided to expand its credit card network outside of its home market of California. Federal restrictions prevented banks from operating out of state, so Bank of America licensed the card to other banks.

This enabled the network to grow quickly and, by 1968, there were over 250 licenses. Dee Hock was one such licensee. He was working as the card centre manager at the Seattle Bank of Commerce at the time and had been tasked with launching their BankAmericard programme. It was in the process of implementing this that he discovered just how much of a mess the BankAmericard network was in. Each of the banks in the network had a different contract and there was no standardisation or automation or mechanism for dispute resolution. And there were massive fraud losses. It was complete chaos.

Hock took it upon himself to fix this problem. He thought the best way forward would be to create a new type of organisation; one that brought the banks together via common purpose, principles, and operating procedures. At the time, the new organisation was called NBI but it would eventually change its name to Visa.

And Visa, as we all know, went on to become enormously successful. In creating Visa, Hock persuaded hundreds of independent competing institutions to sign up to a set of principles not only as they stood that day, but also to their future evolution. This was a remarkable achievement.

Visa was, in Hock’s view, an imperfect embodiment of the chaordic model. Hock defines chaordic organisations as those which self-organise and which blend elements of chaos and order. He created the word chaordic because he was tired of the generic phrases that were being used in the field of complexity science at the time – words like non-linear, self-organising, complex, and autocatalytic. He felt chaordic better encapsulated the characteristics that he was trying to articulate.

The most popular organisational structure today is arguably still the hierarchical command-and-control model. In these organisations, decisions are taken at the top and are pushed down. The best ideas rarely penetrate through the layers of bureaucracy. People are treated like cogs in a machine and, in response, they blindly follow procedures and processes. It is strange that this model has persisted so long in a capitalist system because it is akin to central planning. It has been hard to move on from it precisely because it is so entrenched; we’ve been steeped in it for hundreds of years of history through institutions such as schools, churches, universities, and governments. The top down management model was adequate when the primary function of companies was to make things, but Hock believes this structure is ill-suited for a rapidly changing world built on ideas. His alternative, the chaordic model, proposes getting away from hierarchies and empowering individuals to make decisions.

Chaordic is a portmanteau of chaos and order. The Cambridge Dictionary defines chaos as “a state of total confusion with no order”. The chaos, in chaordic, comes from the idea that people perform at their best when leaders get out of their way and give them space to innovate. For an organisation to be chaordic, this autonomy, however, must be combined with alignment. Chaordic organisations bring order to chaos through purpose and principles, which provide guidance and help steer people in the right direction. The job of leaders in chaordic organisations is to inspire people by creating a compelling sense of mission and purpose, and by working with employees to set broad principles which everyone in the organisation buys into. But once this is done, leaders must get out of the way.

Jeff Lawson, who founded Twilio, a US provider of communications tools, shares the view that chaos and order need to work in harmony. He is a proponent of autonomy, but he believes that guardrails are necessary to make it work, as he outlines in his book, Ask Your Developer: “Without guardrails, people won’t know how to make decisions, and leaders will tend to second-guess them constantly. By creating rules, you paradoxically set people free – in the space between guardrails.” In a similar vein, Jeff Bezos has repeatedly talked about the importance of high-velocity decision making in his shareholder letters. The word ‘velocity’ is chosen because it has both speed and direction components. There’s no point in moving fast if you’re pointing the wrong way. Purpose and principles ensure that the combined velocities of autonomous agents within an organisation serve to reinforce each other, rather than cancel each other out.

Creating alignment around a common set of principles is easier said than done. Purpose and principles form the building blocks of culture. For principles to be a true representation of the cultural DNA of an organisation, they must reflect their authentically practised behaviours. In Ben Horowitz’s terms What you do is who you are. Or, in Hock’s words, “…clear, meaningful purpose and compelling, ethical principles evoked from and shared by all participants should be the essence of every institution.”

So, how can leaders create alignment in this manner? Hock has a lot to say on this topic. He emphasises the important distinction between true leadership and tyranny: “the terms ‘leader’ and ‘follower’ imply the continual freedom and independent judgement of both. A true leader cannot be bound to lead. A true follower cannot be bound to follow.” Leaders work with the rest of their organisation to create a clear shared purpose and principles that people believe in and want to follow of their own free will. Hock uses a rare word to describe this process: ‘educe – to bring or draw forth something already present in a latent, or undeveloped form’. Contrast this with ‘induce – to prevail upon; move by persuasion or influence – to impel, incite, or urge’. “Educed behaviour is the essence of leader/follow… Where behaviour is compelled, there lies tyranny, however petty. Where behaviour is educed, there lies leadership, however powerful”.

Authenticity is the key to educed, rather than compelled, behaviour. Given this context, perhaps founders are better suited to the chaordic model. Founders are more likely than managers to be mission-driven and motivated by a desire to do something useful rather than to get rich. As such, it seems logical that they would be better equipped to inspire their followers and educe desired behaviours.

Founders can also play a major role in ensuring agreed principles are adhered to, given the moral authority that they wield. Hock admits that he underestimated how difficult it would be for Visa to reject the old way of doing things, and he let bad habits creep in. In his words, what Visa was missing was an institutional immune system to keep its principles in check. Whether it’s Netflix’s recent decision to fire three key members of staff for talking behind their colleague’s back because it went against the company’s principle that, “you only say things about fellow employees that you say to their face”, or Jeff Bezos’ consistent reinforcement of Amazon’s “think big” value, when leaders set an example and take difficult decisions which align with their organisation’s principles, they help to reinforce them and protect against bad habits taking hold.

Chaordic organisations empower individuals to innovate. Hock said “…the truth is, that given the right circumstances, from no more than dreams, determination, and the liberty to try, quite ordinary people consistently do extraordinary things”. They create space for great ideas to bubble up, organically, from the periphery of the system. Hock observed this happening at Visa. Visa was a very robust and adaptable system. Because almost all the innovation at Visa occurred in the individual banks, mistakes would fizzle out without harming the health of the system. Successful innovations, on the other hand, were copied and spread around the organisation. And while Visa could develop products centrally; it did not have the power to force these on members.

There are parallels between chaordic organisations and other resilient systems. Hock’s thinking on organisational structure is inspired by nature. He referred to chaordic organisations’ purpose and principles as “genetic code” around which they self-organise. Self-organising systems in nature tend to be resilient and adaptable. Take life itself as an example. On its persistence, evolutionary biologist Stephen Jay Gould wrote, “When we consider the magnitude and complexity of the circumstances required to sustain this continuity so long... if anything in the natural world merits a designation as ‘awesome’, I nominate the continuity of the tree of life for 3.5 billion years”. Or, on a less grand scale, as the Danish theoretical physicist Per Bak noted in his excellent How Nature Works, traffic jams, which self-organise, are far more resilient to shocks than a designed system of equally spaced cars would be. If we tried to engineer traffic flows, they would be fragile and prone to catastrophic failure. The same is true of companies.

The adaptability of chaordic organisations makes them well-suited to the rapidly changing world that we live in today. In his writings Hock talked about the long and multi-step process of turning data into information and then wisdom. Centuries ago, data was being produced at a relatively slow rate, which gave time for societies to process and understand new developments. The ratio of wisdom to data was high. Now, however, new technologies – from mathematics, to global languages, to the printing press, the telephone, TV, the internet, and biotechnology – are causing us to generate new data at an ever-accelerating rate: “we are… in the most sudden, the most profound, the most diverse and complex change in the history of civilisation. Perhaps in the history of earth itself”. The command-and-control model is ill-suited to a world of such high complexity and rapid change. No single person could hope to assimilate and process all the data needed to make effective top-down decisions. The chaordic model provides an alternative, where decentralisation and bottom-up innovation lead to a situation akin to natural evolution where ideas compete and those best suited to the environment survive and propagate.

There are relatively few followers of the chaordic model. In his book, Hock called out Visa, the Internet, and Linux operating systems as examples. For an organisation to embrace such a structure, leaders must be willing to let go, which is hard to do, because it requires rejecting entrenched mental models and embracing new ones, as well as trust and high levels of transparency. At Visa, Hock held open staff meetings and, eventually, even opened up board meetings to outside observers (there was much internal resistance). Leaders also need to be comfortable with what may look like waste as decentralisation can result in duplication. Moreover, chaordic organisations experiment a lot, which leads to failures. They must embrace failure, learn from it, and move on swiftly.

The culture of a firm is defined by what it believes and how it behaves. If the purpose and principles of a chaordic firm are genuine and adhered to, then they also describe the culture of a company. As previously mentioned, founders may be uniquely well placed to drive belief in purpose and voluntary adherence to principles given their mission-driven nature and non-monetary motivations. I view culture and the chaordic model as related concepts which reinforce each other. Chaordic organisations are unlikely to succeed in the absence of a strong culture because they will struggle with alignment. And the chaordic model can make companies with strong cultures more effective by empowering individuals to live up to the principles of the organisation through autonomy and trust.

Many of our holdings embrace elements of the chaordic model. I would contend that this has contributed to their adaptability and enabled some to unlock new growth opportunities that weren’t apparent when we first invested in them (e.g. Amazon), others to deal effectively with strategic inflection points (e.g. Netflix), and others to maintain a rapid pace of innovation at scale (e.g. Shopify, Twilio).

For example, Amazon is run with a strong sense of purpose and is known for integrating its leadership principles tightly into almost everything it does, from hiring to promotions to strategic decision-making. It is extremely conscious, however, of the tendency for productivity to fall with scale and so operates a decentralised structure to counter this. The most famous manifestation of this was the two-pizza team rule, which stated that teams could be no larger than the number of people who could be adequately fed by two large pizzas. In practice, what this meant was teams of no more than 10 people. These teams operated autonomously. The boundaries of each was clearly defined and each was led by a single-threaded leader, who focused only on the task in hand and who had the authority to build product and make changes without coordinating or gaining approval from other teams. Amazon no longer strictly enforces the two-pizza rule, but it still aspires to operate small teams with single-threaded leaders. This structure has helped the company to remain innovative at scale.

Netflix is another company which embodies the chaordic model. The CEO and founder Reed Hastings recently published an outstanding book on Netflix’s culture called No Rules Rules: Netflix and the Culture of Reinvention. A core element of the company’s philosophy is ‘People over Process’. Netflix believes people thrive on being trusted and given freedom, rather than being told what to do. One of the company’s expressions of this is, ‘lead with context over controls’. At Netflix, the role of leaders is to set the broad context while leaving enough space for people to find their own way. The company says it takes pride in how few decisions senior management take. Instead of decisions flowing up to the top of the organisation, an informed captain is appointed who has sole responsibility and accountability for the decision. Informed captains are required to socialise proposals and farm for dissent but, ultimately, it is up to them to decide. This has helped Netflix to avoid committee-based decision making and the velocity penalties that come with this approach. Netflix is highly decentralised in its decision-making, just as a chaordic organisation ought to be. However, another of its mottos is ‘highly aligned, loosely coupled’. While there are no rules, there are real values. And, as mentioned earlier in the institutional immune system context, people are held to account based on these values.

Shopify’s values include ‘people first’, “conformity kills creativity”, and “autonomy rules”. Under the heading ‘autonomy rules’ on its website the company writes: “Magic happens when people are given the freedom to create their own path. We trust you to be resourceful, solve problems as they arise, and define how you want to make an impact”. These are words which could have come out of the mouth of Dee Hock himself. Shopify combines these values, which promote autonomy, with three additional values which speak to purpose: ‘scale for impact’, ‘propelled by ambition’, and ‘learn with the best’. Under ‘propelled by ambition’ the company writes: “We’re growing quickly and, like a rocket ship, we show no signs of slowing down. We want to define the future of entrepreneurship, be a 100 year company, and the global engine that powers commerce”. This value seems very clearly designed to educe rather than compel.

In our conversations, Shopify’s founder Tobi Lütke has spoken of the importance of decentralisation to maintaining innovation at scale. He views organisational scaling as “super analogous” to building software. Both are complex systems and in both cases what many would view as being efficient from a design perspective is a form of centralisation which introduces dependency. “Centralisation is the enemy of speed, not something that leads to more speed”. Lütke strongly believes that duplication can be a valuable strategy if it reduces the dependencies between teams. So much so that, prior to shifting to remote-first, Shopify’s enterprise division, Shopify Plus, used to be walled off from the rest of the company and based in a different city.

Twilio’s culture has many parallels with Amazon, which is not surprising given founder Jeff Lawson spent time working at Amazon Web Services (AWS). For example, instead of two pizza teams, Twilio has ‘dozen bagel’ teams. As noted earlier, Lawson believes strongly in the value of guardrails to set the direction component of these autonomous teams. Lawson also has a very healthy attitude towards experimentation, something which I think is critical to making the chaordic model work. In his recent book, Ask Your Developer, Lawson talked about the importance of “planting seeds”, by which he means small experiments. So long as there is a large potential market opportunity and a hypothesis to be tested, Lawson has a bias to saying ‘yes’ to ideas. However, an important element of this model is a willingness to embrace, learn from, and move on from, failure. In fact, Twilio doesn’t use the word failure internally. Failed experiments are called disproven hypotheses. Lawson says the only experiments which are failures are those which have no hypothesis to begin with, because it is impossible to learn from those.

Dee Hock’s chaordic model is appealing. Companies which follow the spirit of it seem to have anti-fragile characteristics and are better equipped than most to adapt in the face of rapid change. It is, however, just one model and I don’t want to give the impression that there is a right and a wrong way to structure a company. The most important thing is that the organisational structure is well-suited to the company’s culture and mission. Steve Jobs was, famously, a micro-manager at times, and a very successful one at that. But as the world shifts from being product-driven to ideas-driven and the pace of change continues to accelerate, the chaordic model seems like a good choice for those wishing to build an innovative, adaptable, and enduring organisation.

Risk warnings

The views expressed in this article are those of Gary Robinson and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited 柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (“BGO”) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.