Illustration by Anna Higgie

Please remember that the value of an investment can fall and you may not get back the amount invested.

For Henry Kissinger, it oiled the wheels of diplomacy. “If we drink enough Moutai, we can solve anything,” the US Secretary of State joked to Deng Xiaoping at talks in 1974.

For the emperors of the medieval Tang and Song Dynasties, the baijiu (white spirit) was prized for its quality. Visitors to court were expected to present it as tribute.

I was reminded of all this heritage as we toured the company’s museum at its distillery complex in the town of Moutai in the province of Guizhou (Kweichow in the old Romanisation), a three-hour flight south-west of Shanghai.

The pervasive sweet scent of fermenting sorghum, an ancient cereal grain, took me back to my first visit seven years ago. This time, my fellow trust manager Sophie Earnshaw was accompanying me. To her, it smelled of “alcoholic soy sauce”.

We were there to catch up with Kweichow Moutai’s chief financial officer and board secretary, Ms Yan Jiang, on the plans and projections of one of China’s largest, most profitable companies. This was Sophie’s first direct encounter with the unique culture of the company that, since overtaking Diageo in 2017, has become the world’s most valuable drinks brand.

With a net profit margin of 79 per cent, Moutai has achieved a kind of modern-day alchemy, turning the base elements of sorghum, water and yeast into liquid gold. We think it has the key ingredients of an exceptional stock: steady revenue growth projected in the mid-teens annually, a rock-solid competitive position and the longevity that comes with symbolising status and celebration wherever Chinese people get together.

Moutai achieved this by mixing ancient methodology with modern science and having a business and governance model that combines partial public ownership, commercial flair and fastidious strategic planning.

Although the drink comes in 16 varieties, much of that profit is earned by its 53-per-cent-proof flagship product, Feitian (flying fairy), whose distinctive red-ribboned white bottles retail for about £200. Feitian makes up around 80 per cent of the company’s £16bn of annual sales.

Family ties

I’ve known this product nearly all my life. Growing up in Chongqing in Sichuan, whose spicy food pairs perfectly with Moutai, my grandfather would call for a bottle whenever celebration was in order.

Today, no family occasion, business deal or diplomatic ceremony is complete without toasts and shots of the fiery liquor with a sweet aftertaste. When my son was born, I bought some bottles of the Year of the Pig special edition to lay down for him to enjoy in adulthood. A friend bought a lot more in anticipation of her newborn daughter’s future wedding party.

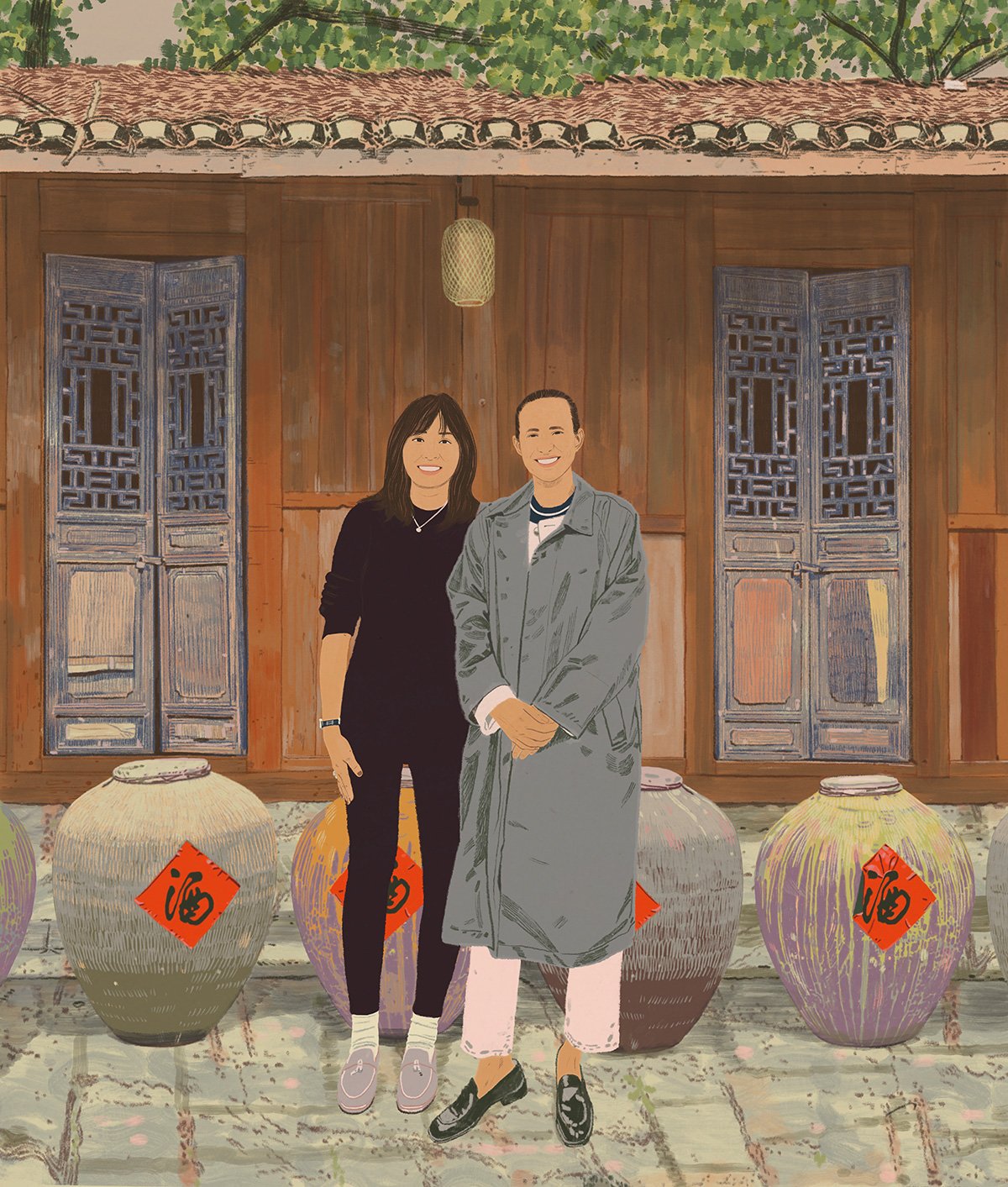

Linda Lin (left) and Sophie Earnshaw visited Kweichow Moutai on a fact-finding trip to China in April

Other baijiu are available, but for wealthy or aspirational Chinese it has to be Kweichow Moutai. Anyone offered an alternative would take note that they – or the occasion – were deemed unworthy of the best.

It’s this brand value and the rarity enforced by natural supply constraints that give Kweichow such formidable pricing power. A colleague recently described it as having “the best licence to print money I’ve seen since Microsoft in 1996”.

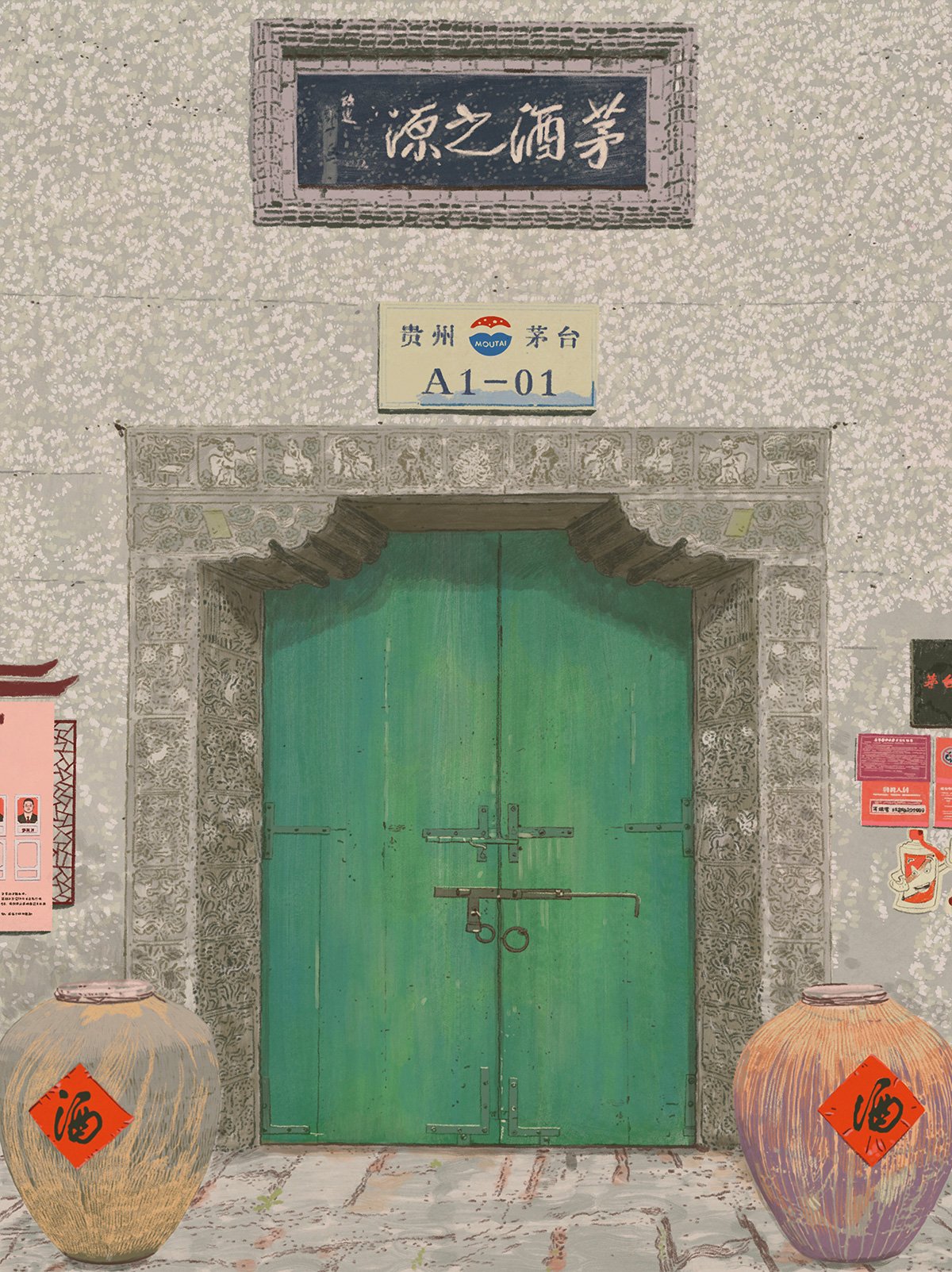

Spending time in the distillery complex is like stepping back into the distant past. One ancient-looking doorway features the inscription mao jiu zhi yuan (the origin of Moutai). This place hasn’t been recreated for tourists but instead reflects the company’s obsession with preserving the drink’s authenticity and artisanal heritage.

Everywhere, there are rows and stacks of dark-grey ceramic jars ready to be filled with yeast or the fermentation base liquor known as qu. They add sorghum to this at the start of a labour-intensive cycle of steaming, fermenting, drying, grinding, distilling and for Feitian – the equivalent of single malt Scotch – ageing.

Still following the ‘24 solar terms’ of the ancient Chinese agricultural calendar, this intricate multi-stage process has been handed down from master to apprentice through the centuries. The fact that it has changed so little is a testament to an obsession with the integrity of the brand and the unwavering pursuit of quality.

Uncompromising on quality

Kweichow Moutai resists the temptation to modernise or accelerate processes for the sake of productivity gains. That said, its master blenders have applied modern data analytics to production records to reduce waste from about 35 per cent to as low as 5 per cent, as well as to monitor ground and weather conditions.

Moutai controls the whole supply chain, growing its own sorghum to ensure quality and security of supply and to protect the local ecosystem. As locals kept telling us, the drink is inseparable from its natural environment: the soil, the water and the air, none of which can be replicated elsewhere. Master distillers who have left the company and tried to apply their experience elsewhere have all failed.

Local pride is unsurprising given that the company employs a third of the town’s population, with some families having worked for it across multiple generations. But increasingly it recruits the brightest and best graduates from Beijing and Shanghai, paying big-city salaries for their expertise in environmental science, data analysis, marketing and other skills key to the firm’s future.

The environmental obsession is notable in a country where enforcement of standards is erratic. Here, Moutai’s ownership model certainly helps. Guizhou’s provincial government has a 35 per cent stake in the business and can enforce strict environmental standards that rival baijiu makers struggle to meet. It can also influence neighbouring Sichuan, from whence flows the all-important Chishui River.

Partial state ownership, grounded in the drink’s links to the foundation mythology of the People’s Republic, has also helped ingrain an ultra-cautious culture whereby every decision is carefully weighed for potential damage to the brand.

Political connections have involved it in past corruption scandals, but its reformed governance now involves more collective endeavour, overseen by multiple stakeholders. They include capable local officials who are acutely aware of the importance of company profitability to their tax take. A mix of expert non-executives from academia and elsewhere, as well as political appointees, provide board oversight.

It all amounts to a system of checks and balances that ensures change is only ever incremental. It wouldn’t work for a fast-moving consumer goods firm or a tech company but suits a successful luxury brand.

Bright future

The big question regarding future growth projections is whether the younger generation wants to drink Moutai and whether they will see it, as I do, as part of their family culture. That’s certainly the company’s intention.

Sophie and I tucked into Moutai ice cream, which the company launched more to increase brand awareness than as a money-spinner. It has also partnered with another Baillie Gifford China Growth Trust holding, Luckin Coffee, to launch a hit range of baijiu-flavoured lattes and the like. There are moves to globalise the brand, but this seems to me a ‘nice-to-have’ given the easier routes to grow in the vast and increasingly prosperous Chinese market.

You would expect extended growth horizons from a business whose product has 3,500 years of tradition behind it. As investors, we pride ourselves on the long-termism of our outlook, but meetings with Kweichow Moutai make us think we’ve met our match. While we focus on its growth prospects for the next five to 10 years, it is thinking about the next 100.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in September 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Investing in private companies could increase risk as these assets may be more difficult to sell, so changes in their prices may be greater.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

115255 10049582