Tom Slater speaks to Chris Miller, author of Chip War: The fight for the world's most critical technology

As with any investment, your capital is at risk.

In 1985, Taiwan effectively gave Morris Chang, an American businessman of Chinese birth, a blank cheque to establish the island’s semiconductor industry.

He bet on a revolutionary idea, a business dedicated to building others’ chips, not its own.

Today, Baillie Gifford funds invest in companies across the semiconductor industry and its supply chain. TSMC is one of the world's most valuable firms. Many other Baillie Gifford holdings, including NVIDIA, Tesla and Amazon, depend on it, while another investment, ASML, is one of its closest partners.

Investment manager Tom Slater caught up with Chris Miller to discuss the semiconductor chip industry’s development and the economic, geopolitical and technological forces that continue to shape it.

Miller is associate professor of international history at the Fletcher School of Law and Diplomacy at Tufts University near Boston and the author of the 2022 book Chip War: The Fight for the World’s Most Critical Technology.

TSMC: from zero to hero

Miller describes TSMC as “indispensable and the world’s most important chipmaker”. Before its founding, it was the norm for companies to design and physically produce their own chips. The few who didn’t had to risk exposing their intellectual property to a rival.

However, Chang realised that “specialisation was key” to creating the efficiencies that would counteract the increased cost of making the ever-smaller transistors (tiny on-and-off switches) required to make more complex chips. So, he focused on pioneering the foundry – a factory dedicated to manufacturing others’ designs.

That paid off. Today, TSMC is one of the world’s 10 most valuable listed companies, and it is critical to progress in smartphones, electric vehicles, AI and more. Only Samsung has been able to keep up with making the most advanced architectures, but it lags far behind in market share.

TSMC recently said it produces 99 per cent of the chips used to train artificial intelligence, known as AI accelerators or graphics processing units (GPUs).

“[That’s] about as close to the definition of monopoly as you can get,” says Miller.

“It's striking that some of the commentary from Wall Street was confusion about why TSMC hadn't hiked prices more. But TSMC's leadership would say they're not thinking about this contract or the next.

“They're thinking about relationships that have already lasted decades and that they hope will last decades into the future. That requires a level of trust in manufacturing and, I think, trust in pricing with their customers.”

From the Cold War to national priority

National interests have been central to the semiconductor industry’s evolution. Miller’s initial interest in semiconductors was sparked by “their central position in competition between countries for national power”.

Some of the US’s first commercially produced chips were used in nuclear missiles’ guidance systems during the Cold War against Russia. Today, China’s access to high-end technology preoccupies much of the US’s defence thinking.

China is the largest importer of semiconductors, spending more money each year on them than on oil over the past decade, and the US has been trying to limit its access to the most advanced technology.

“Both China and the US have identified artificial intelligence as… a general-purpose technology that each government believes will have broad economic, technological and strategic ramifications.

Machine checking silicon wafers in clean room laboratory. Source: Cultura RF

“Indeed, we already see both governments beginning to use AI, … to sift through intelligence that their spy satellites are collecting, … or to guide drones more accurately as they fly through the air.

"Everyone has access to algorithms that are largely open-sourced. Talent disperses widely across the world. But computing power is produced by a tiny number of companies.”

The US has prevented TSMC from building state-of-the-art chips for Chinese clients, including limiting sales to Chinese customers, such as Huawei.

“But that only underscores the extent to which TSMC is a company with unique capabilities that no one, in China or anywhere else, can match,” says Miller

ASML: betting on the long term

No country or company can do it alone, but one company may come close to being indispensable.

Today, the most complex chip-making tools are photolithography machines. The Dutch firm ASML produces the most advanced equipment capable of “carving the most intricate patterns in silicon.” It has a 100 per cent market share of the leading equipment and harnesses a complex supply chain to do so.

Miller puts its dominance down to management’s long-term mindset. In the 1990s and 2000s, the company made a strategic “bet on producing the next-generation [extreme ultraviolet lithography (EUV)] tool that today is central for advanced chipmaking.”

The company persevered despite EUV being seen “as harder than bringing a man to the moon.”

According to Miller, the machines “require the flattest mirrors humans have ever made and one of the strongest lasers ever deployed in a commercial device”.

Inside every machine, “a tiny ball of tin is pulverised into a plasma. The temperature of this explosion is 40 times hotter than the sun's surface.

“Humans have made no tools more complex than these. You can understand why it seemed highly implausible for a long time that a machine with an explosion like this inside would be usable in a factory context.”

ASML succeeded. Its latest machines cost over $300m per machine and contain hundreds of thousands of components; each must be extraordinarily reliable and precise. Misplacing even a single atom can disrupt the process when manufacturing at the nanometre (billionths of a metre) scale.

Miller suggests it will be almost impossible for anyone to catch up with the company in the foreseeable future.

“By the time you’ve learned to replicate it, ASML will have already produced its next-generation tool, and so [its competitors] will still be behind.”

NVIDIA: all-in on GPUs

Miller views technology leadership as critical for establishing longevity: "Ultimately, the only way you’ve got a defensible market position is by having better technology than your competitors.”

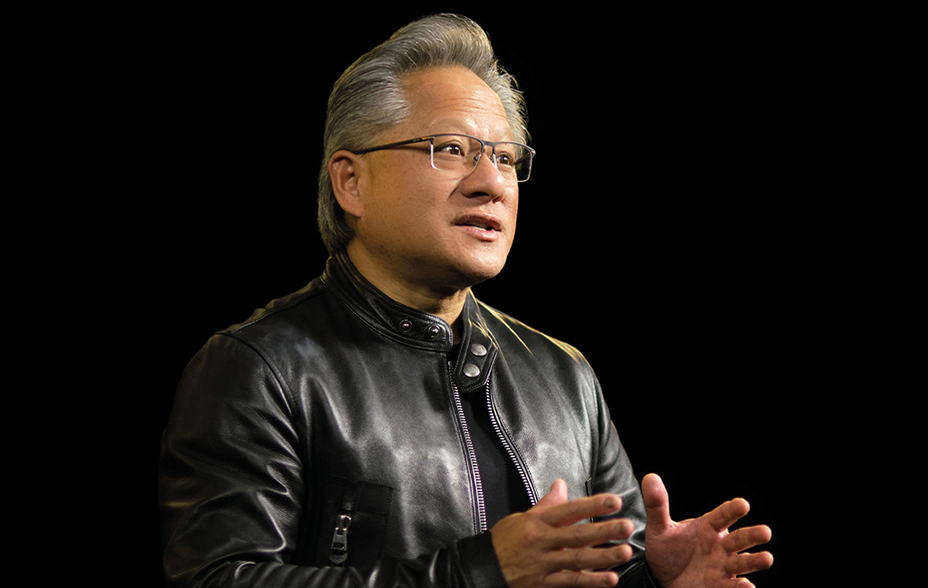

NVIDIA has done this through the foresight of its chief executive, Jensen Huang, who invested heavily in the developing technology and software now critical to AI models.

The first large-scale generative AI tool to capture widespread public attention was OpenAI’s generative AI chatbot, ChatGPT. About a month after Chip War’s publication, ChatGPT launched, and demand for NVIDIA's graphics chips soared as others rushed to build and train their own AI models.

But over a decade prior, Huang had realised his firm’s graphics processing unit (GPU) chips could be used for more than just rendering computer graphics. He understood that their parallel processing capabilities could be used to solve complex scientific problems and accelerate computational tasks.

Chief Executive Office of NVIDIA, Jensen Huang © NVIDIA

His company invested deeply in building software tools called CUDA to make GPU programming more accessible to developers. When AI researchers adopted the technology, NVIDIA seized the opportunity, giving CUDA extra functionality and optimising the GPUs’ architectures to help.

At the time, AI was seen as “far out and implausible”, at least as a business for NVIDIA.

Miller highlights Wall Street’s discomfort on: “first, building chips for an industry that didn't exist, and second, giving away the software for free.”

Huang understood that repurposing NVIDIA’s chips would make them “vastly more efficient than the existing class of processors, called CPUs (central processing units)”.

“NVIDIA bet that if it could make its chips efficient for AI, it would drive down the costs of AI and, therefore, blow up in a much larger market than anyone else foresaw.”

Miller contrasts that with Intel, which was once the world’s largest chipmaker and still plays a dominant role in the design and manufacture of the CPUs that are still important for personal computing and data centres.

He points out that it “flirted” with AI in various formats but “could never really convince itself to dive in in a way that Jensen bet the company on AI being its future.

“He deserves much credit for NVIDIA's decisions,” says Miller of one of the Fortune 500’s longest-serving chief executives.

“Significant bets were taken, not based on short-term profit, but instead on long-term technological shifts that, it's now quite clear, NVIDIA bet correctly.”

Patience is a virtue

It’s a reminder that technology moves fast, but perhaps not as quickly or clearly as we might anticipate.

As Miller highlights, companies need to determine “the proper use case, the correct form factor and the suitable business model” and that can take decades.

He points out that it was a decade from the invention of the first transistor to the first integrated circuit. Then, it took another decade for mainframe computers to become widespread in large corporations. Two decades later came the first personal computer, and another decade later, the first smartphone.

“Each of these steps was ‘transformative’ and produced companies that were among the most valuable in the world at the time,” Miller says, suggesting that AI still has a long road ahead.

"We have yet to conceptualise [its] application in many spheres because we’re in the very earliest stages of a technological shift that will take decades to play out.”

Progress will not be a straight line, but we can be confident that the advances in artificial intelligence and other emerging industries, such as space travel and the energy transition, will demand more advanced chip designs and complex chip manufacturing.

For that to happen, companies need access to capital from patient investors prepared to back visionary companies and leaders through the ups and downs of progress. That is Baillie Gifford’s forte.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in August 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

124302 10050898