Overview

The Worldwide US Equity Alpha Fund aims to maximise total return principally through investment in equities which are listed on Regulated Markets in the US.

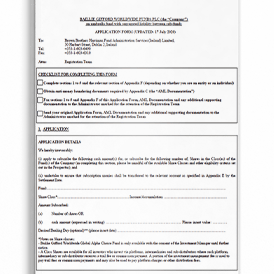

Top Ten Holdings - 31/03/2025

Fund % 1 Amazon.com 3.1% 2 Microsoft 3.1% 3 Meta Platforms 2.9% 4 NVIDIA 2.8% 5 Netflix 2.8% 6 Shopify 2.5% 7 Alphabet 2.4% 8 AutoZone 2.4% 9 DoorDash 2.4% 10 Hershey Foods Corporation 2.2% Total 26.7% Sector analysis of total assets 31/03/2025Fund %

- 1 Consumer Discretionary 20.88

- 2 Information Technology 20.36

- 3 Health Care 15.46

- 4 Communication Services 11.85

- 5 Financials 9.16

- 6 Industrials 7.86

- 7 Consumer Staples 7.60

- 8 Real Estate 2.64

- 9 Materials 2.35

- 10 Energy 1.25

- 11 Cash 0.59

- Total 100.00

Totals may not sum due to rounding.

As well as cash in the bank, this balance includes unsettled cash flows arising from both shareholder flows and outstanding trades. Therefore, a negative balance may arise from timing differences between shareholder flows and security trading and does not necessarily represent a bank overdraft.

Managers

Michael Taylor

Michael is an investment manager in the US Alpha Team. Having previously worked at Baillie Gifford from 2009 to 2014, Michael re-joined Baillie Gifford in 2022 to lead our US Alpha Strategy. He is also a trusted advisor for the Global Alpha Team. Prior to returning to the firm, Michael was an investment manager at Marathon Investment Management. He graduated BA (Hons) from the University of Oxford in 2008. Michael is a CFA Charterholder.

Saad Malik

Saad is an investment manager in the US Alpha Team. He joined Baillie Gifford in 2016. Saad is also an investment scout for the Sustainable Growth Strategy. He graduated MSc from the London School of Economics in 2016. Prior to this, he completed a BA (Hons) double major in Philosophy and Criminology at York University in Canada.

Sacha Meyers

Sacha is an investment manager in the US Alpha Team. He joined Baillie Gifford in 2015. He previously worked on global and regional teams with both small and large caps. Sacha holds a BSc from King’s College London and two master’s degrees, one from University College London and another from Imperial College London. Sacha is a CFA Charterholder.

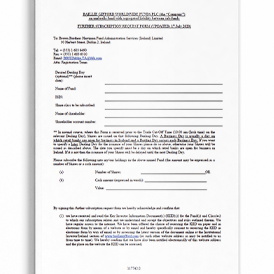

How to Invest

You can invest in a range of our funds via a number of fund platforms and supermarkets. Certain share classes are available for investment via a number of platforms. Please see the links opposite.

Baillie Gifford does not sponsor, maintain or have any control over the content of any other websites.

Therefore, we are not responsible for the adequacy or accuracy of any of the information you may view, nor do we undertake to ensure successful transmission to any linked website.

How to Invest

Professional Investor Enquiries

For further information on the funds, including availability and investment options, please contact our local distributor Volcom Capital.

Professional Investor Enquiries

Documents

You can access any literature about the Fund here, either by downloading or requesting a copy by post (where available).

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.

Important disclosures

MIFID II ex-ante disclosures

Prospectus

Quarterly investor reports

Shareholders rights directive

PRIIPs key information document

PRIIPs performance disclosures

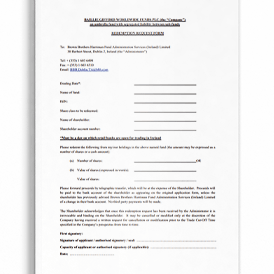

Risks

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

The specific risks associated with the Fund include:

Custody

Custody of assets involves a risk of loss if a custodian becomes insolvent or breaches duties of care.

Single Country

The Fund’s exposure to a single market and currency may increase share price movements.

Concentration

The Fund’s concentrated portfolio relative to similar funds may result in large movements in the share price in the short term.

Volatility

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Further Details

Further details of the risks associated with investing in the Fund can be found in the Key Information Document (KID), or the Prospectus. Copies of both the KID and Prospectus are available at bailliegifford.com.

Definitions

Active Share: A measure of the Fund's overlap with the benchmark. An active share of 100 indicates no overlap with the benchmark and an active share of zero indicates a portfolio that tracks the benchmark.

Important Information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. ’Professional investors’ are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. You can read details of our Legal and Important Information here.