Capital at risk

Global Discovery

The strategy seeks ambitious, rare companies that could shape our future by solving today’s most important, complex problems. We aim to find them at an early stage and hold them for the long term as they scale.

Unearthing transformational growth

Global Discovery seeks to invest in immature, disruptive companies experiencing exciting, formative growth phases. We then look to hold them for the long term as they scale.

While this approach can lead to individual stock and strategy volatility, we believe it also increases the chance of highly asymmetrical outcomes.

The strategy aims to outperform (net of fees) the S&P Global Small Cap Index, in sterling, by at least 2 per cent per annum over rolling five-year periods.

We consider opportunities below $10bn but believe immaturity, not size, is the best proxy for potential. We hold regardless of market cap if the company has desirable traits.

Discovery: our philosophy

Investment manager, Douglas Brodie, discusses the Baillie Gifford Discovery Strategies and reflects on their philosophy and the exciting opportunities ahead.

A unique pursuit

The portfolio is built from the bottom up, disregarding the benchmark. Thus, it has a very high active share. This differentiates us from others.

We exist in a huge investible universe, but most companies don’t meet our specifications. So we place ourselves on the frontier of technological progress.

The resulting portfolio varies by industry and geography. What unites it is immaturity. We define this as:

- Scalability

- Quality and ambition of management

- Innovation to solve problems and reshape industry

- Emerging competitive edge

We established the Global Discovery Strategy to capture the opportunity in the enduring supercycle of innovation.

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | Alnylam Pharmaceuticals | 7.2% |

| 2 | Axon Enterprise | 3.3% |

| 3 | Zillow | 3.1% |

| 4 | Oxford Nanopore Tech | 3.0% |

| 5 | LiveRamp | 3.0% |

| 6 | Ocado | 2.9% |

| 7 | JFrog | 2.7% |

| 8 | AeroVironment | 2.6% |

| 9 | Kingdee International Software | 2.5% |

| 10 | Exact Sciences | 2.4% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

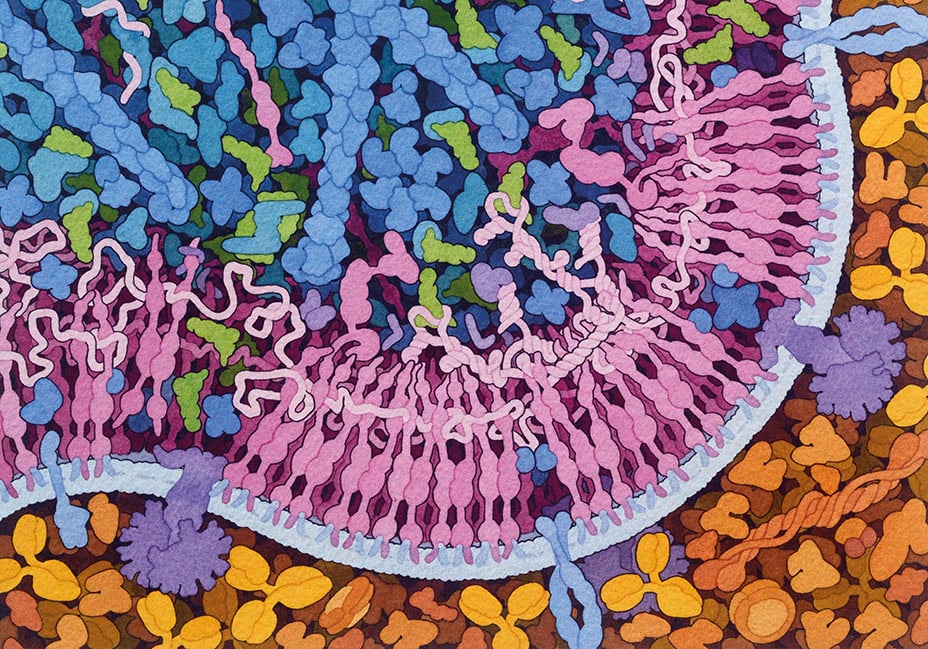

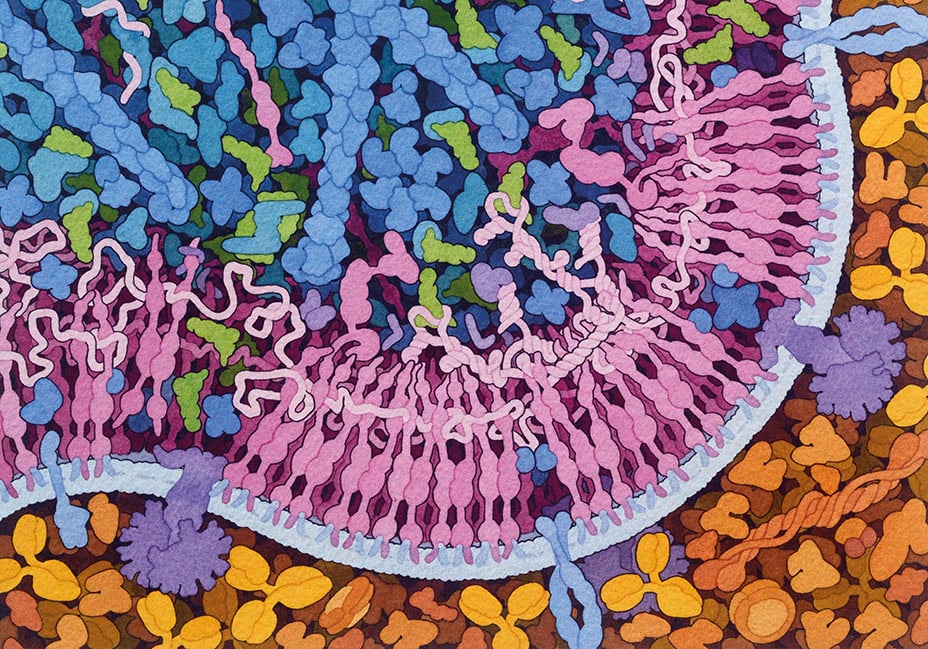

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Discovery Q1 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Discovery: our philosophy

Investment manager, Douglas Brodie, discusses the Baillie Gifford Discovery Strategies.

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

Discovery Q4 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Small cap strife: big opportunities

Exploring the transformative potential of small-cap companies such as DexCom, Tesla and Axon.

Discovery Q3 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Future Stocks: Our best disruptive ideas

Bill Chater spotlights three companies set to make world-changing breakthroughs.

Discovery Q2 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

Global Discovery manager update

Hear why investors’ confidence in the Strategy remains steadfast despite challenging times.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Global Discovery manager update

Investors discuss recent performance, holdings, and portfolio positioning for the Global Discovery Strategy.

Discovery: a view from the frontiers

Baillie Gifford’s Global Discovery Team reflects on the lessons of turbulent times.

A decade of discovery

A focus on growth and innovation has led to exciting finds such as Tesla and Ocado.

Bricks and clicks

With online companies currently dominating sales, it is widely expected that the need for tangible stores will continue to decrease, but Baillie Gifford has spotted a rise in forward-thinking companies who are utilising physical spaces to provide an innovative and interactive shopping experience.

Discovery Q1 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Alnylam: Stock Story

Richie Vernon explores the revolutionary drugs transforming patient lives.

Discovery Q1 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Discovery: our philosophy

Investment manager, Douglas Brodie, discusses the Baillie Gifford Discovery Strategies.

Quantum, space, fusion: the big three

How PsiQuantum, SpaceX and SHINE Technologies seek to shape the future and deliver growth.

Discovery Q4 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Small cap strife: big opportunities

Exploring the transformative potential of small-cap companies such as DexCom, Tesla and Axon.

Discovery Q3 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Future Stocks: Our best disruptive ideas

Bill Chater spotlights three companies set to make world-changing breakthroughs.

Discovery Q2 update

The Discovery Team reflects on recent performance, portfolio changes and market developments.

Stock story: PsiQuantum

How one company is finally bringing the boundless possibilities of quantum computing into reach of the wider market.

Global Discovery manager update

Hear why investors’ confidence in the Strategy remains steadfast despite challenging times.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Small caps: Beyond the myths

Opportunities remain in small-cap investing, regardless of interest rates or market volatility.

How Alnylam nips disease in the bud

The US-based company’s technology promises to ‘silence’ genetic disorders and target some of the world’s biggest killers.

Global Discovery manager update

Investors discuss recent performance, holdings, and portfolio positioning for the Global Discovery Strategy.

Discovery: a view from the frontiers

Baillie Gifford’s Global Discovery Team reflects on the lessons of turbulent times.

A decade of discovery

A focus on growth and innovation has led to exciting finds such as Tesla and Ocado.

Bricks and clicks

With online companies currently dominating sales, it is widely expected that the need for tangible stores will continue to decrease, but Baillie Gifford has spotted a rise in forward-thinking companies who are utilising physical spaces to provide an innovative and interactive shopping experience.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. 'Professional investors' are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.