Key points

How companies take care of employees’ wellbeing and develop their own corporate culture matters more than ever to LTGG.

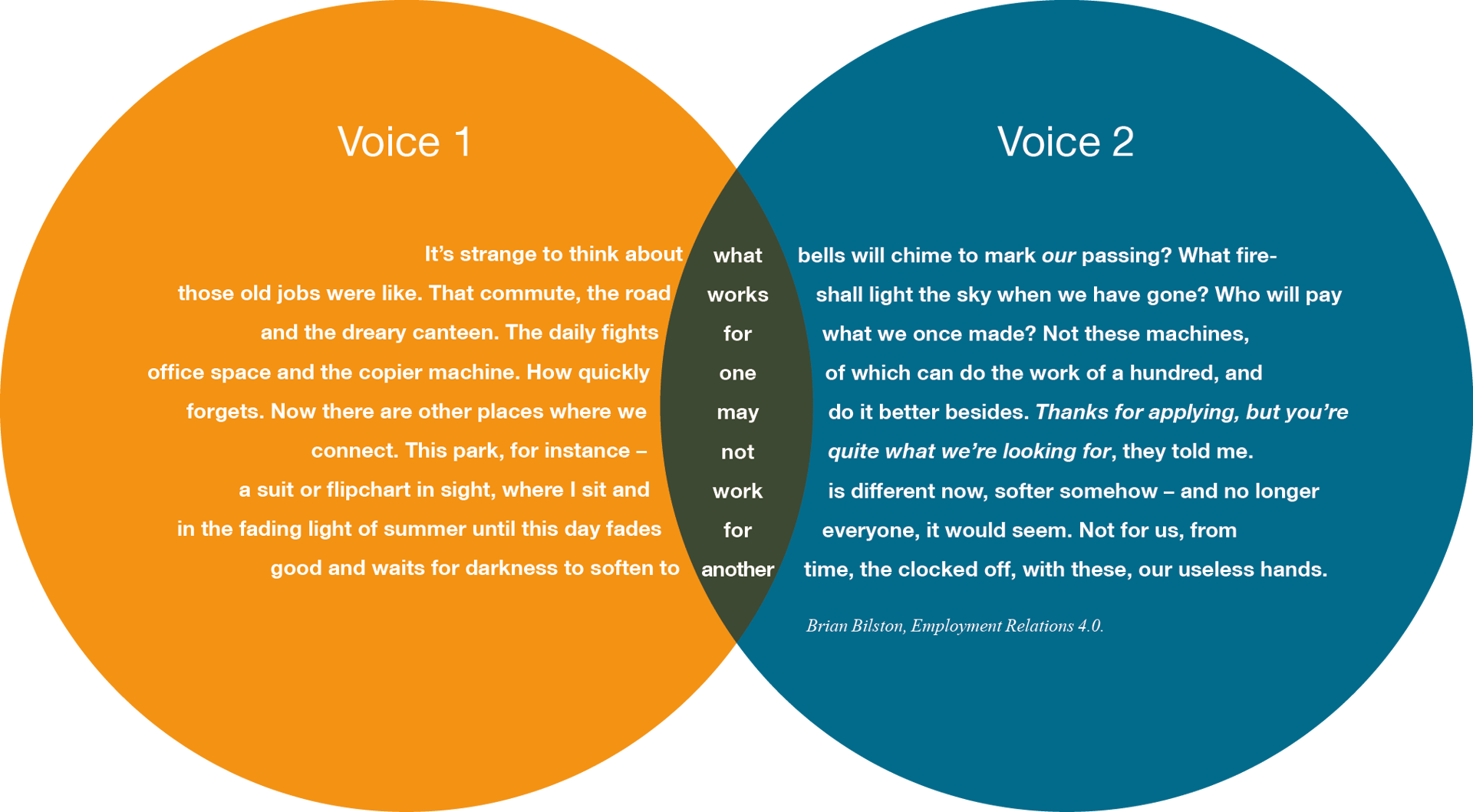

Invited to ponder the future of work, poet Brian Bilston responded with a poem in two voices. One lamented the passing of a generation of workers, concluding: “Work is different now, softer somehow – and no longer / for everyone, it would seem. Not for us, from / another time, the clocked off, with these, our useless hands.”

The other voice brimmed with excitement about the new world of work in the 21st century, incredulously querying past tolerance for the “dreary canteen”, the “daily fights for office space and the copier machine”.

Bilston’s poem illustrates the overlap of one paradigm with another. Specifically, where exciting tech-enabled opportunities, such as remote working and automation, intersect with concerns about displacement and equality in the workplace.

Available labour data also points to both progress and challenges. For instance, nearly 15 per cent of jobs are estimated to be at high risk of displacement due to automation. Yet strikingly there is no sign of this resulting in fewer jobs. Certain occupations do appear to be experiencing job loss, such as machinery workers, but the Organisation for Economic Co-operation and Development suggests that cost efficiencies afforded by automation may in fact contribute to greater consumer demand, creating more jobs elsewhere and an overall gain in employment.

Commendably there’s also been a reduction in child labour. In 2016, there were 94 million fewer youngsters in the global workforce than in 2000. This is in part thanks to growing international focus on companies’ supply chains. However, firms cannot become complacent. The International Labour Organisation estimates that one in 10 of all children worldwide are still in work, nearly half of whom are involved in hazardous tasks.

This illustrates that while large numbers of people have benefited from better living conditions over the past couple of decades, not all of society has improved. Many feel dissatisfied, frustrated and poorly treated. Many worry about a future devoid of opportunities to work and to advance. Given the speed and prevalence of technological change, workers are having to be more adaptable than ever to changing jobs.

Bilston’s poem illustrates the overlap of one paradigm with another. Specifically, where exciting tech-enabled opportunities, such as remote working and automation, intersect with concerns about displacement and equality in the workplace

We in the Long Term Global Growth team believe that companies must also adapt to the changing expectations of their workers and of society more broadly. We know that the turbocharged performance we seek from your holdings is demanding, and can create strains both for management and employees. To justify a place in the LTGG portfolio, a company’s management must be able to anticipate and react to the scale and speed of progress. This is vital for companies to grow sustainably in the long run and generate superior returns for clients.

So how do we analyse this?

We’re working on it

Baillie Gifford does not limit its analysis of labour issues, or indeed any ESG issues, to simplistic screening processes or box-ticking. Such an approach is prone to flaws, not least that disclosure by many companies is still limited and those that haven’t mastered the ‘exam technique’ get marked down regardless of underlying performance. Instead, we seek to delve into the issues facing each company on a case-by-case basis. Whenever we feel there is a potential material risk to long-term performance, we will engage with management before considering appropriate voting action and/or an investment decision.

As a minimum, we expect all holdings to operate within the 10 principles set out by the United Nations Global Compact and we monitor company performance accordingly. Most relevant to our analysis of labour issues are six principles, which call on businesses to:

- support and respect the protection of internationally proclaimed human rights

- make sure that they are not complicit in human rights abuses

- uphold the freedom of association and effective recognition

of the right to collective bargaining - eliminate all forms of forced and compulsory labour

- abolish the use of child labour

- eliminate discrimination in respect of employment

Furthermore, as signatories to the United Nations Principles for Responsible Investment since 2007, we encourage companies to make appropriate disclosures. This might include, for example, disclosures on employee injury rates in manufacturing or warehouses, as well as due diligence on supply chain labour standards.

For LTGG, as we seek to invest in companies for five to 10 years and beyond, they need to demonstrate the ability to go above and beyond minimum standards to meet the expectations of workers and society. This means bearing a degree of responsibility for societal changes they contribute to, and recognising the leadership roles that many can play given their unprecedented influence. This isn’t just about ‘doing the right thing’, nor is it about merely reacting to the shifting short-term focus of media headlines. Companies that are proactive and engage stakeholders to create opportunities for workers in the long term will have an above-average chance of success over the coming decades. Companies that aren’t risk fossilising as talented workers look elsewhere. This will cause innovation to falter and productivity to suffer; it may also invite regulatory penalties. Ultimately the result will be weaker returns for our clients.

No company is perfect. For many it’s a matter of learning from mistakes. By engaging with our holdings, we try to understand their direction of travel and ambitions on labour issues where they may be material to future growth. Often our meetings consist of fact finding and monitoring. Depending on how we believe a company is progressing, we will challenge and support management as appropriate. Here follow some examples of our engagements:

Aligning interests

Peloton

Peloton co-founder and CEO John Foley thinks in decades. To continue its exceptional growth path, he believes Peloton must attract and retain exceptional talent. Foley is preparing to develop the culture of a nascent business into one at scale. His vision of Peloton is as a non-hierarchical, modern brand with progressive HR and diversity and inclusion at its core. The desire to work for a company is often influenced by how that company behaves. It matters that during the pandemic Peloton helped customers under financial strain continue their memberships, while also gifting bikes to healthcare professionals and hospitals. Equally, the company's early announcement of support for the Black Lives Matter movement struck a chord with its highly diverse workforce.

Moderna

While Moderna is well-positioned to attract talent, its strength comes from an exponential mindset preached and practised by CEO Stéphane Bancel. He encourages employees to think in multiple rather than in marginal terms, to challenge their thinking, and to move away from incrementalism towards new dynamic ways of operating. To reinforce these behaviours, Moderna employees are eligible for equity awards, determined by long-term key performance indicators. All of this plays a vital role in the strength and speed of Moderna's business. The company might not have been successful in developing the Covid-19 vaccine if, prior to the pandemic, it had not spent time developing a long-term collaborative approach across its workforce. It appears that Moderna's technological breakthroughs largely depended on exponential thinking by its workforce within an interdisciplinary approach across molecular biology, physics, chemistry and data science.

Atlassian

Co-CEO Scott Farquhar's long-term vision for Atlassian and its corporate culture is to "unleash the potential of every team" by overcoming friction. This is defined as anything that hinders teams from performing at their best. Atlassian is built to be open, inclusive, fair and just. Employees champion a culture which is about more than a 'job' – it's about a mission. Atlassian believes that companies that have a mission of people, community and planet at their core will attract and retain the best talent and deliver greater value. Empowered employees are engaged employees.

Adapting cultures

Netflix

With more than 200 million paid subscribers and $25bn in annual revenue (growing at nearly 25 per cent a year), it's perhaps surprising to hear Spencer Wang, vice president of finance, tell us that Netflix's culture needs to change. But this is a company which has long kept complacency at bay. As Netflix becomes more international and reaches more audiences, management recognises that its content must reflect the lives of the populations it serves. To do so, Netflix's work environment needs to be diverse and inclusive, representative of its global reach. It began on this journey in 2018, when it appointed Vern, Myers to a newly created role of vice president of inclusion strategy. This was followed by co-CEO Ted Sarandos stating he wanted to empower employees by putting a strong emphasis on diversity and inclusion, which he believed was the foundation for the next generation of great content. We are seeing signs of success as ideas from teams of young people in regional offices percolate up to management, such as its successful new catalogue of Hindi-language shows.

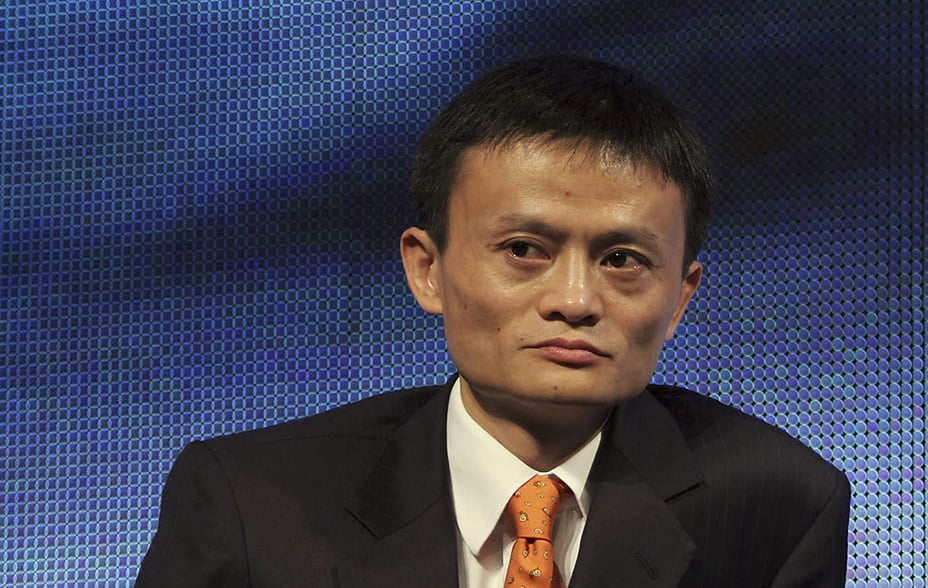

Alibaba

When Jack Ma founded Alibaba in his kitchen, he had to pool his money with 17 colleagues to form a partnership because no bank would finance the business. Today, the Alibaba Group is a global leader and more than 20 years old. It believes its success is driven by a workforce committed to a set of values, but the company recognises that those values must evolve to stay relevant to its growing workforce of 250,000-plus employees. Alibaba's partners took over a year to agree on the company's six core values, suggesting that they are more than corporate-speak. Daniel Zhang, chairman and CEO, believes these values codify the lessons and beliefs that Alibaba's co-founders historically passed on verbally to new employees. These values are seen as a vital guide for Alibaba employees to make decisions that will see the company flourish into the next century.

Growing pains

Beyond Meat

Beyond Meat experienced management churn in 2021, replacing its chief financial officer, chief growth officer and chief people officer. CEO Ethan Brown is frank in discussions that its culture doesn't suit everyone. He is a missionary for plant-based meat and its role in saving the planet. He expects staff to go the extra mile – they refer to this internally as 'going beyond' – given the urgency of the societal problems the company exists to solve. For some, this serves as inspiration. Others find it too demanding. Brown is unapologetic about his exacting standards, but he is thoughtful about nurturing employee wellbeing. As a young company focused on managing exponential growth, wellbeing has perhaps taken a back seat until now. We are confident that Beyond Meat is taking this seriously as an important component of long-term success, and will continue to monitor progress.

Amazon

In spring 2021, Amazon workers in Bessemer, Alabama decisively and controversially cast their ballots against forming a union. There were several media reports of an intimidating anti-union campaign by Amazon. When we discussed this with Tessie Petion, Amazon's head of ESG engagement, she clarified that while the company was not in favour of unionisation, it accepted the employees' right to choose. Petion believes that Amazon's communication with staff was reasonable, but concedes that its messaging focused on the financial merits of working at Bessemer and the implications of union dues/membership on pay, over the underlying reasons for a vote in the first instance. There was a reflection that staff motivation was more than financial, and that Amazon should instead communicate steps taken to protect employees' welfare. For example, the $15 per hour wage provided by Amazon, plus the benefits and training package, is good by industry standards. It is clear Amazon has been challenged by and is learning from this experience. Jeff Bezos, founder and executive chair, acknowledged: "We need to do a better job for our employees. While the voting results were lopsided and our direct relationship with employees is strong, it's clear to me that we need a better vision for how we create value for employees – a vision for their success." We continue to monitor.

ASML

As with many companies in the electronics industry, certain 3TG or 'conflict minerals' (tin, tungsten, tantalum and gold) are required for ASML's products to be made and function. We have discussed with management the potential use of these minerals in the firm's lithography equipment supply chain, and how it works with suppliers to understand how they are sourced to ensure principles of sustainability are upheld. ASML is committed to a conflict-free minerals policy and closely monitors the use of conflict minerals in its supply chain. Additionally, the company supports international efforts to ensure the mining of 3TG minerals from high-risk locations does not contribute to conditions of armed conflict or human rights abuses in the Democratic Republic of the Congo or any neighbouring countries. ASML has also led the industry in encouraging suppliers and sub-suppliers to have policies and due diligence measures in place to ensure the 3TG minerals are responsibly sourced. We continue to monitor.

Meituan

There are approximately 80 million gig workers in China. More than nine million of them earned income from Meituan in 2020. Much like in the West, a societal issue has arisen with regard to these workers. It began with reports of impossible deadlines and low wages. Meituan swiftly responded by vowing to improve working conditions for its vast network of delivery drivers. Now it's a case of who is responsible for social security payments. Meituan's management team told us that the firm was fully responsible for covering the drivers' personal accident insurance. However, the team said that social security was a much more complicated issue given differing local policies. For example, the Nanjing government announced guidance requiring businesses to cover basic social security payments for full-time employees, and 60 per cent of Meituan riders fall under this classification. This illustrates the growing pains of companies transforming society, highlighting not only the rapid rise of the gig economy but also labour issues which accompany it. The importance of strong culture and adaptative management has never been greater. Companies are not only having to remain nimble amid a changing competitive landscape and new threats of disruption, but must also be alive to the changing regulatory climate. We continue to monitor and engage with management.

Risk Factors

The views expressed in this article are those of the LTGG Team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in December 2021 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock Examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This article contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated. The images used in this article are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs. Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/ Institutional clients only.

Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (‘BGO’) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

12270 10004160