Capital at risk

Global Income Growth

Long-term dividend compounding is the eighth wonder of the world.

We focus on companies that can compound earnings and dividends effectively over long periods. These are rare but can deliver attractive returns.

For a lifetime of income, choose growth

Whether you require an income today and for years to come or are simply looking for attractive capital growth and total returns over the long term, dividend growth investing might be what you’re looking for.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

A truly long-term approach

We aim to deliver a dependable income and real growth in dividends and capital over the long term.

We believe the best way to meet these objectives is to invest in companies that can pay dependable dividends across the cycle and have the prospect of real growth in profits, which will, in turn, lead to growth in dividends and capital.

Such companies are rare and highly attractive to a client who needs income today and is also seeking capital appreciation well into the future.

Resilient and dependable dividends

Our portfolio is a selection of carefully selected dividend-paying companies with attractive growth prospects and resilient businesses.

The strategy is managed with a growth mindset and a lengthy investment time horizon. We focus on dividend growth, not short-term yield.

The companies we hold support real growth in dividends, and they typically have resilient business models that provide stability at times of market volatility.

With many investors fixated on the short-term, our long-term focus gives us the opportunity to invest into mispriced dividend-growing companies.

Meet the managers

Documents

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 May 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | Microsoft | 4.2% |

| 2 | Fastenal | 4.0% |

| 3 | Deutsche Börse | 3.8% |

| 4 | Procter & Gamble | 3.5% |

| 5 | Partners | 3.0% |

| 6 | Apple | 2.9% |

| 7 | TSMC | 2.9% |

| 8 | CME Group | 2.8% |

| 9 | Coca-Cola | 2.7% |

| 10 | Admiral Group | 2.7% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Global Income Growth Q2 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

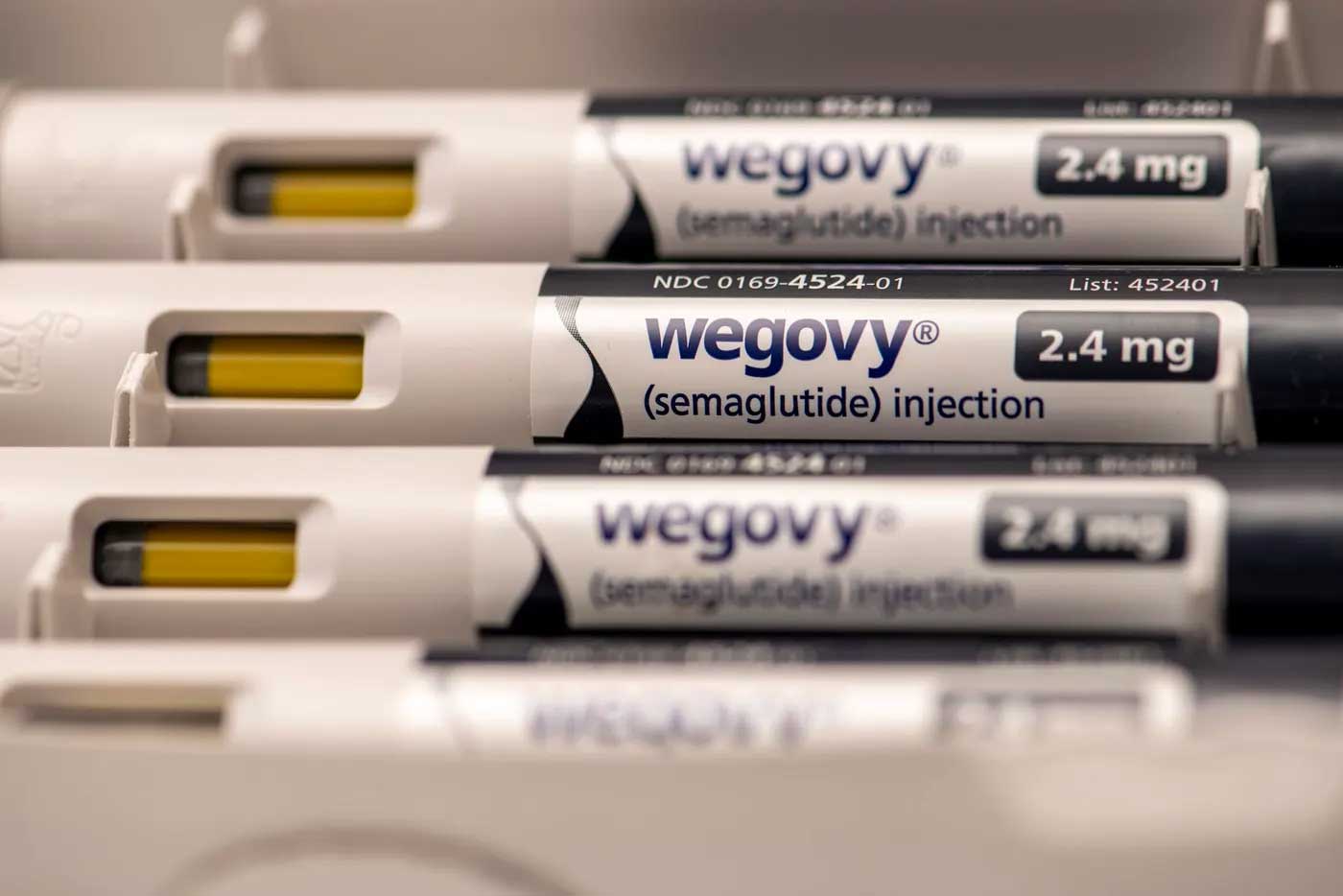

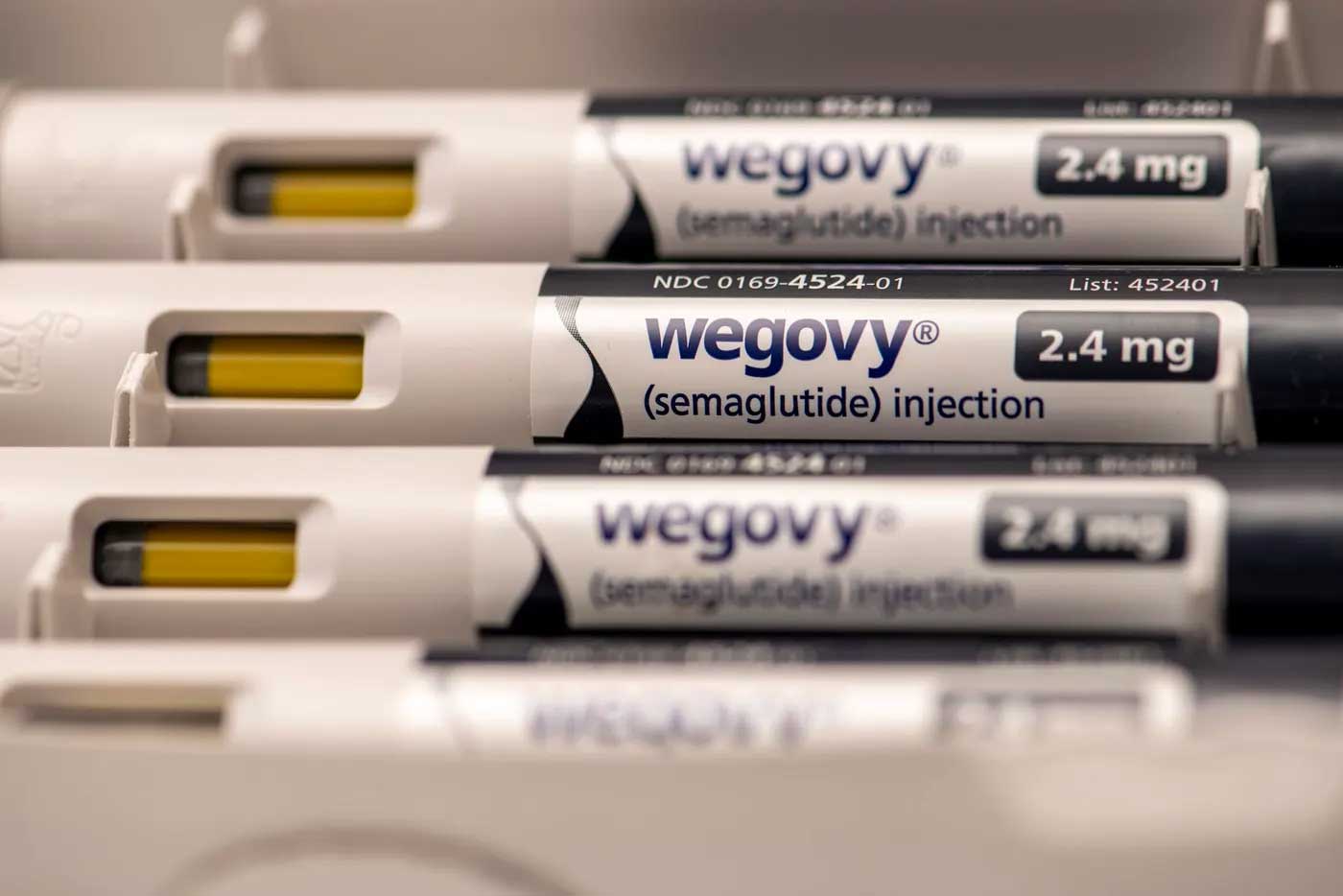

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

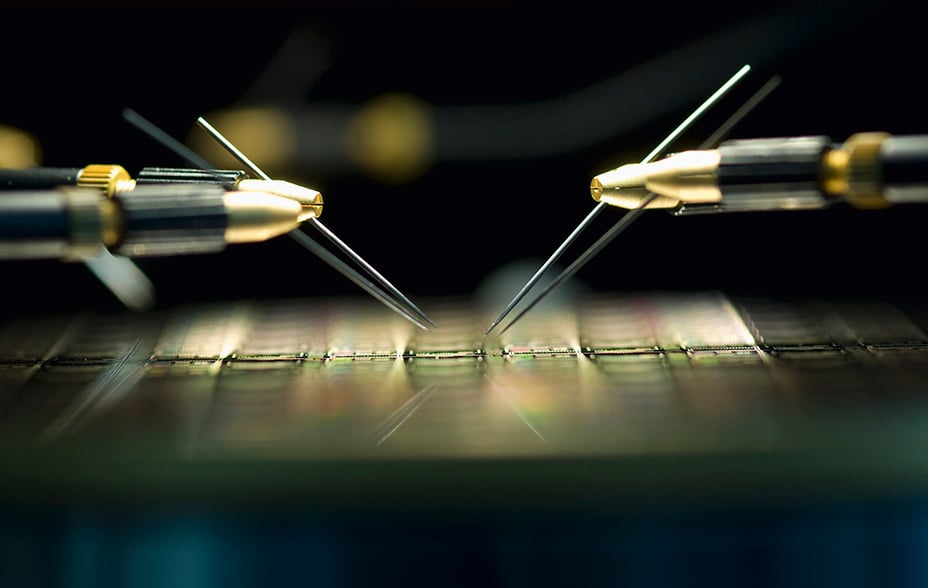

TSMC’s decarbonisation dilemmas

TSMC’s progress in securing greener energy supplies in Taiwan.

Global Income Growth Q2 update

The Global Income Growth team reflects on recent performance, portfolio changes, and market developments.

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Impact, Ambition and Trust

If ESG scores are not the answer, how does Global Income Growth Team’s ESG approach measure up?

Global Income Growth

Some people look at life as sustaining the now, while sowing the seeds for a better tomorrow. Global Income Growth think the same way. In this film we explore their philosophy and how when searching for a lifetime of income, they choose growth.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Profile of a sustainability researcher

Explore how Ben Hart's sustainability research at Baillie Gifford integrates ESG into investment strategies.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Atlas Copco: Stock Story

Ben Drury explores how a culture of innovation and decentralisation drives success in industrial technology.

L'Oréal: Stock Story

Katie Muir discusses how innovation and a positive culture have fuelled the success of the world’s leading beauty enterprise.

Profile of an investigative researcher

Explore how Hatty Oliver's unique research at Baillie Gifford shapes investor thinking and informs income growth strategies.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q4 investor letter

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Global Income Growth Q2 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Global Income Growth Q1 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Novo Nordisk: tipping the scales

Charting how a century of innovation led to a game-changing weight-loss treatment.

How dividend growth signals compounding

Investor James Dow explains why dividend growth indicates a company can compound its earnings.

A new recipe for weight loss

The huge growth potential of Novo Nordisk’s anti-obesity medicines.

Albemarle: salt flats and social responsibility

Why the lithium giant Albemarle engages in research and data monitoring.

Global Income Growth Q4 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Global Income Growth Q3 update

The Global Income Growth Team reflects on recent performance, portfolio changes and market developments.

TSMC’s decarbonisation dilemmas

TSMC’s progress in securing greener energy supplies in Taiwan.

Global Income Growth Q2 update

The Global Income Growth team reflects on recent performance, portfolio changes, and market developments.

Resilient growth for the long term

Why long-term growth firms such as battery-maker Albemarle and data aggregator Experian are the ones to watch.

Impact, Ambition and Trust

If ESG scores are not the answer, how does Global Income Growth Team’s ESG approach measure up?

Global Income Growth

Some people look at life as sustaining the now, while sowing the seeds for a better tomorrow. Global Income Growth think the same way. In this film we explore their philosophy and how when searching for a lifetime of income, they choose growth.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. ’Professional investors’ are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.