Capital at risk

Impact

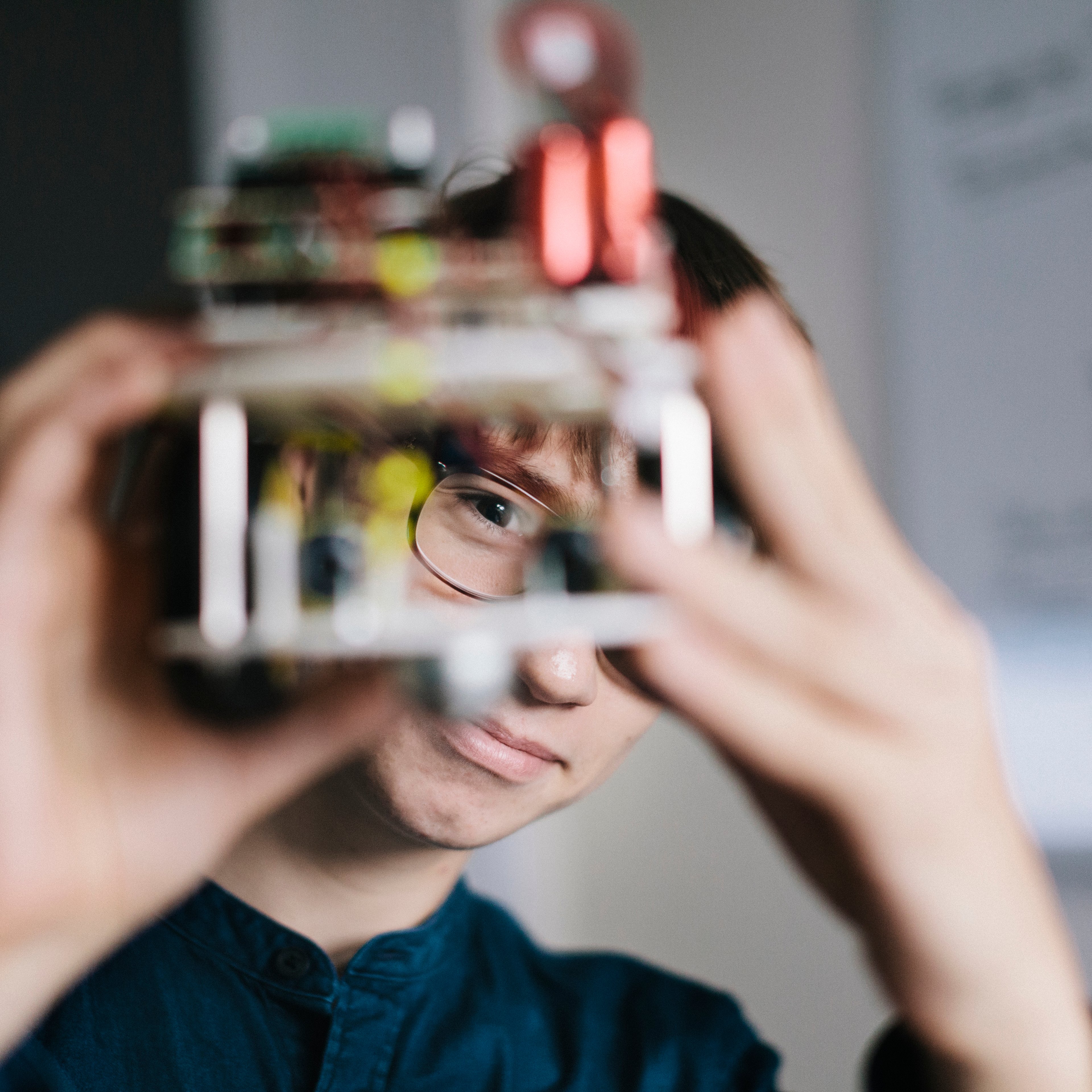

Backing companies that can bring about real-world change and hold the potential to generate long-term growth.

What is impact investing?

We reserve the term for strategies that primarily seek to achieve growth by investing in companies aiming to make positive environmental and/or social impacts. You might wish to support companies involved in renewable energy, the electrification of transport or that otherwise benefit the planet. You might be equally interested in firms that make education more accessible or drive medical advances, among other inclusive aims. Our impact investments target such goals while pursuing strong returns.

How does Baillie Gifford measure impact?

We require our relevant strategies to do two things to ensure we invest in companies with a positive measurable impact.

First, they must have clear impact definitions and frameworks to identify which companies can make it into their portfolio and be able to explain why. Second, they must produce a report that sets out the impact rationale and impact measurement for every company in the portfolio.

Impact strategies

All our investment capabilities

Core growth

Large, diverse portfolios of growth-focused holdings built with benchmarks and reduced volatility in mind.

Flexible growth

Portfolios containing a mix of firms focused on disruption, steady compounding and timely capital allocation.

High growth

Concentrated portfolios of fast-growth companies, typically holding between 25 and 50 stocks.

Important information

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients and is authorised and regulated by the UK Financial Conduct Authority. Baillie Gifford Overseas Limited is not licensed under the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law.

Baillie Gifford Overseas Limited markets and distributes Baillie Gifford’s range of collective investment schemes to Qualified Clients and Qualified Investors in Israel, as listed in the First Addendum to the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and in the First Addendum to the Israel Securities Law, 5728-1968 (the “Securities Law”). Detailed disclosure of the collective investment schemes can be found within this website and in the relevant scheme prospectus.

Baillie Gifford Overseas Limited does not provide investment advice. If you are in any doubt about whether an investment is suitable, you should seek independent advice.

No action has been or will be taken in Israel that would permit a public offering or distribution of the Funds mentioned in this website to the public in Israel. This website and the Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”). In addition, the Funds mentioned in this website are not regulated under the provisions of Israel’s Joint Investment Trusts law, 5754-1994 (the “Joint Investment Trusts Law”). This website and the Funds mentioned herein will only be distributed to Israeli residents in reliance on an exemption from any advice or marketing restrictions [in a manner that will not constitute “an offer to the public” under sections 15 and 15a of]/[in reliance on an exemption from the prospectus requirements under] the Israel Securities Law, 5728-1968 (the “Securities Law”) or the Joint Investment Trusts Law, and any guidelines, pronouncements or rulings issued from time to time by the ISA as applicable.