Capital at risk

Emerging Markets All Cap

We’ve been investing in Emerging Markets (EM) since 1994 and are grateful to be entrusted by a range of long-standing global clients. Our Emerging Markets All Cap Strategy, a diverse portfolio of 60-100 companies is our oldest global EM offering.

Powerful growth rewards patience

We take a patient approach in the least patient markets. EM companies often have substantial addressable opportunities and decades of growth ahead of them. We believe being selective is imperative to those seeking the best results.

Emerging Markets: our philosophy

Will Sutcliffe, Head of the Emerging Markets Equity Team, introduces emerging markets and reflects on the exciting opportunities ahead.

Finding world-class companies

Our key goal is to build strong relationships with like-minded clients. We know we can only do this if we deliver strong investment performance, net of costs, over the long term.

The number of genuinely world-class companies in emerging markets is growing and we feel very fortunate to be tasked with seeking these out. We must invest with patience and give good decisions time to prove themselves.

EM investors should be open-minded as to where growth can come from and have a clear idea of the market inefficiencies that they are trying to exploit.

Exploiting inefficiencies

We appreciate what is underappreciated. And we believe there are three persistent inefficiencies that we are well-placed to exploit for our clients:

- Growth duration: many companies grow for much longer than expected

- Growth pace: many companies grow much faster expected

- Growth surprise: many companies grow when it’s least expected

Much of our process relies on the interplay of data, experience, educated creativity and probability. This does not necessarily lend itself to a matrix or a flowchart.

The quality of companies in the opportunity set is increasing, growth is on offer, yet due to external factors and risk perceptions we can invest in many of these at what look like very low prices.

Meet the managers

Portfolio construction group

Documents

Quarterly update

Get the latest investment commentary, portfolio overview, transactions and performance information alongside governance engagement and voting.

Philosophy and process

Explore our investment philosophy and the processes around how the Emerging Markets team construct the portfolio.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2025

| # | Company | Fund % |

|---|---|---|

| 1 | TSMC | 11.2% |

| 2 | Tencent | 7.5% |

| 3 | Alibaba Group Holding | 4.7% |

| 4 | MercadoLibre | 4.1% |

| 5 | Reliance Industries Ltd | 3.2% |

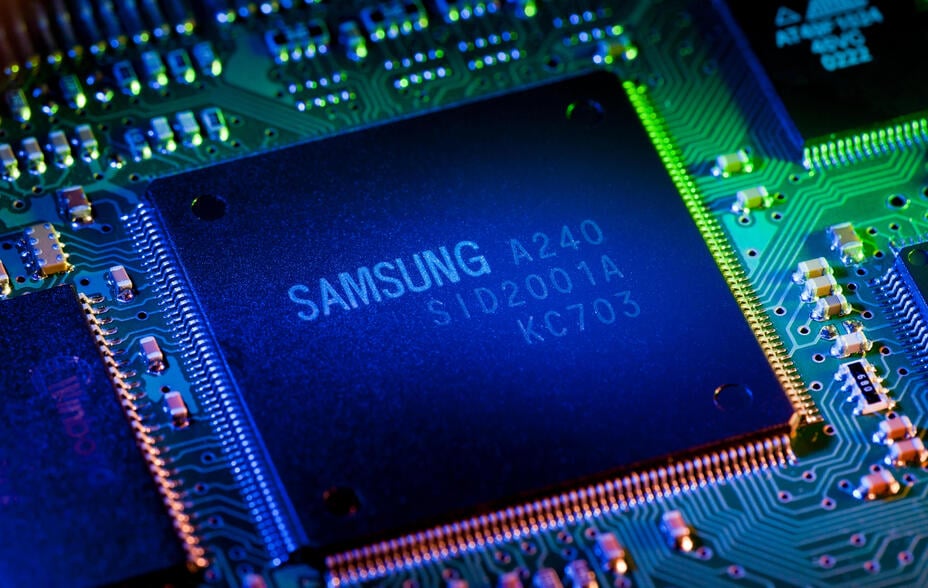

| 6 | Samsung Electronics | 3.2% |

| 7 | Petrobras Common ADR | 2.9% |

| 8 | SK Hynix Inc | 2.2% |

| 9 | Meituan | 2.1% |

| 10 | Midea Group 'A' | 1.9% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Emerging markets: the next engines of global growth

From lithium mining to a do-it-all super-app, companies capitalising on transformational trends.

India: selective exposure to a key market

Why the Emerging Markets’ Team is reviewing its underweight position in Indian equities.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Tariff twists and turns

Why EM investors should avoid knee-jerk reactions.

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Emerging Markets Q1 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Lithium: powering the future

Investing in the Chilean mining company charging the energy transition.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

DeepSeek: disruptive AI

Why investors shouldn’t overlook Chinese innovation

Brazil: an uncomfortable dance?

How our Brazilian holdings are leading with strong growth amid fiscal complexity.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging markets: new opportunities

The evolving landscape of emerging markets, fuelled by AI, energy transition and world-class companies driving growth.

Samsung: chipping away at challenges

How Samsung turns challenges into opportunities for future growth.

The rise of the Global South

Unpacking the BRICS summit's outcomes, the Global South's rise and implications for EM investors.

Emerging Markets Q3 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Travelling Brazil: open for business

We share the trip notes from our time in Brazil, highlighting the energy sector, sustainability and fintech.

Future Stocks: Our best ideas in Asia

Qian Zhang highlights three Asian companies at the forefront of global structural trends.

The brilliance of Brilliance

Brilliance China Automotive's journey with its partnership, BMW, through governance, engagement, and value.

China’s third plenum: staying the tech course

Unveil China's third plenum resolutions focusing on AI, biotech, and renewable energies amid global challenges.

Emerging Markets Q2 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging markets democracy: better than you think

See what the recent elections in Mexico and India mean for emerging markets investors.

From earth to equity: the platinum opportunity

Platinum's role in health, tech and green energy.

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

Luckin Coffee: looking forward

How Luckin Coffee is revolutionising China's coffee culture.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

ESG analyst trip notes: India and China

Read more about the unique perspective on the evolving energy landscape and corporate governance in these emerging markets.

BRICS expansion and impact

Unveiling the BRICS expansion's global influence and its effect on trade and geopolitics

Copper's role in emerging markets

Assessing copper's supply challenges and investment potential in emerging markets for 2024.

How do we do what we do

How do we implement our emerging markets equities philosophy in practice?

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Why do we do what we do

Andrew Keiller and John Rae look at why we invest in emerging markets equities in the way that we do.

India's triumph in a turbulent world

Uncover insights on emerging markets, India's economy, and Asia's rising export champions.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

South-east Asia's new export champions

Uncovering Asia's rising export stars in Vietnam, Indonesia and Thailand.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

Conversations with Shanghai

Discover the importance of High Bandwidth Memory in AI development and the key players in the market - SK Hynix and Samsung Electronics.

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Beyond the numbers

An analysis of the relationship between GDP growth and stock market returns in emerging markets, with a focus on China.

Brazil's economic landscape

Challenging perceptions: Lula's re-election and Brazil's economic potential

Emerging Markets Q2 update

The Emerging Markets team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q1 update

Emerging Markets Team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets: the possibilist

Understanding the difference between pessimism and possibility in Emerging Markets.

Emerging Markets: coming of age

It’s time to stop looking in the rear-view mirror when it comes to emerging markets.

The shape of things to come

It’s essential to be realistic and keep the risk of over-optimism in check. But there’s plenty to feel positive about in emerging markets, says Tim Erskine-Murray, who offers an insight into the reasons for his unwavering enthusiasm.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Monthly insights

Related insights

Emerging markets: the next engines of global growth

From lithium mining to a do-it-all super-app, companies capitalising on transformational trends.

Actual investing revisited

In this keynote paper Partner Stuart Dunbar reaffirms the importance of active management to healthy capitalism.

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Emerging Markets Q1 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q3 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Future Stocks: Our best ideas in Asia

Qian Zhang highlights three Asian companies at the forefront of global structural trends.

Emerging Markets Q2 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets: our philosophy

Investment manager William Sutcliffe introduces Emerging Markets, reflecting on the exciting opportunities ahead.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

How do we do what we do

How do we implement our emerging markets equities philosophy in practice?

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Why do we do what we do

Andrew Keiller and John Rae look at why we invest in emerging markets equities in the way that we do.

China: fear or FOMO?

Ben Buckler on how investors should steer between the twin poles of risk in China.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Emerging Markets Q2 update

The Emerging Markets team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q1 update

Emerging Markets Team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets: the possibilist

Understanding the difference between pessimism and possibility in Emerging Markets.

Emerging Markets: coming of age

It’s time to stop looking in the rear-view mirror when it comes to emerging markets.

The shape of things to come

It’s essential to be realistic and keep the risk of over-optimism in check. But there’s plenty to feel positive about in emerging markets, says Tim Erskine-Murray, who offers an insight into the reasons for his unwavering enthusiasm.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. ’Professional investors’ are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.