Capital at risk

Global Alpha Paris Aligned

We aim to own companies with the potential to deliver superior earnings growth in line with the Paris Agreement. The portfolio is global, and our research draws on the insights of the entire investment floor.

Investing with a purpose

An ambitious approach to investing in exceptional growth companies from across the spectrum of opportunity, consistent with addressing the climate crisis. The portfolio is truly global, and our research draws on the insights of the investment floor.

Global Alpha: our philosophy

Investment manager Helen Xiong introduces Global Alpha, reflecting on the exciting opportunities ahead.

High growth, low emissions

We aim to identify companies which can grow their earnings at a superior rate to the market over a sustained period, with prices which don’t reflect their potential. As share prices are ultimately driven by earnings growth, this approach underpins our objective to deliver returns of 2 to 3 per cent per annum ahead of the benchmark over rolling five-year periods before the deduction of fees. The strategy also commits to maintaining a Weighted Average Greenhouse Gas Intensity lower than the MSCI ACWI EU Paris Aligned Requirements Index, attempting to limit the rise in global temperatures to 1.5 degrees.

Decarbonising with diversity

Our philosophy is to invest long-term in well-managed businesses with sustainable competitive advantages. We embrace diversity, splitting the portfolio across three growth profiles – compounders, disruptors and capital allocators – which seek to exploit different inefficiencies. Each holding is analysed to ensure consistency with the transition to a low-carbon economy. The resulting portfolio of about 90 holdings represents the most attractive opportunities aligned with ambitious decarbonisation goals.

For me, open-mindedness, imagination and the ability to embrace change are essential for long-term growth investors.

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 December 2024

| # | Holding | % of portfolio |

|---|---|---|

| 1 | Amazon.com | 5.1% |

| 2 | Microsoft | 4.8% |

| 3 | NVIDIA | 4.7% |

| 4 | Meta Platforms | 4.4% |

| 5 | Prosus | 3.1% |

| 6 | TSMC | 3.1% |

| 7 | DoorDash | 2.9% |

| 8 | Mastercard | 2.7% |

| 9 | Elevance Health Inc. | 2.5% |

| 10 | Service Corporation International | 2.4% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: Rakuten and the 'Dog Shogun'

Richie Vernon, investment specialist, explains why the Global Alpha Team has a different perspective on Rakuten's future market growth.

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments

Do elections matter for stock returns?

What the past tells us about a new US president’s impact on growth companies.

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Future Stocks: Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Global Alpha Q2 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

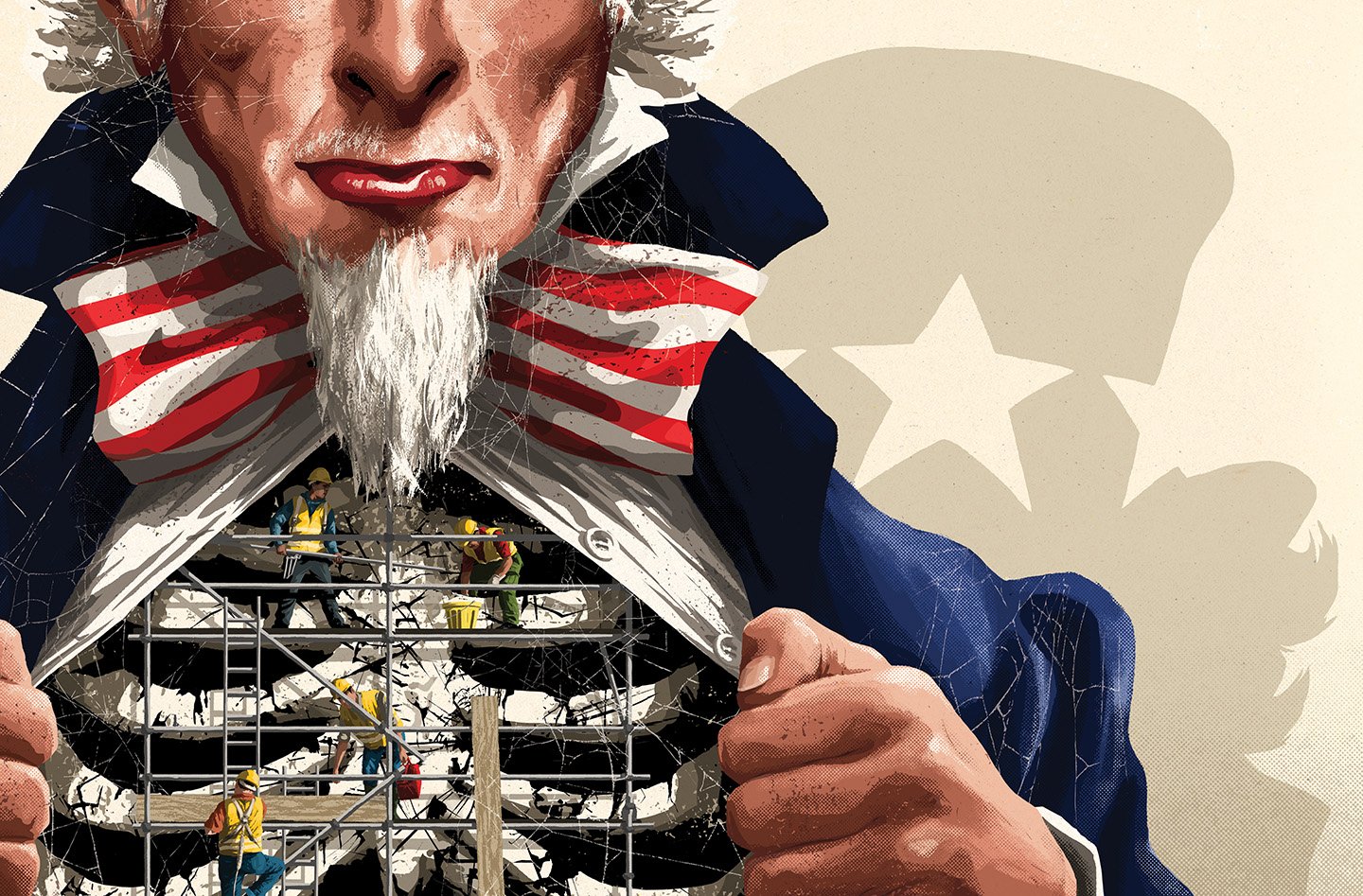

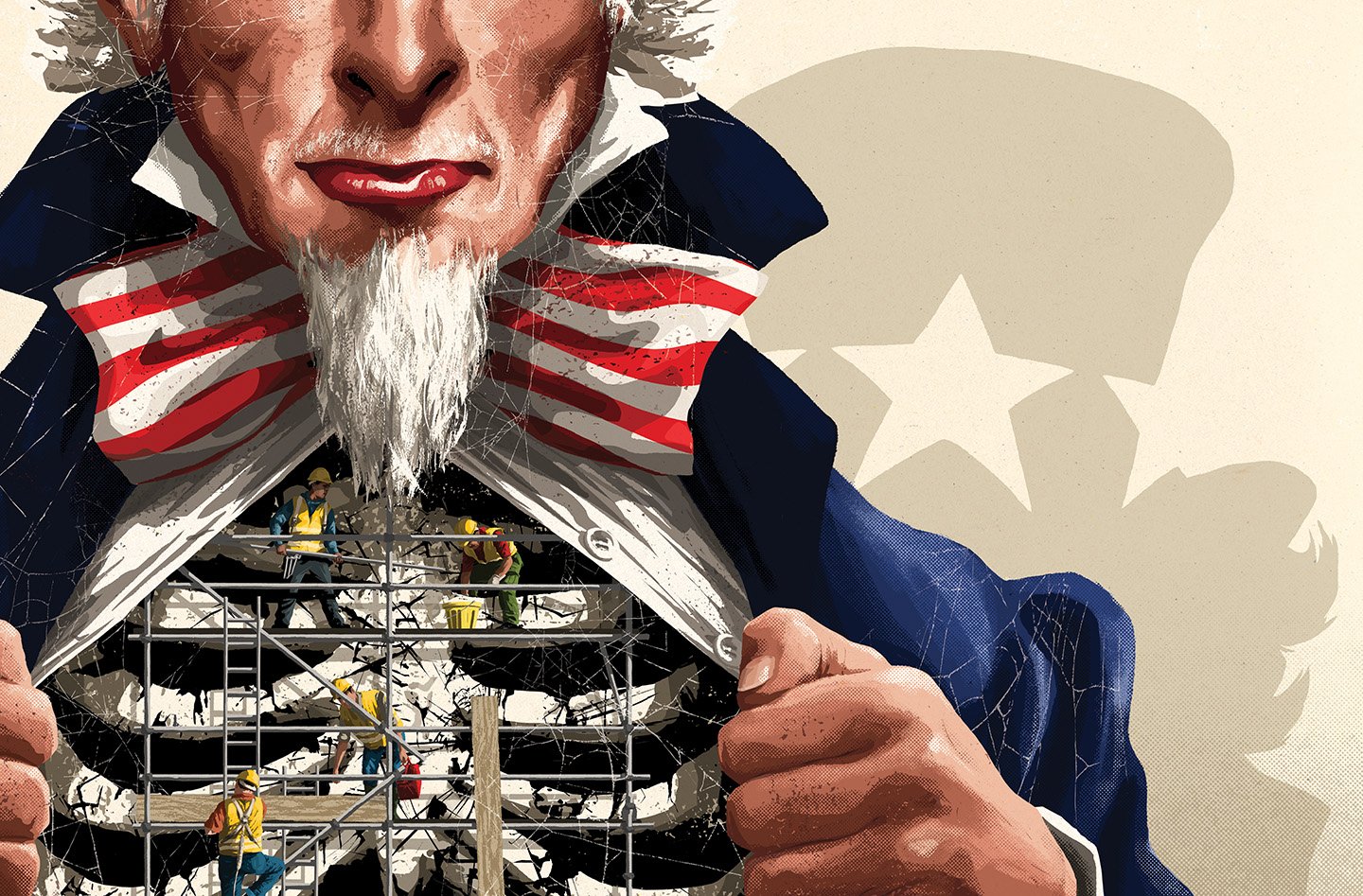

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Global Alpha Research Agenda

From AI to infrastructure – Global Alpha homes in on the growth areas and companies best placed to exploit opportunities.

Global Alpha: back to growth

The managers tell a London Investment Forum about new sources of opportunity and optimism.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Global Alpha: manager update

The managers discuss the market environment, portfolio positioning and current opportunities.

Global Alpha Paris-Aligned

The Global Alpha Paris-Aligned portfolio offers a pathway for clients to align their assets with the objectives of the Paris Agreement. Here, we provide some background to the Paris Accords and outline how we aim to implement its objectives.

Global Alpha: our philosophy

Investment manager Helen Xiong introduces Global Alpha, reflecting on the exciting opportunities ahead.

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: Rakuten and the 'Dog Shogun'

Richie Vernon, investment specialist, explains why the Global Alpha Team has a different perspective on Rakuten's future market growth.

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments

Do elections matter for stock returns?

What the past tells us about a new US president’s impact on growth companies.

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Future Stocks: Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Kweichow Moutai: spirit of China

The fiery spirit that’s a profitable symbol of Chinese culture and luxury.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Global Alpha Q2 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

The US building bonanza

America’s infrastructure upgrade plan vastly exceeds its spending on rebuilding post-war Europe.

Global Alpha Research Agenda

From AI to infrastructure – Global Alpha homes in on the growth areas and companies best placed to exploit opportunities.

Global Alpha: back to growth

The managers tell a London Investment Forum about new sources of opportunity and optimism.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

Global Alpha: manager update

The managers discuss the market environment, portfolio positioning and current opportunities.

Global Alpha Paris-Aligned

The Global Alpha Paris-Aligned portfolio offers a pathway for clients to align their assets with the objectives of the Paris Agreement. Here, we provide some background to the Paris Accords and outline how we aim to implement its objectives.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

The information on this Website is issued by Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (the “Company”) which is licensed by the Securities and Futures Commission of Hong Kong (the “SFC”) under the Securities and Futures Ordinance (“SFO”) for Type 1 (Dealing in Securities) regulated activity with CE Number BGB803. It allows the Company to market and distribute the Baillie Gifford’s range of collective investment schemes to Professional Investors (as defined by the SFO) in Hong Kong.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the SFO or any conduct of business rules which we are bound to comply with. The information on this website has not been reviewed by the SFC. These Terms and any non-contractual obligations arising from or connected with them shall be governed by, and these Terms shall be construed in accordance with, the laws of Hong Kong.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation or offer to buy, sell or hold a particular investment. You can read details of our Legal and Important Information here. Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

This website does not collect personal information. "Cookies" may be stored on your computer for easy navigation. A "cookie" does not allow us to identify you, but stores information about navigation through our website (such as pages already visited, time and date of visit) which we can remember during the user's next visit to our website in order to improve your browsing experience. If you have any enquiries in relation to our data protection policies and procedures, this Website or the information on it, please click here to contact Baillie Gifford.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is incorporated in Hong Kong. The Company’s principal place of business is Suites 2713-2715 Two International Finance Centre, 8 Finance Street, Central, Hong Kong . Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.