Key points

- When markets are challenging, Global Alpha seeks areas where growth is unaffected – or helped – by tough conditions

- Amid conflict, scarcity, inflation and climate change, disruptive entrepreneurialism continues to present us with opportunities

- From AI to gravel, from biotechnology innovators to streaming companies, there’s plenty to excite us

All investment strategies have the potential for profit and loss, your or clients capital may be at risk.

In our search for outstanding growth companies, we are drawn to areas of innovation and enduring growth: pockets of economic, societal, or technological change that offer fertile conditions for companies to thrive. Our annual Research Agenda outlines the most promising of these areas of opportunity.

During periods of difficult performance, this exercise becomes more important than ever. It helps to ensure we remain reward-seeking in our outlook and focus our research productively.

We shared our first Research Agenda back in 2013. This is the 12th version. As ever, some of the areas included look to build on previous work – for instance, assessing how the opportunities in healthcare have evolved amid recent upheaval. Others are more counterintuitive. The challenges arising from a changing geopolitical order, or a shift from abundance to scarcity in a range of key resources, are well covered in the daily market noise. Less obvious are the emerging beneficiaries of these trends. Domestic champions grow stronger; access to scarce resources becomes a powerful competitive advantage.

If equity market returns in the pre-pandemic decade were dominated by ‘technology’ companies, we may be heading into a new era of more diverse winners. As AI diffuses intelligence ever more broadly throughout our economy, we must cast our net wide in the search for businesses possessing the right qualities to harness this paradigm shift. Our Research Agenda helps us focus our time and attention on the crucial task of identifying the companies on the right side of these changes and ensuring your portfolio remains in vigorous long-term health.

Generative AI – the next frontier

We are witnessing the dawn of a major technological revolution. Like previous revolutions, it will precipitate profound social and economic changes. Unlike previous revolutions, the pace

of diffusion will surely be rapid.

It is difficult to overstate advancements in artificial intelligence (AI). It was only a year ago that ChatGPT exploded into our collective consciousness, becoming the fastest growing consumer application in history. It’s ludicrously easy to use and embodies more knowledge than any human could. The ability to converse at a human level, combined with extraordinary powers of data processing, has captured the public imagination.

In the 15th century, the Gutenberg printing press took a limited set of letters and symbols and recombined them in unlimited ways to create the modern world. It changed almost every aspect of life: it helped scholars accumulate knowledge, disseminate ideas, standardise language, and increase literacy. In turn that changed the relationship between man and God, individuals and society, and the past and the present.

Generative AI is not a new algorithm. It is a new paradigm.

What might generative AI be able to produce from a recombination of all human knowledge?

Unlike the printing press, which can only copy content, generative AI can create it. It might be used to generate movies on demand, provide tutelage to children, or teach cars to drive themselves. It can do all this without requiring a single new line of code. Generative AI is not a new algorithm. It is a new paradigm. A new way of developing software, by ‘training’ rather than ‘coding.’ This may sound futuristic, but the future is here. Tesla will soon release a new version of its self-driving software. It is end-to-end AI – and it can match human driving performance without anyone coding traffic rules for it.

Software has been an accelerant to growth. It democratised the tools to entrepreneurship and created a new economic model where success of a company scales with its user count. Many of the largest companies today – Microsoft, Apple, Alphabet, Amazon, Meta, Tesla – are all in essence software companies. It’s no wonder that there has been fierce competition for software talent.

Generative AI acts an accelerant to software. Just like it can create new images, music, and videos, so too can it create new software. It democratises programming talent. Already programmers on GitHub, an open-source coding site, use AI-based co-pilots to produce half their code. Tesla’s AI-generated self-driving software replaced over a decade of engineering work and over 300,000 lines of code.

Rather than seeing the end of the software-driven growth era, could we be entering a period of even faster development? What are the new scarce resources? Which companies will capitalise on them? It is clear that we are at the beginning of something big. The pace of progress is far beyond what Moore’s Law dictates, and there is no clear upper bound to what might be possible.

What’s less clear is the impact this might have on companies and societies. Any technology that holds such disruptive potential is bound to cause unease. AI raises difficult questions about the labour force, data privacy, safety, bias, and more. But it is also an engine of progress, and progress powers prosperity. What problems can it solve? Who will be the beneficiaries? And how can we harness this technology to live healthier, safer, and more fulfilling lives? An exploration of these questions will help us identify the winners of tomorrow.

Infrastructure upgrade and the resurgence of the domestic champion

AI captures the imagination. But not all opportunities today are yesterday’s science fiction. Some are familiar, even mundane – but could be equally rewarding.

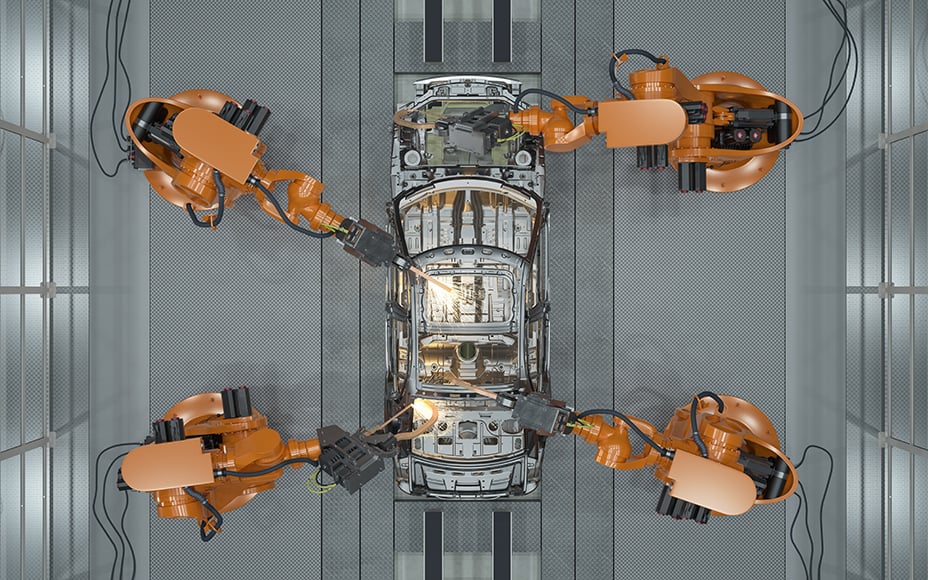

In last year’s Research Agenda, we highlighted businesses positioned to benefit from the repair and enhancement of physical infrastructure. Developed nations have underinvested for decades. Resilience and longer-term economic growth have suffered. Roads need repaired; bridges rebuilt; power grids upgraded; advanced manufacturing installed. Our conviction that we are witnessing the early stages of an industrial super-cycle across the western world has deepened further.

Two other factors are emerging that will accelerate the trend. Firstly, the pandemic and erupting regional conflict have exposed the vulnerabilities of globally distributed production. This has caused a drive to reinforce domestic supply chains. As geopolitical fractures spread, nations look to their supply of resources – both natural, such as energy and metals, and manufactured, like semiconductors.

Secondly, national security is threatened by something other than rival countries: climate change. It is difficult to underestimate the scale, and the unpredictability, of the implications of a warming world. Risks to physical assets are rising. Billions of dollars need to be spent on everything from the electrical grid to stormwater drainage.

Of course, even without these factors, ongoing investment is needed simply to maintain ageing infrastructure. Some argue that political cycles can stall even essential infrastructure projects. This is an election year after all. However, both geopolitical and climate concerns are issues of national security. Such worries are seldom put off. These trends will be persistent.

Several companies in your Global Alpha portfolio already benefit from these themes. They include the building materials businesses, Martin Marietta Materials and CRH, ground water management company, Advanced Drainage Systems, power management firm, Eaton, and the mechanical electrical contracting business, Comfort Systems. We expect to find many more opportunities, in the US and abroad.

Capital cycles and emerging scarcity

In the years following the Global Financial Crisis of 2008–09 capital was cheap. Indeed, so inexpensive, and so abundant, that some market participants seemed to forget it had a cost. Starting in 2022, central bank rate moves – in the US, the fastest rate-hiking cycle in 50 years – have provided a rude awakening.

The impact of higher rates in some ways was immediate and obvious. Long duration assets – such as high growth equities – became less valuable. We have certainly felt that. However, in others, the impact has been slower to materialise. Changes to the supply side take time. Yet in the long run the impact of capital scarcity on spending, and therefore competition, should be far more impactful than merely a higher discount rate today.

We have already seen signs of changing competitive dynamics and shifting capital allocation. The US oil and gas sector has entered a period of mega-mergers. Streaming companies – Netflix, Disney, Amazon – have become more restrained in content spending now that such investment has a cost. Tech companies globally are focused on profits, not merely revenue growth. The margins of some of your holdings, such as Shopify and DoorDash, are already benefitting. Moreover, capital may not be as geographically free flowing as it has been. Protectionism is growing, while whole economies are perceived as unsafe homes for capital investment. The UK and China spring to mind.

We are alert to the possibility that 2024 might bring the first flowerings of a more benign supply side. Our research will unearth areas in which rational competition will allow for higher profits, or where sound capital allocators with good balance sheets can take advantage of low valuations. Areas as diverse as telegraph pole manufacturing and British house builders are already on our radar.

Capital is not the only area of emerging scarcity. A key skill of a fund manager is not just to ask questions of companies, but to listen. Our holdings have repeatedly highlighted other areas of shortage to us. Semiconductors have been a headline grabbing example. A new crisis may emerge as a result of the energy transition – is there enough copper, lithium, specialist components (and political will)? Another intriguing bottleneck is labour: both knowledge professionals and blue-collar workers are in short supply. The problem only gets worse. Labour’s share of GDP has seldom been lower, but it is likely to change.

Which companies have access to these resources? Which ones can work around the problem? Those able to attract and retain workers – through compensation, mission, or a loyal workforce or who have a process that requires less labour – will have a burgeoning competitive advantage. We are looking for scaled players rolling up fragmented industries, robotics and automation companies, and, of course, AI leaders.

Capital and labour shortages may spell trouble for many. But for some, it will be a huge benefit. These big winners should be very profitable investments. We intend to find them.

Healthcare – a year of healing

We are drawn to areas of structural growth that are temporarily, and unfairly, out of favour.

In 2023 healthcare companies underperformed the wider global market by 20 per cent. This reset was the worst result in 20 years. A decade’s worth of cumulative outperformance by the sector was wiped out. Relative valuation measures are close to 10-year lows. So, healthcare is out of favour – but is it unfairly so?

The long-term drivers of demand growth are intact. Firstly, the population continues to age. The World Health Organization (WHO) forecasts that the global number of people aged over 60 will double by 2050. The number of people over 80 will triple. As we age, we consume much more healthcare. A 90-year-old Brit incurs approximately 10 times the healthcare costs of someone half their age.

The number of FDA-approved drugs last year… was the second highest in a generation.

Secondly, we are rapidly expanding the boundaries of medicine. More areas are being ‘medicalised’ and previously incurable diseases are becoming controlled with long-term therapies.

Third, biological innovation has accelerated. The number of Food and Drug Administration (FDA)-approved drugs last year – a leading indicator of future industry revenue growth – was the second highest in a generation.

If demand growth is so obvious, what’s the problem? Several waves of fear have built up to create a near-perfect storm. The list below is not exhaustive. However, a common and intriguing thread is that each headwind is lessening.

- Waiting lists lengthened as procedures were postponed. Revenue from expected interventions never materialised. Non-urgent medical procedures, such as hip replacements, were crowded out by the pandemic, staff shortages, and then supply chain delays. The waiting list for elective treatments in England is almost three times larger than a decade ago. However, we will now need many years of above-average activity to clear the backlog – heralding a golden period of demand for medical device makers.

- Similar disruptions caused inventories to be overbuilt for bioprocessing and life science products. The excess is being run down, temporarily depressing demand and near-term growth rates. We expect a return to more normal conditions in the west. In the east, a central clamp-down on purchasing saw life science and medical device demand fall very sharply. Normalisation will mean growth.

- Falling risk tolerances resulted in companies requiring equity funding to significantly trim their ambitions and conserve cash. Pre-revenue biotech was hit hardest. Yet even the largest and most profitable pharmaceutical companies struggled as the Inflation Reduction Act raised fears of significant US drug pricing pressure. The funding environment now looks like it may ease, and worst-case pricing scenarios have not materialised.

- Finally, a broad swathe of medical companies (and consumer goods businesses, like those selling chocolate and alcohol) found share prices under pressure as the efficacy of a new class of anti-obesity medicines become a market focus. We believe in the strong commercial potential for these drugs – but their long-term existential impact on demand for adjacent areas appears greatly overdone.

Our initial contentions are that structural demand drivers remain in place, valuations are strongly supportive, and several waves of fear are beginning to subside. Opportunities should be bountiful.

Conclusion

The world is beset with challenges. Conflict, scarcity, inflation, climate change. And yet, innovation and entrepreneurship are as alive today as they have ever been. The opportunity set before us is broad and deep. From AI to gravel, from biotechnology innovators to streaming companies – it’s a time to be excited. We look forward to a year of fruitful research.

Important information and risk factors

Annual past performance to 31 December each year (net%)

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Global Alpha Composite | 32.7 | 36.4 | 7.3 | -29.1 | 19.5 |

| MSCI ACWI Index | 27.3 | 16.8 | 19.0 | -18.0 | 22.8 |

Annual past performance to 31 December (net%)

| 1 year | 5 years | 10 years | |

| Global Alpha Composite | 19.6 | 10.5 | 8.3 |

| MSCI ACWI Index | 22.8 | 12.3 | 8.5 |

Source: Baillie Gifford & Co and MSCI. USD. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite.

Past performance is not a guide to future returns.

Legal notice

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in February 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

93002 10045112