Key points

Regulations are often complicated to draft and challenging to follow, but companies that engage rather than resist can wind up better off.

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

Past performance is not a guide to future returns.

Rules have existed ever since social groups first strove to organise themselves. Harmonised weights and measures on the silk and spice routes, a national currency in seventh century China – these were the beginnings of regulation.

Rules help nurture order and stability. But things can get complicated quickly. Our interactions are now covered by a vast patchwork of legal restrictions, contractual obligations, self-regulations, co-regulations, certifications, accreditations, policies, standards and norms. Each can demand or forbid certain conduct, and the regulators involved have varying levels of independence from government. Regulations may also reflect differing industries, economies, societies and value systems, and often vary over geography and time.

An additional challenge is the way many of today’s businesses mutate. They straddle traditional industries and sometimes create new ones as they grow rapidly, and can launch products to billions of people in an instant.

Evolutions and revolutions

The rules we live by evolve, reflecting changes to technology, society and the economy. The economic historian Professor Carlota Perez has documented many of the paradigm shifts experienced since the Industrial Revolution – from canals to railways to steel to mass production to the current rise of information technologies – and their accompanying regulatory frameworks.

The chart illustrates the time lag between the development of a new technology (shown in black) and the introduction of related rules and regulatory institutions (shown in orange) designed to address social and economic concerns. Regulation can be slow to catch up. It took more than 70 years from the Ford Model T’s launch in 1908 for the first US state, New York, to make seatbelt use mandatory. And even now, their use is not compulsory for adults in New Hampshire.

This reflects the fact that regulatory change in the real world is far messier and less linear than the chart suggests. There are inevitable confrontations between defenders of the old regime and vanguards of the new. For example, in the space of just five years the US signed the Paris Agreement on climate change, withdrew, and then signed it again.

What makes all this even more challenging is that technological change is occurring at unprecedented speed. Since LTGG’s inception in 2004, we have witnessed the likes of Facebook, Amazon, Alibaba and Tencent reach such scale and herald such profound transformations in our lives that they are now being subjected to immense public and regulatory scrutiny.

Regulators and others also need to form opinions about things they didn’t grow up with, such as cryptocurrencies and facial recognition. These can be harder to get to grips with than supermarkets, automobiles and other more concrete entities. Whatever the regulatory response, company managers need to acquire new skills. Being long-term investors, we continually examine business leaders’ ability to adapt to the new rules of the game, or better yet to proactively and constructively contribute to the rules.

What makes all this even more challenging is that technological change is occurring at unprecedented speed

Company managers need to acquire new skills

Differing perspectives

The standardisation of shipping containers in the 1950s made international trade more efficient, driving globalisation to fresh heights.

Today’s ‘containers’ are digital, and cross-border trade has accelerated again. We are more connected than ever, making it easier for companies to reach huge audiences. But one size doesn’t fit all. There are strong regional differences in attitudes and perspectives that need to be considered. These don’t solely reflect the fact different markets are at different stages of economic development, but also that their citizens hold different religious and political beliefs.

This adds further complexity. Local regulations reflect localised attitudes and can’t always be imposed by an external body in the same way the dimensions of shipping containers could be dictated in the past.

Differing attitudes...

How important is it for women to have the same rights as men?

Over the past 20 years do you feel your country has become more diverse? Do you think this is a good or bad thing?

How important is it that people can use the internet without government censorship?

Is it important that media can report the news without government censorship?

How important is it that people can say what they want?

…lead to differing regulation

How have different countries approached cryptocurrency regulations?

Into the morass

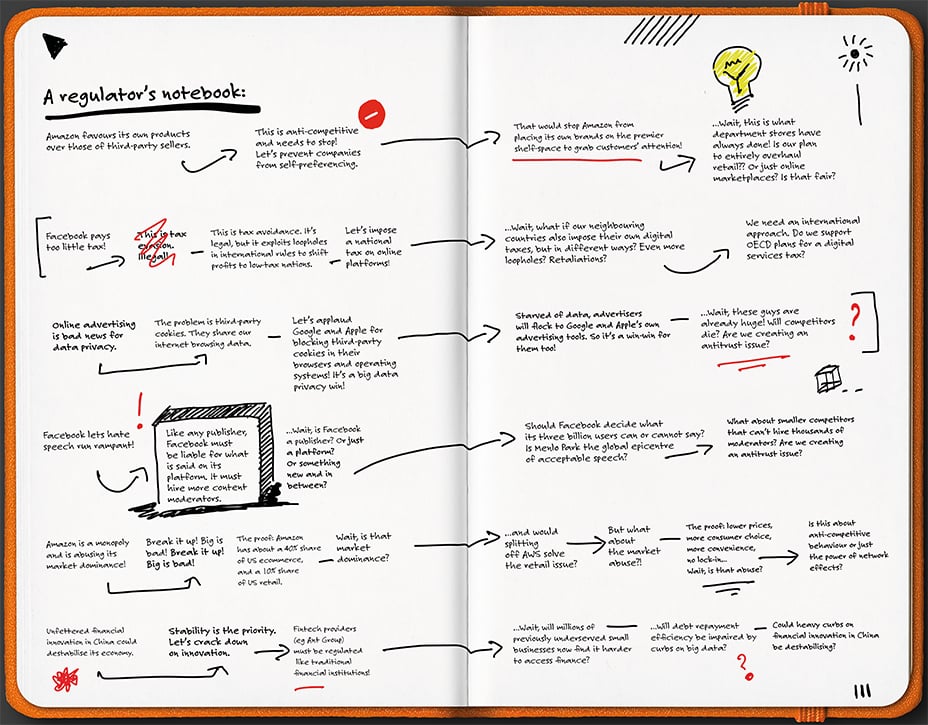

Moral panics coupled with the struggle of keeping up with innovation’s frenetic pace can lead politicians and their regulators to seek easy answers. There’s an appealing simplicity to slogans like ‘Break them up!’.

But the reality is there are no easy solutions, only trade-offs. Sacrifices must be made. Nuance is needed.

Observations and opportunities

Given all the complexity involved, it’s little wonder that regulations and bureaucracy are often perceived as costly burdens to businesses and the public. And that rules and officialdom are characterised as obstacles to efficiency and growth. Of course, mistakes and clumsy regulations occur. But the reality is nuanced.

The economist Professor Mariana Mazzucato has highlighted how states can spur on new technologies. This is not solely about top-down prescriptive practices, such as the goals described in China’s five-year plans. It’s also about the subtler opportunities created as a regulatory by-product.

For instance, Facebook has been subject to intense regulatory scrutiny. This encouraged it to amass tens of thousands of content moderators supported by sophisticated AI tools. It has also established an Oversight Board, which is intended to act as an independent body. While not without their flaws, these are industry-leading initiatives. And though costly, they may lead to new business opportunities. Perhaps Facebook will one day provide content moderation as a service to other businesses, rather as AWS provides cloud computing to its customers.

Similarly, the regulatory push to use electric vehicles could be an additional growth driver for Carvana, the online used-car marketplace. Its founder, Ernie Garcia, suggests that because EVs require less maintenance than internal combustion engine vehicles, large automakers may in the future have less incentive to expand their costly servicing networks. He recently mused that Carvana’s impressive logistics network and fixation on customer service could equip it to fill any resulting gaps in demand.

Another example: many investors spend an inordinate amount of time worrying about the costs of new Chinese regulatory measures levelled at large tech-enabled companies such as Alibaba, Pinduoduo and Meituan, among others. But provided the fundamentals of our long-term investment theses remain intact, sensible rules that strike an appropriate balance between innovation and stability can bring benefits. They may reinforce the longevity of companies that can not only adapt but also lead in a more regulated environment.

What can we take from all of this? When LTGG thinks about regulation, our approach to investing considers both materiality of impacts and alignment of interests. On the former, we carry out stock-specific analysis to distinguish which regulatory evolutions may materially affect a company – for better or worse – over the coming five to 10 years and beyond, and which changes are merely ‘noise’ to be tolerated along the way. As for alignment of interests, we look for companies that demonstrate thoughtfulness and adaptability when navigating regulatory changes. These companies are willing to learn from their mistakes, and proactively engage with regulators to take advantage of opportunities that align with the long-term goals of the societies and environments in which they operate.

Some holdings will inevitably fall foul of regulation. But others that master the rules of the game stand to generate asymmetric returns – for our clients, society and the planet.

We look for companies that demonstrate thoughtfulness and adaptability

Risk Factors

The views expressed in this article are those of the LTGG Team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2021 and has not been updated subsequently.

It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk.

Past performance is not a guide to future returns.

Stock Examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated. The images used in this article are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/ Institutional clients only.

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (‘BGO’) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 13800 10005328