Insights

Filters

Insights

US perspectives: comfortable in discomfort

Explore how embracing uncertainty and discomfort can lead to exceptional investment opportunities and long-term success.

LTGG Reflections: Know where your towel is

Why investors should avoid the temptation to throw in the towel during market turmoil.

Fast fashion: investing for positive change

Shifting consumer attitudes are driving innovative solutions to make fashion more sustainable.

Global Alpha insights: a time to trade?

Explore how we're evolving the portfolio as the investment environment enters a period of rapid change.

UK growth: opportunities amid tariff turbulence

How adaptable firms in growth-driving sectors can prosper over the long term despite trade restrictions.

The case for private growth equity

How companies like Stripe, Databricks and SpaceX are shaking up growth trends typically dominated by public markets.

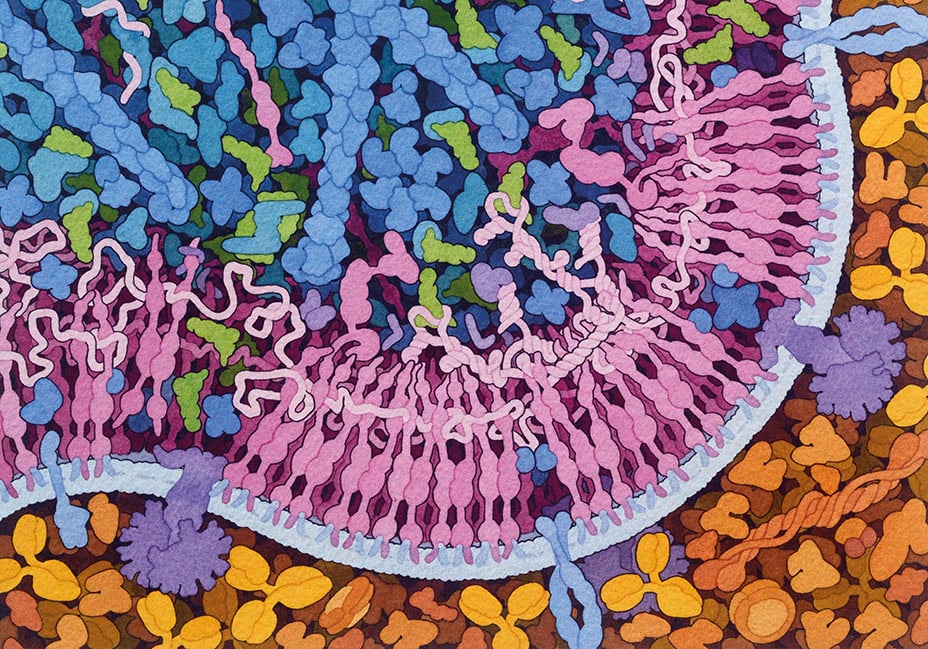

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

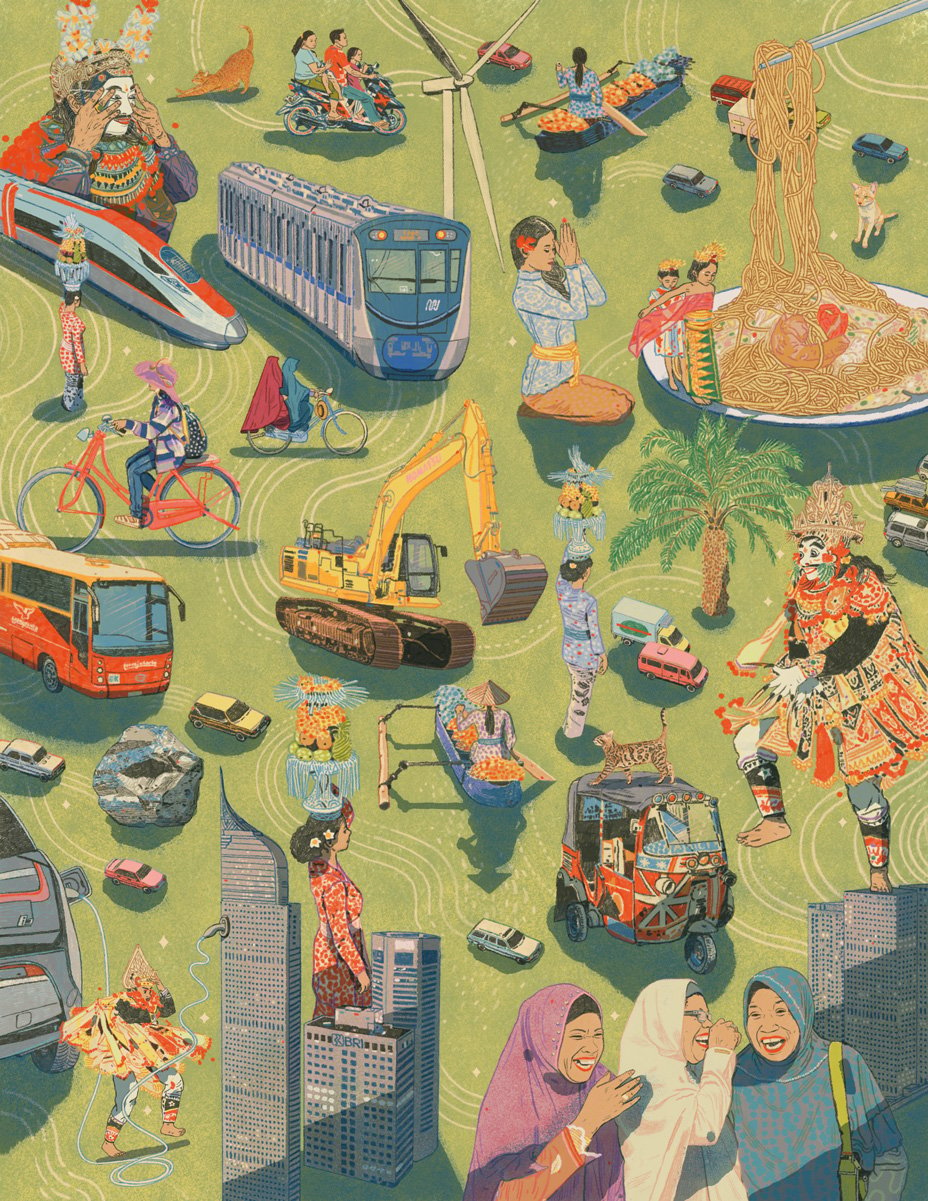

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

US perspectives: the retail ecosystem

Explore the evolution of retail, where cutting-edge technology and shifting consumer trends drive innovation.

With the benefit of foresight

Investors must navigate uncertainty to create long-term value in a rapidly changing world.

US Alpha Q1 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

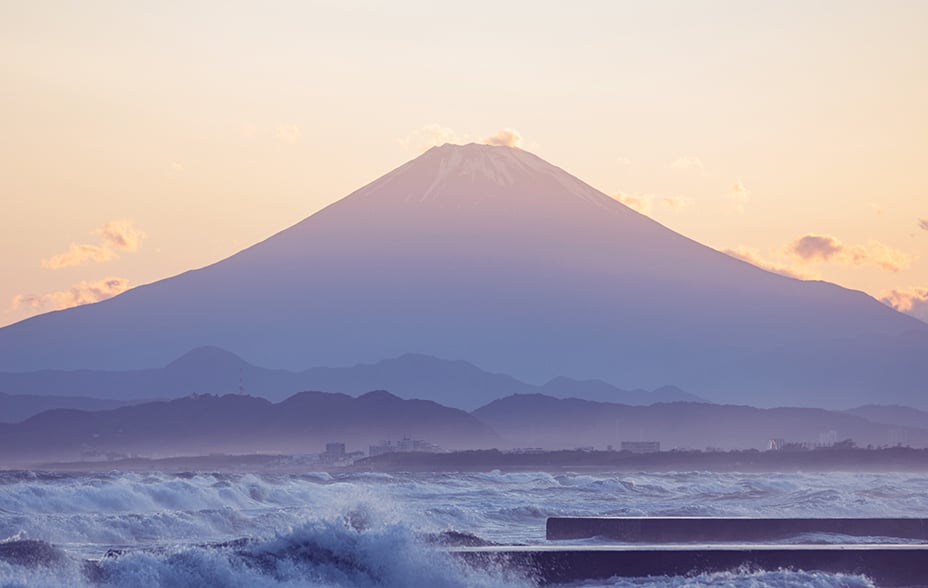

Japan Growth Q1 update

The Japan Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Discovery Q1 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Japan All Cap Q1 update

The Japan All Cap Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q1 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

UK Core Q1 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Alpha Q1 update

The UK Alpha Team reflects on recent performance, portfolio changes and market developments.

European Equities Q1 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 investor letter

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q1 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q1 investor letter

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

China Q1 investment update

The China Team reflects on recent performance, portfolio changes and market developments.

Nexans: Stock Story

Lucy Haddow examines the sub-sea cable manufacturer crucial for the offshore wind and energy transition.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

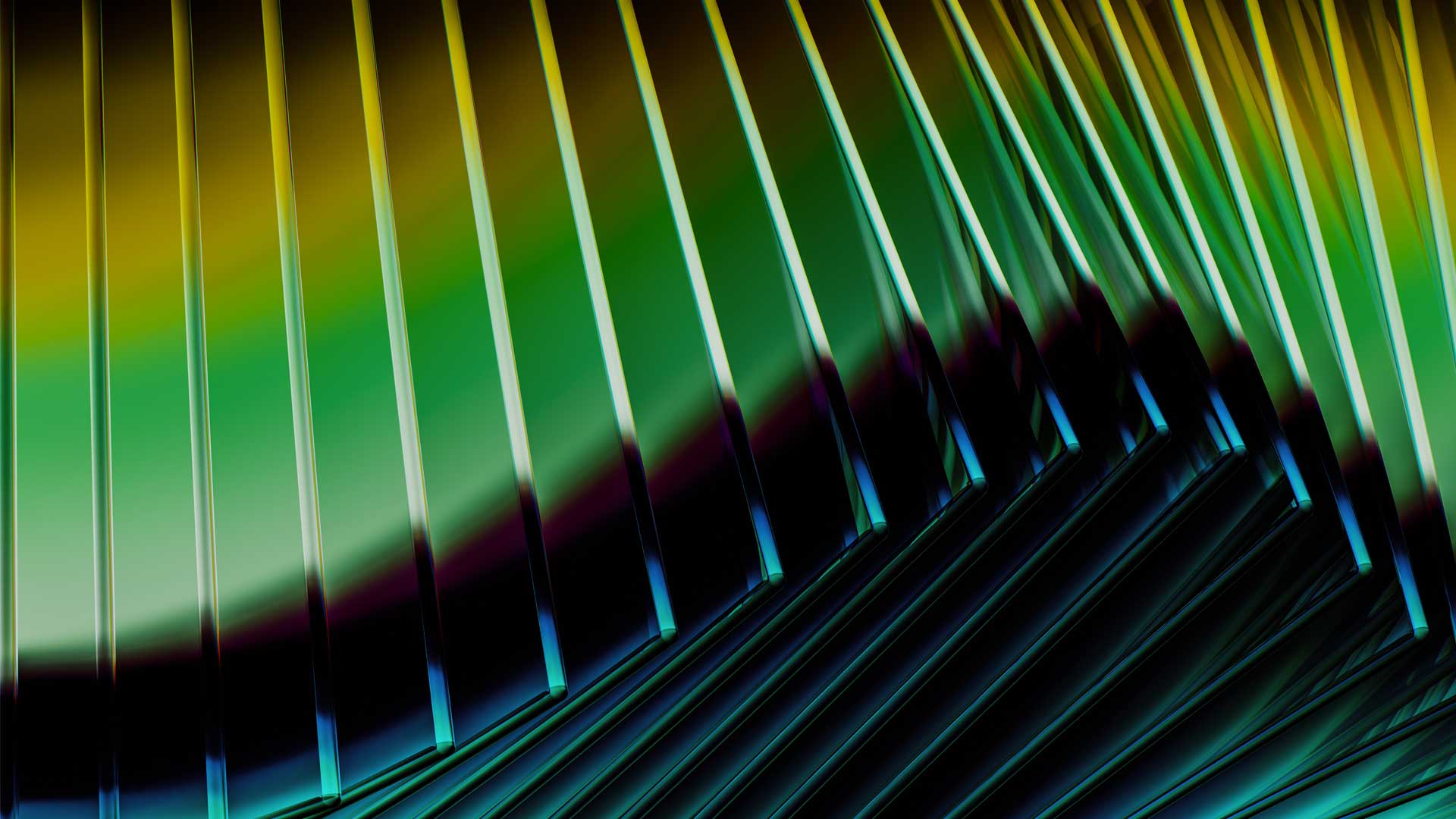

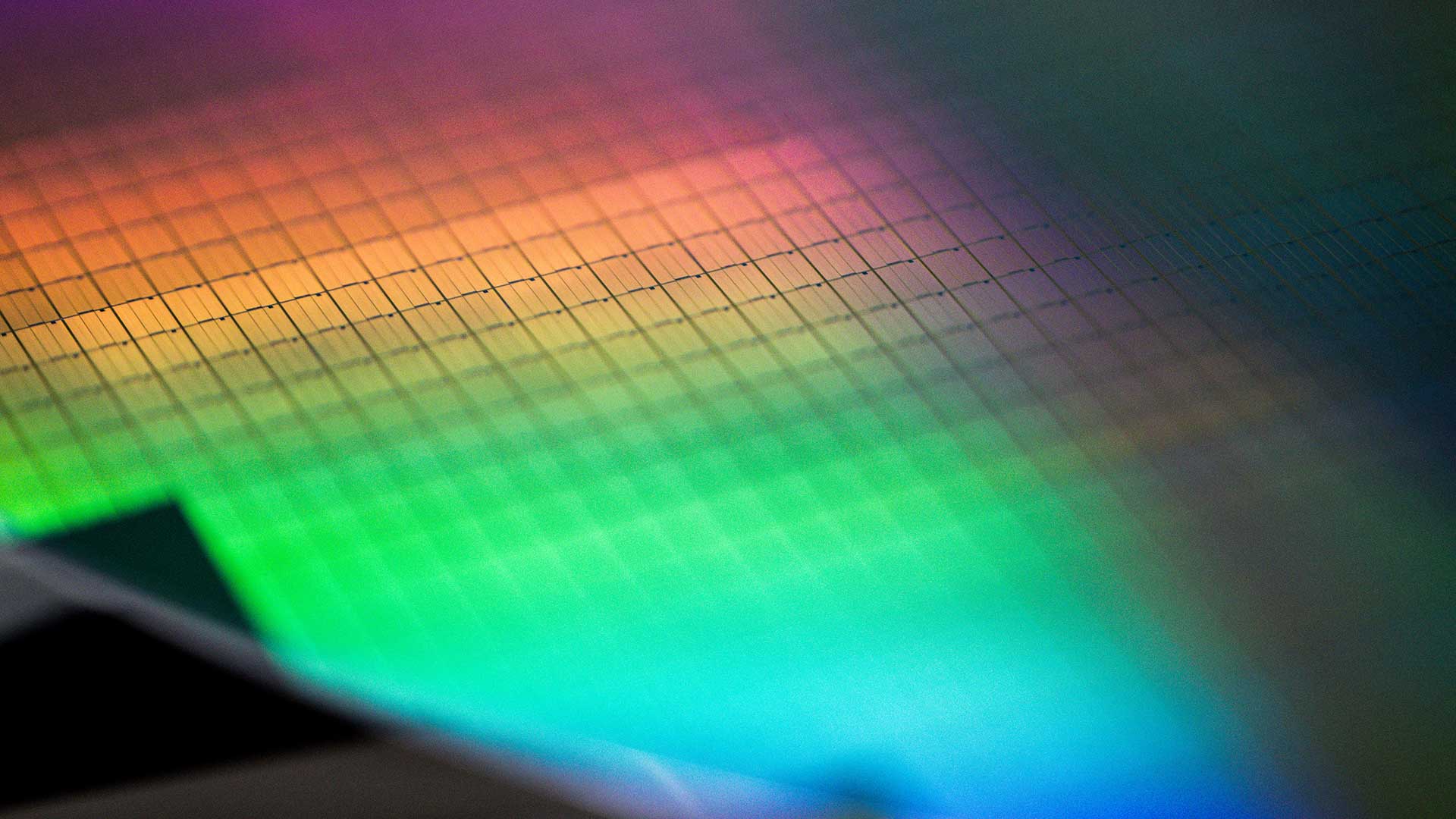

ASML: Stock Story

Paul Taylor explores the cutting-edge semiconductor technology advancing the digital revolution.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

In conversation with our Islamic scholars

Join our Islamic Scholars as they discuss the importance of aligning investments with Islamic principles.

In conversation with our investment managers

Join co-managers Kave Sigaroudinia and Tolibjon Tursunov as they discuss the Baillie Gifford Islamic Global Equity Strategy.

Europe: unique brands, hidden champions

Why a long-term approach to the continent’s growth stocks is more relevant than ever.

Why ants, scaffolding and long jumps matter to growth investors

Kirsty Gibson shares frameworks to analyse the cultures of exceptional growth businesses.

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

Trip notes: Kazakhstan

Sizing up super-app Kaspi.kz in Almaty.

How DSV became global freight’s top dog

Conquering trade logistics one merger at a time.

Watch this space: Tim Marshall on the future of ‘astropolitics’

Author Tim Marshall explains how space is set to become the new arena for rival powers.

Healthy returns: Japan’s assault on old-age disease

Japanese medical firms are making advances that could help fight cancer and Alzheimer’s.

Nubank: Latin America’s digital disrupter

Charting the app-based lenders’ long-term growth.

Joby Aviation readies for take-off

How a flying taxi firm could launch a transport revolution.

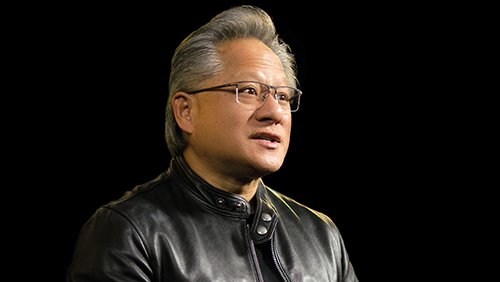

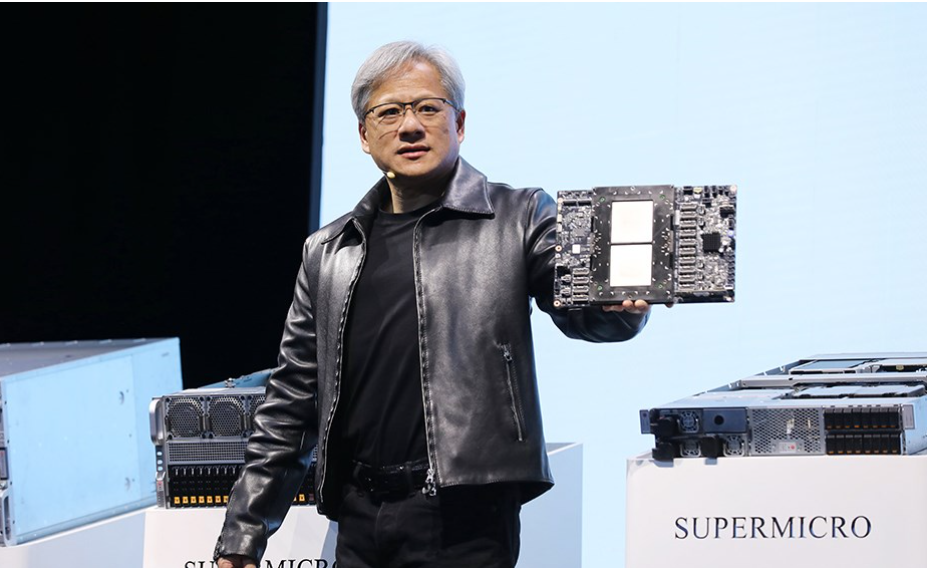

US perspectives: AI evolves again

Explore how the rapid market shift in AI and computer processing is transforming industries.

Positive Change: a review of 2024

A detailed overview of 2024 covering performance, portfolio and investment approach.

A new quest: Shariah-compliant investing

Discover how the Islamic Global Equities Strategy is blending finance and faith for global impact.

Climate scenarios: so what?

Six themes we think will influence companies’ futures as the world adapts to climate change.

Climate scenarios: preparing for uncertainty

How scenario analysis and climate adaptation can unlock exciting investment opportunities in resilient companies.

Private growth: Looking over the overlooked

Learn more about the key features and attributes of the growth equity asset class.

Positive Conversations 2024

Discover the difference made by dialogue in Positive Change’s latest ESG and engagement report.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Discovery: our philosophy

Investment manager, Douglas Brodie, discusses the Baillie Gifford Discovery Strategies.

Climate and energy scenarios

Explore four climate transition scenarios, their economic impacts and investment strategies for a low-carbon future.

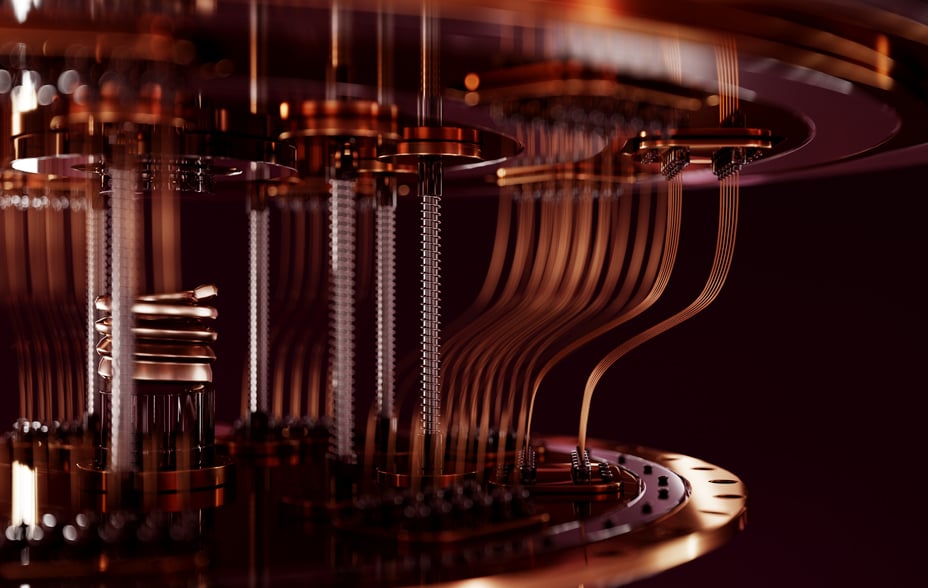

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

AI revolution: behind the 'overnight' success

AI is revolutionising industries globally. Stewart Hogg explores how AI is reshaping companies and driving long-term growth.

Diabetes: investing for positive change

Discover how innovative diabetes solutions are driving global positive change.

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

The G of ESG: governance reimagined

Why we don’t follow the crowd when assessing a company’s governance behaviours and structures.

5 inevitable and investable long-term growth drivers

Ways the world will change, from smarter robots to medical breakthroughs achieved at speed.

The concentration conundrum: challenge or opportunity?

In today’s era of US mega caps, is market concentration a challenge or an opportunity?

Finding sanity in the circus

An LTGG insight into what really matters for long term growth investing at the current juncture.

Volatility in LTGG: a feature not a bug

Why volatility is crucial to LTGG's strategy of capturing outsized returns.

Long Term Global Growth Q4 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

China Q4 update

The China Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

European Equities Q4 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q4 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

US Alpha Q4 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q4 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Japan Growth Q4 update

The Japan Growth Team reflects on recent performance, portfolio changes and market developments.

Japan All Cap Q4 update

The Japan All Cap Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q4 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Private Companies Q4 update

The Private Companies Team reflects on recent performance, portfolio changes and market developments.

Discovery Q4 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q4 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q4 investor letter

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q4 investor letter

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Upfront: US equities

Gary Robinson on what a Trump presidency and AI opportunities could mean for growth investors.

Heeding nature: what’s at stake?

How we seek to understand the implications of a changing world for the companies we back.

Stock story: Ecolab

Learn how Ecolab is helping customers around the world be better stewards of water.

Investing in an ageing society

Increasingly elderly populations could transform our lives as much as climate change or AI.

Emerging markets: new opportunities

Why increased resilience and strong growth prospects merit a closer look.

Private investments: unlocking growth

The three Rs – relationship, reputation and research – are key to private company investing.

Any other business: Disruption Week questions 2024

Baillie Gifford's strategy specialists address your remaining queries from Disruption Week 2024.

The great US infrastructure rebuild

Finding gold amid the grit of the US drive to repair its essential networks.

Growth investing: hunting the outliers

It’s not about growth or value. It’s about the few companies that drive stock market returns.

Why not just invest in the index?

Partner Stuart Dunbar explores why as an active manager Baillie Gifford can add value beyond investing in an index over the long term.

Small cap strife: big opportunities

Exploring the transformative potential of small-cap companies such as DexCom, Tesla and Axon.

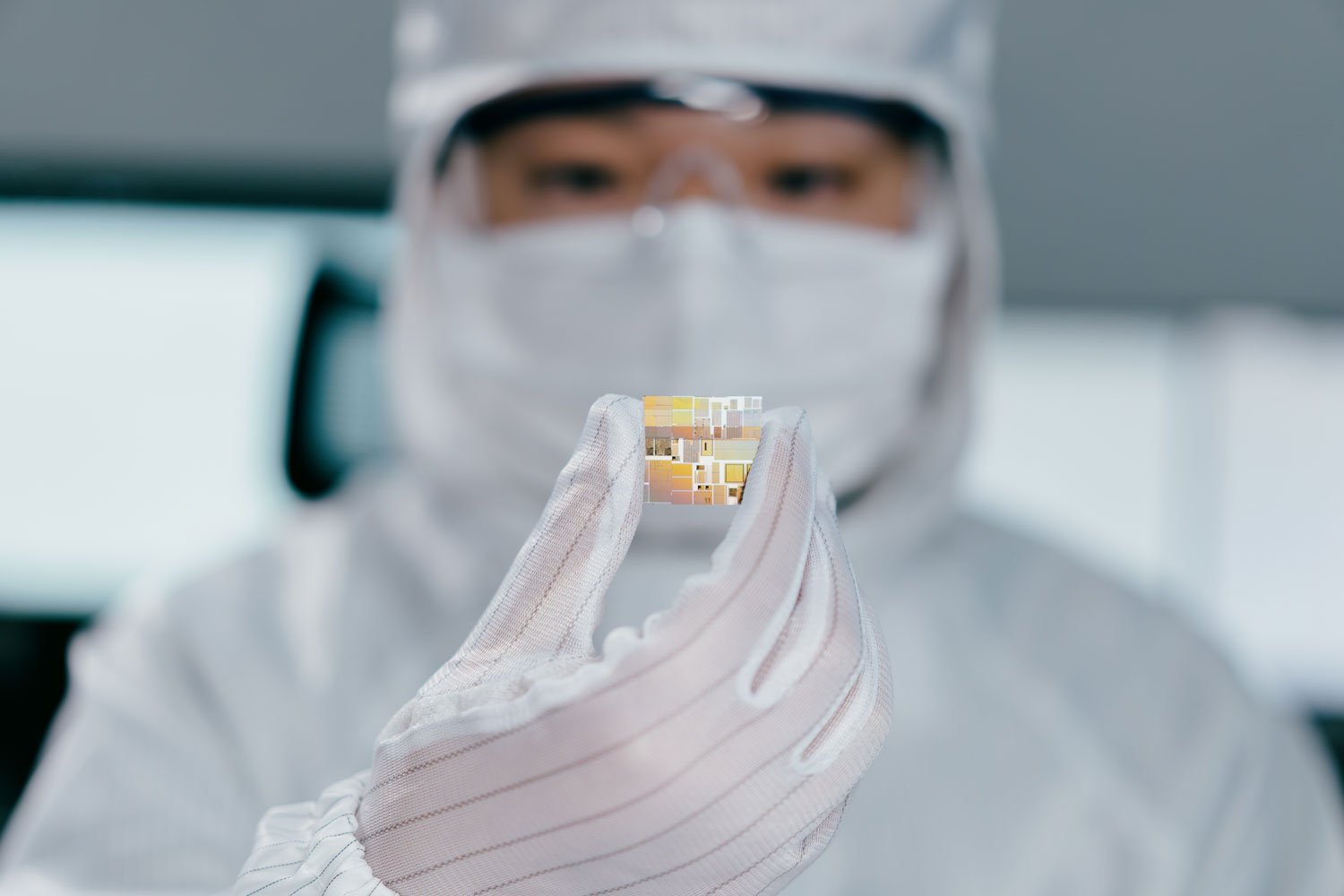

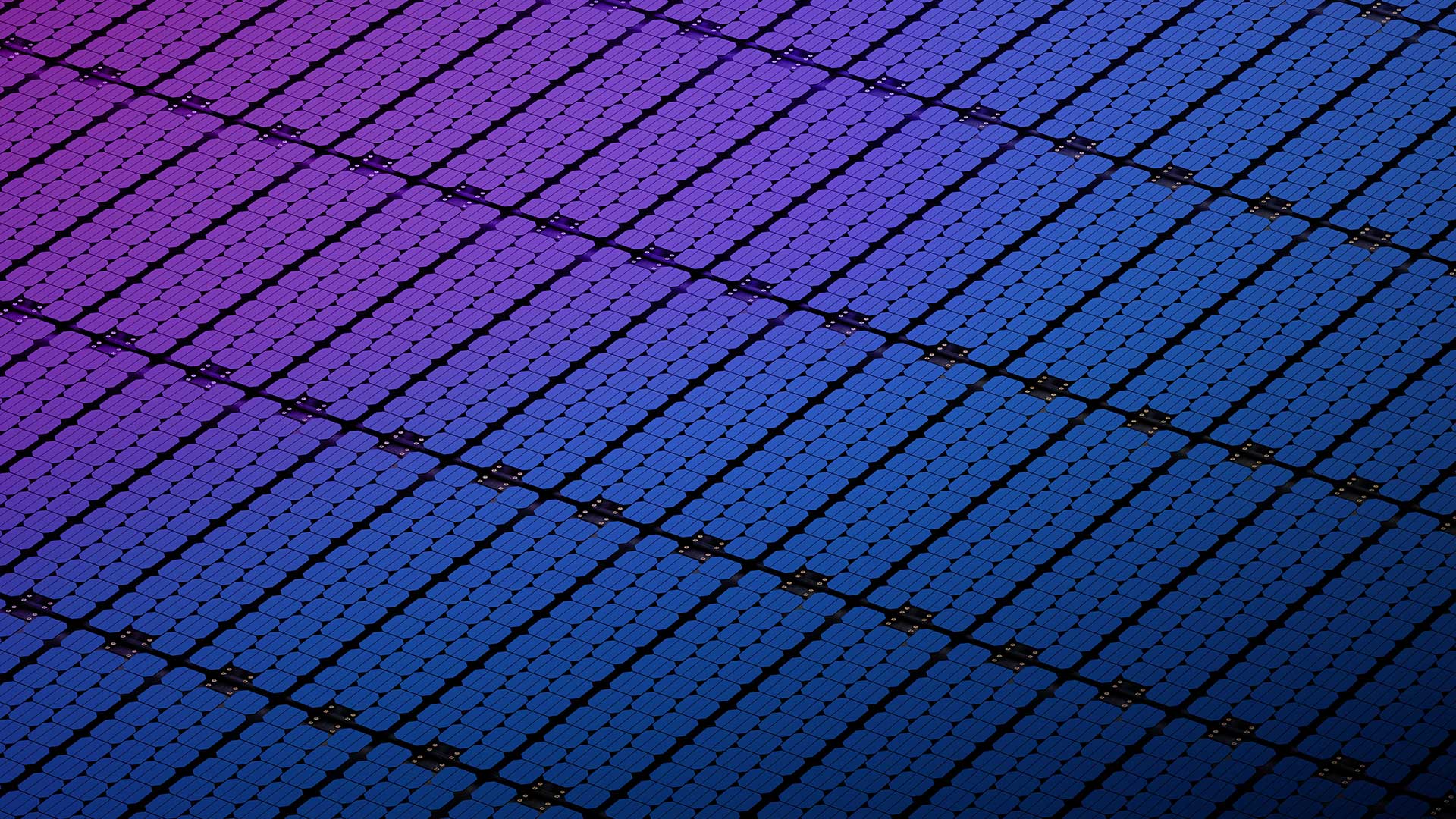

Semiconductor chips: the global tech battle

Companies and countries are vying for influence on the technology powering computation.

Saving when sending abroad: a Wise move

With international payments a profitable afterthought for the banks, it’s been left to a newcomer to build the best way of moving money around the world.

Long Term Global Growth Q3 investor letter

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments

US Equity Growth Q3 investor letter

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments

Positive Change Q3 investor letter

The Positive Change Team reflects on recent performance, portfolio changes and market developments

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments

Emerging Markets Q3 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments

Do elections matter for stock returns?

What the past tells us about a new US president’s impact on growth companies.

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Wise: Money Without Borders

Co-founder and CEO of digital payments platform Wise explains how a customer-centric approach is helping revolutionise global money movement.

China Q3 update

The China Team reflects on recent performance, portfolio changes and market developments.

Discovery Q3 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

European Equities Q3 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Japan Growth Q3 update

The Japan Growth Team reflects on recent performance, portfolio changes and market developments.

Japan All Cap Q3 update

The Japan All Cap Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q3 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q3 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

UK Core Q3 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q3 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q3 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

US Alpha Q3 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Future Stocks: Our best ideas in Japan

Thomas Patchett uncovers three companies driving new opportunities in Japan.

Future Stocks: Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks.

Future Stocks: Our best ideas in Asia

Qian Zhang highlights three Asian companies at the forefront of global structural trends.

Future Stocks: Our best ideas in Europe

Thomas Hodges uncovers three of Europe’s hidden growth champions: Lonza, Topicus and Soitec.

Future Stocks: Our best disruptive ideas

Bill Chater spotlights three companies set to make world-changing breakthroughs.

Future Stocks: Our best impact ideas

Rosie Rankin explains why Nubank, Xylem and Grab can both improve lives and offer investment returns.

The importance of focus

Why focus and patience are crucial elements when investing and identifying growth companies.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Ahead of the game: rethinking play’s importance

Kelly Clancy makes the case for why play is more important than you might think.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Creo Medical: at the spearhead of surgery

The Welsh company cutting surgery waiting lists – and costs.

Why technical leaders have an advantage

How the leaders of Meta, Shopify, Roblox and Spotify’s expertise helps them put AI to use.

Trip Notes: Seoul and Mumbai

Lawrence Burns sees great growth firms in action in South Korea and India.

PsiQuantum: the leap to quantum computing

PsiQuantum’s efforts could revolutionise medicine, energy use, farming and more.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

Beyond Silicon Valley

The US’s new hotbeds of innovation are increasingly based outside California.

SWCC Showa: rewiring Japan

How an ultra-traditional Japanese engineering firm became key to Japan’s power overhaul.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Japan: opportunities in automation

Japan's automation revolution and its global leadership in robotics.

Japan: opportunities in healthcare

Japan’s innovation medical breakthroughs are combatting ageing.

Japan: opportunities in quality brands

Behind the success of Japan’s leading quality brands and what opportunities they present.

Japan: opportunities in entertainment

Japan's media giants: Sony and Nintendo's timeless influence.

MercadoLibre: Latin America’s unbanked

MercadoLibre offers hope to Latin America’s 178 million unbanked population.

The rise of cloud computing

From data lakes to Databricks, cloud storage will be key to driving progress and future innovation.

Wise: Growing global money transfers

Charting rising cross-border money payments and the opportunity for remittance service Wise.

Japanese changemakers shaping the future

The firms taking advantage of four transformational opportunities.

Starlink: internet for mobile dead zones

Low-orbit satellites could be the answer for the three billion unable to access the internet.

International viewpoints: semi-cap resilience

Why our long-term conviction in ASML, Tokyo Electron and TSMC stands up to recent sector volatility.

Extraordinary times and opportunities

James Budden explains why now is the time for growth, as markets weather exceptional volatility

Environment: making sense of the E in ESG

How companies’ relationships with climate, energy and the environment relate to long-term growth.

Academic collaborations that count

The experts helping us gain an investment edge when thinking about farming, human rights and AI.

Positive Change Impact Report 2023

Where innovation meets impact: logging portfolio companies’ progress in shaping a better future.

Lessons from a time traveller

A journey through time uncovers the deep transitions that can reshape our world.

Long Term Global Growth Q2 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q2 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q2 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q2 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q2 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth: investor letter Q2 2024

Investment specialist Fraser Thomson gives an update on the US Equity Growth Strategy covering Q2 2024.

AI: driving a new healthcare paradigm

Why AI could be key to us living longer and being in better health in the future.

Positive Change: investor letter Q2 2024

Investment specialist Rosie Rankin gives an update on the Positive Change Strategy covering Q2 2024.

Streamlined for success

How efficiency drives at Meta, Shopify and Block could fuel their long-term growth.

Discovery Q2 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

European Equities Q2 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Sustainable Growth Q2 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

China Q2 update

The China Team reflects on recent performance, portfolio changes and market developments.

Japanese Equities Q2 update

The Japanese Equities Team reflects on recent performance, portfolio changes and market developments.

US Alpha Q2 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments

Global Income Growth Q2 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

International viewpoints: eastern promise

What market sentiment, recent valuations and policy changes mean for us as investors in Asian growth companies.

Private equities: time to turn to growth

Why high interest rates help rapid growth private companies with proven products stand apart.

Japan: the next opportunity

Explore Japan's market evolution, digitalization, and investment opportunities in unique growth themes.

Why small companies matter to us

Unlocking the potential of small cap investments.

A write up of Baillie Gifford’s responsible investing breakfast

An insight into the critical role of responsible investing in aligning financial success with sustainability efforts.

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

China through a Japanese lens

Japanese tech dominance is under increasing pressure in China from domestic challengers.

Stock story: MercadoLibre

The company on a mission to democratise ecommerce and finance for 650 million people.

Upfront: Japanese equities

Praveen Kumar shares the latest on growth equities in Japan and why now is the time for small cap investors to be bold.

Webinar: Why growth? Why now?

Partners Tim Garratt and Stuart Dunbar identify signs of emerging growth.

Algorithmic alchemy: investing with optimism in AI

How artificial intelligence creates growth opportunities and ways for us to serve you better.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Sustainable Growth Q1 update

The Sustainable Growth Team reflects on recent performance, portfolio changes and market developments.

UK Core Q1 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

European Equities Q1 update

The European Equities Team reflects on recent performance, portfolio changes and market developments.

Japanese Equities Q1 update

The Japanese Equities Team reflects on recent performance, portfolio changes and market developments.

Long Term Global Growth Q1 update

The Long Term Global Growth Team reflects on recent performance, portfolio changes and market developments.

International Growth Q1 update

The International Growth Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

China A Shares Q1 update

The China A Shares Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Private companies and the Power Law

Author Sebastian Mallaby on the attraction of investing in game-changing firms at an early stage.

Moncler: from mountain to street

How the outerwear pioneer innovated its way into the fashion elite.

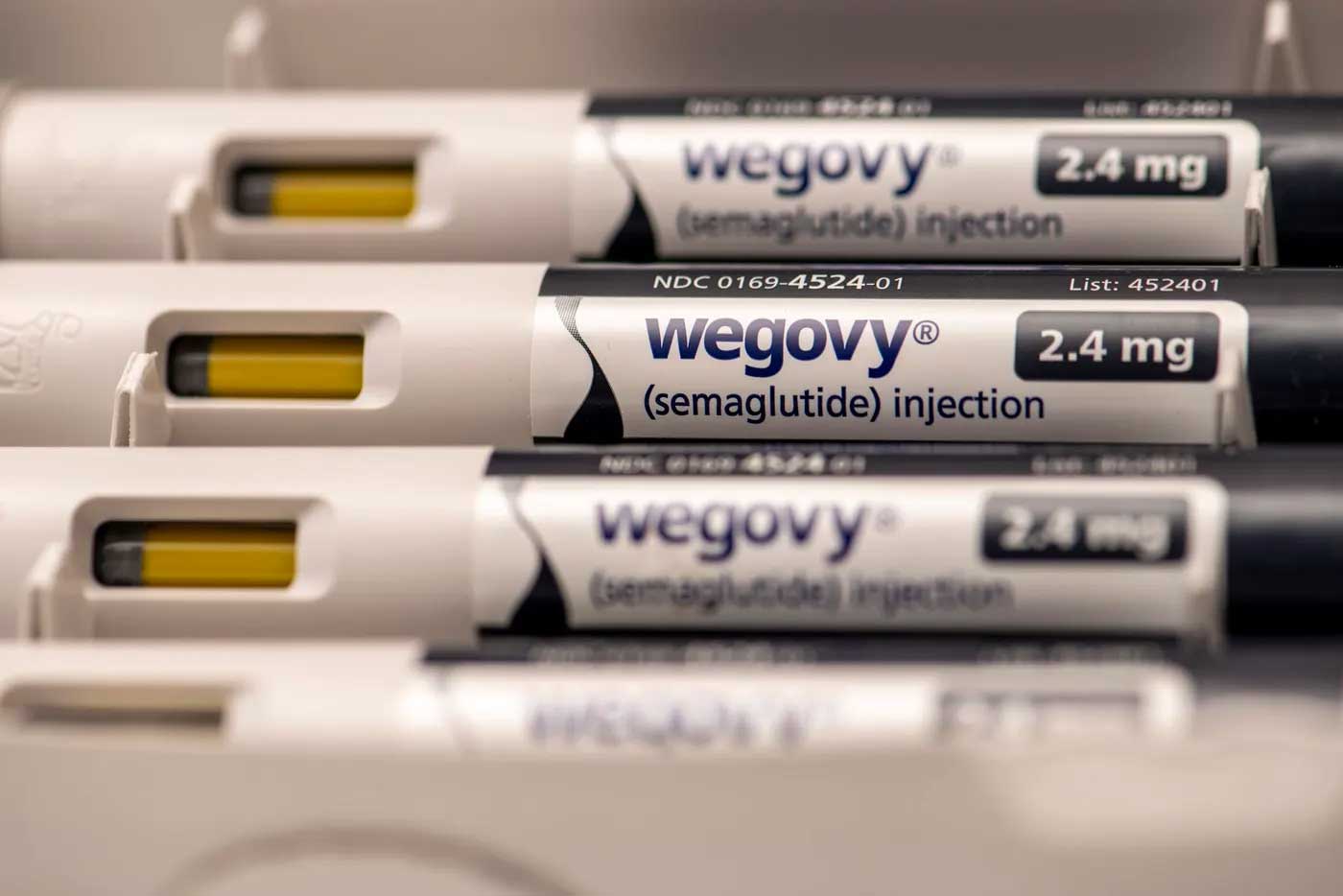

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

The fresh face of Japanese finance

New online services are transforming Japanese financial habits.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Lessons from the laws

Investment managers share some of the economic laws that guide their decision-making.

Vietnam: Asia’s rising star

Visiting Saigon, Roderick Snell explores what went right for the pro-business communist country.

AI: intelligence everywhere

Why AI could be the printing press of intelligence.

Remitly: easy global remittance

The mobile app that busts stress and high charges for workers sending money back home.

Starlink’s Space-based broadband

How the SpaceX subsidiary is turning internet deserts into online oases

The founder factor

Tom Slater on the secret sauce shared by founder-led companies.

Climeworks: digging deeper for climate solutions

A small holding with a long-term climate goal.

Upfront: Asia’s emerging markets

Roderick Snell on investing in Asia – from a strengthening dollar to the semiconductor value chain.

Positive Conversations 2023

The Positive Change Team’s ESG and engagement report shows the difference talking can make.

Stock story: Pinduoduo

The innovative ecommerce company poised to take advantage of China’s large consumer base.

All aboard the growth train

Why do we prefer growth stocks despite the lure of shorter-term assets?

Positive Change: a review of 2023

A performance update explaining why we back firms solving social and economic issues such as Moderna and MercadoLibre.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Moderna: designing drugs on a computer

Can scientists meet unmet health needs by writing code to help the body heal itself?

The AI paradigm shift

Being open-minded to what rapid changes brought on by AI could mean for growth stocks.

Niches, anomalies, and things to come

How can we spot large growth opportunities at the stage when others dismiss them as fads?

Lessons from evolutionary biology

Why the study of gene fitness can help us spot ambitious growth companies with huge potential.

Enduring good

What values are important to you? And are they reflected in your investments?

Making sense of social

Considering the S in ESG ranges from supply chain analysis to cybersecurity precautions.

Stock story: SoftBank

Matthew Brett discusses SoftBank and considers Japan’s exciting technological future.

Avoided emissions methodology

Climate and Environment Analyst Matt Jones considers the potential of emissions avoidance and disruptive innovation.

HelloFresh: changing how people eat forever

HelloFresh’s CEO explains the art and science of meal kit delivery at a global scale.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

South-east Asia’s new export stars

Unearthing growth companies in Vietnam, Indonesia and Thailand.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

China revisited

Lawrence Burns explores the new landscape of opportunity.

Spotting the stars amid a surge

Rising Japanese markets are flattering old-style companies: better to look for long-term growth.

Innovation’s drumbeat

Charting how technological progress and prosperity march together.

Aurora: the technology company transforming trucking

The US’s $800bn trucking industry is on track for a shake up with Aurora’s self-driving technology.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

When software meets steel

The ‘next wave’ of companies, mixing the digital and physical realms.

Nuclear comeback

Could smaller reactors and fusion power herald a new atomic age?

AI: a long-term perspective

Why investors must put the rise of ChatGPT and other generative AI in context.

Climate change: imagining the future

The years ahead are uncertain, but we can turn that to our advantage.

Adding value from climate change

Companies addressing climate change could create huge societal and economic value over time.

Legally bond: finding underestimated resilience

By keeping an open mind, we hope to find opportunities other credit investors might overlook.

Japan’s new growth opportunities

Seeking the entrepreneurial firms that could sustain the country’s rally.

How Microsoft got its mojo back

By shifting the focus from Windows and embracing AI, the firm has revitalised its fortunes.

The hidden costs of software

A decade ago, software companies were venture-backed and capital-light. That’s no longer true.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Climate futures: preparing for uncertainty

How can we avoid a hothouse world? Head of Climate Change Caroline Cook discusses with experts.

Can we mine sustainably?

Minerals are key to the energy transition. We believe mining responsibly will bring rewards.

Nuclear fusion: SHINE lights the way

The cancer-fighting firm that aims to lead a clean energy revolution.

ESG: beyond the growing pains

Why considering environmental, social and governance factors helps us pursue long-term returns.

Joiners’ mate

Iain McCombie on how Howdens’ kitchens won the building trade’s trust.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Three climate change scenarios

Considering different ways global warming and a transition to new energy sources might occur.

Disruption Week 2023

Glimpse a universe of opportunity at Baillie Gifford’s Disruption Week in November 2023.

What is private company investing?

Discover what private company investing is, and why our decades of institutional knowledge of exceptional growth companies gives us an advantage.

Stock story: Kering

Find out what makes luxury fashion conglomerate Kering stand out from the competition.

What does Moderna do?

Learn how the Boston-based life science company is disrupting the drug development industry.

The secrets of enduring growth

Toby Ross reveals the four signs that a company’s growth might endure for decades.

Growth investing across decades

Mark Urquhart discusses the science and art of picking growth stocks with enduring potential.

Adapting to survive – and thrive

Using a fighter pilot’s business strategy can help a company orient itself amid change.

Positive Change Impact Report 2022

If impact and investing go together, it is important to understand the difference we make.

Stock stories: Climeworks

Climeworks, the company using innovative technology to capture and store CO2 underground safely, measurably and permanently.

Eating better to save ourselves

Tim Spector and Henry Dimbleby on what our diet says about our health and the health of the planet.

What does Northvolt do?

Learn how the Swedish battery company Northvolt is driving change in the EV industry

Making health insurance manageable

How Elevance Health uses its scale to smooth a path through the US health system’s maze.

Asia ex Japan manager update

Roderick Snell and Qian Zhang discuss current views and portfolio positioning for the Asia ex Japan Strategy.

Climate change innovators

How Positive Change targets companies at the forefront of tackling carbon emissions.

China A Shares: in conversation

Investor Sophie Earnshaw explains how we navigate China’s complexity to boost growth potential.

Why the long-term matters

There’s safety in being one of the crowd but it could stop you from seeing potential rewards.

Indonesia powers a green transition

The island nation’s natural wealth makes it crucial to a low-carbon future.

The changing face of growth

By investing in companies at the frontiers of structural shifts we can pursue fantastic returns.

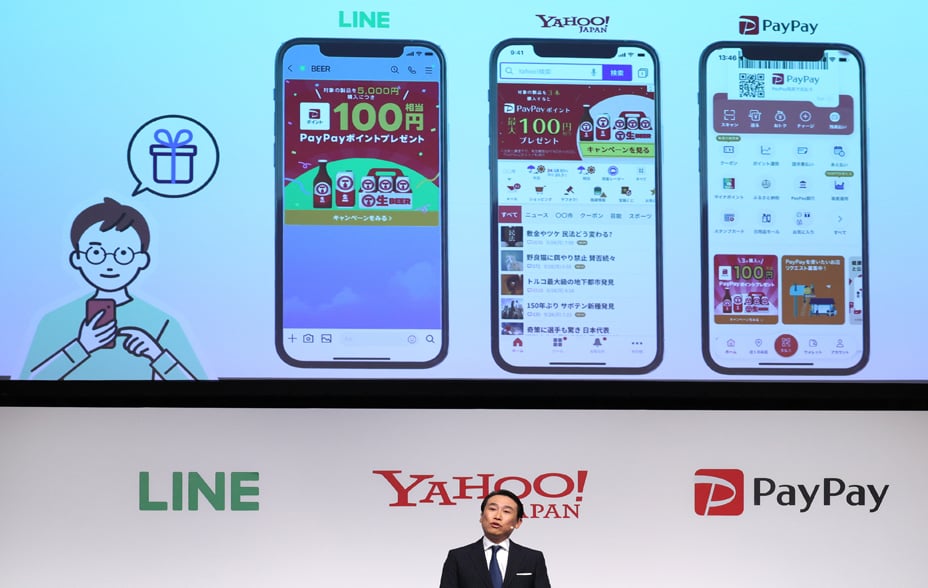

From Y to Z: Japan’s online powerhouse

How Yahoo! Japan and Z Holdings' conquest of the country’s internet realm unfolded.

Rethinking renewables

Research suggesting faster-than-expected adoption has far-reaching consequences for investors.

Japan’s place in the chip market

The Japanese semiconductor companies set to benefit from the rise of 5G and electric cars.

Ocado’s robot revolution

The UK firm partnering with leading grocers to deploy its automated warehouses worldwide.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Positive Conversations 2022

We don’t just talk to managements, we listen. A snapshot of Positive Change’s ESG conversations.

Denali Therapeutics: rising to the challenge of brain disease

Developing brain disease drugs is hard, but this company’s early results suggest it can succeed.

Four questions for growth investors

Investors must find companies with the key qualities needed to thrive in a stormy economy.

Positive Conversations 2022

Responsible business practices are fundamental to delivering sustainable long-term growth and addressing global challenges.

LTGG investor update – January 2023

LTGG’s Stewart Hogg and Gemma Barkhuizen on volatility, business culture, and the long-term view.

Nothing lasts forever

Why international equity markets shouldn’t be forgotten.

Teleportation: just a Zipline away

Zipline delivers instantly, whether that’s blood in Rwanda or rotisserie chicken from Walmart.

MercadoLibre: a lesson in innovation

Investment manager Lawrence Burns talks to MercadoLibre’s CFO Pedro Arnt.

Japan Growth: Asia’s resurgence

Despite the turbulence of last year there are reasons to be optimistic about Japanese companies.

Japan: setbacks or permanent change?

Our investors’ job is to tell the difference between passing phases and deeper behavioural shifts.

Beauty secrets: sharing Shiseido’s story

Masahiko Uotani, CEO of the Japanese cosmetics giant, discusses its profitable makeover with Iain Campbell.

Global Alpha Research Agenda 2023

How can we invest in quality companies with the potential to generate sustainable returns in a changing market?

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Insights: investment research in Japan

Japan’s cultural landscape is changing, with implications for companies like Shiseido, CyberAgent and PayPay.

Asia and energy transition

Exploring the emerging energy opportunities in Asia.

Chip War

How semiconductors bring a competitive world together.

Why patience matters

Endurance and imagination are key ingredients for quality growth investing.

Why private companies matter more

SpaceX, Epic Games and Stripe: the list of the unlisted continues to grow. How can investors benefit?

A private companies approach to ESG

The special considerations at play when we invest in high-growth, late-stage unlisted firms.

Tomorrow’s world, here today

Investing in private companies applying today’s early-stage tech to create tomorrow’s world.

Looking back going forward

The LTGG Team look back on an extraordinary 12 months and discuss the growth prospects of the portfolio, the rapid development of vaccines and the importance of hold discipline.

The Second Space Age

Fifty years after Apollo 11, can a fresh wave of innovation in space technology open new frontiers and promising investment opportunities? Investment manager, Luke Ward looks across the gulf of space and gives us his views.

Learning from Academia

Our support of inquisitive people plays a crucial role in our investment research. Discover more in our academia anthology.

Webinar: Why growth? Why now?

Quarterly investment updates

Keep up to date with the latest views of our investment teams in these short strategy briefings.

Long-term vision

It takes time to achieve transformational change. So we invest in companies for years, even decades. And we support their leaders in making decisions that can deliver strong, sustainable returns to you.

Recent insights

US perspectives: comfortable in discomfort

Explore how embracing uncertainty and discomfort can lead to exceptional investment opportunities and long-term success.

LTGG Reflections: Know where your towel is

Why investors should avoid the temptation to throw in the towel during market turmoil.

Fast fashion: investing for positive change

Shifting consumer attitudes are driving innovative solutions to make fashion more sustainable.

Global Alpha insights: a time to trade?

Explore how we're evolving the portfolio as the investment environment enters a period of rapid change.

UK growth: opportunities amid tariff turbulence

How adaptable firms in growth-driving sectors can prosper over the long term despite trade restrictions.

The case for private growth equity

How companies like Stripe, Databricks and SpaceX are shaking up growth trends typically dominated by public markets.

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

US perspectives: the retail ecosystem

Explore the evolution of retail, where cutting-edge technology and shifting consumer trends drive innovation.

With the benefit of foresight

Investors must navigate uncertainty to create long-term value in a rapidly changing world.

US Alpha Q1 update

The US Alpha Team reflects on recent performance, portfolio changes and market developments.

US Equity Growth Q1 update

The US Equity Growth Team reflects on recent performance, portfolio changes and market developments.

Japan Growth Q1 update

The Japan Growth Team reflects on recent performance, portfolio changes and market developments.

Positive Change Q1 update

The Positive Change Team reflects on recent performance, portfolio changes and market developments.

Discovery Q1 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Important information

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK clients and is authorised and regulated by the UK Financial Conduct Authority. Baillie Gifford Overseas Limited is not licensed under the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and does not carry insurance pursuant to the Advice Law.

Baillie Gifford Overseas Limited markets and distributes Baillie Gifford’s range of collective investment schemes to Qualified Clients and Qualified Investors in Israel, as listed in the First Addendum to the Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the “Advice Law”) and in the First Addendum to the Israel Securities Law, 5728-1968 (the “Securities Law”). Detailed disclosure of the collective investment schemes can be found within this website and in the relevant scheme prospectus.

Baillie Gifford Overseas Limited does not provide investment advice. If you are in any doubt about whether an investment is suitable, you should seek independent advice.

No action has been or will be taken in Israel that would permit a public offering or distribution of the Funds mentioned in this website to the public in Israel. This website and the Funds mentioned herein have not been approved by the Israeli Securities Authority (the “ISA”). In addition, the Funds mentioned in this website are not regulated under the provisions of Israel’s Joint Investment Trusts law, 5754-1994 (the “Joint Investment Trusts Law”). This website and the Funds mentioned herein will only be distributed to Israeli residents in reliance on an exemption from any advice or marketing restrictions [in a manner that will not constitute “an offer to the public” under sections 15 and 15a of]/[in reliance on an exemption from the prospectus requirements under] the Israel Securities Law, 5728-1968 (the “Securities Law”) or the Joint Investment Trusts Law, and any guidelines, pronouncements or rulings issued from time to time by the ISA as applicable.