Your capital is at risk.

What do human brains, cities, cells, ecosystems and business markets have in common? They are all complex systems comprised of many underlying components that dynamically interact with each other. These interactions lead these systems to have unusual properties and features. They include:

- Nonlinearity: outputs that do not scale linearly with inputs. For example, as a population of animals grows, the number of possible mating pairs increases faster.

- Emergence: system-level properties that are not present in any of the underlying parts. Think of how flocks of birds create intricate patterns of movement even though each one is following simple rules to adjust for its neighbours’ speed and position without considering the larger swarm’s shape.

- Punctuated equilibrium: long periods of relative calm interspersed with short periods of rapid change. Fossil records appear to follow this pattern, with explosions in the diversity of new species occurring after mass extinctions before more stable periods of evolutionary activity.

- Path dependence: where small changes at one point in time lead to large differences further down the road. For instance, deciding where to build bridges over a river dividing a small town can have significant ramifications for the layout of the city that it develops into centuries later.

These properties make predicting behaviour in complex systems difficult, particularly over the long term. That is why no one takes much notice of weather forecasts more than a few days out, for example.

Given the commonalities, it is possible to learn and apply lessons from complex systems in one domain to complex systems in others. This article explores how a model used in evolutionary biology might provide a helpful framework for thinking about business strategy and growth investing.

Fitness landscapes

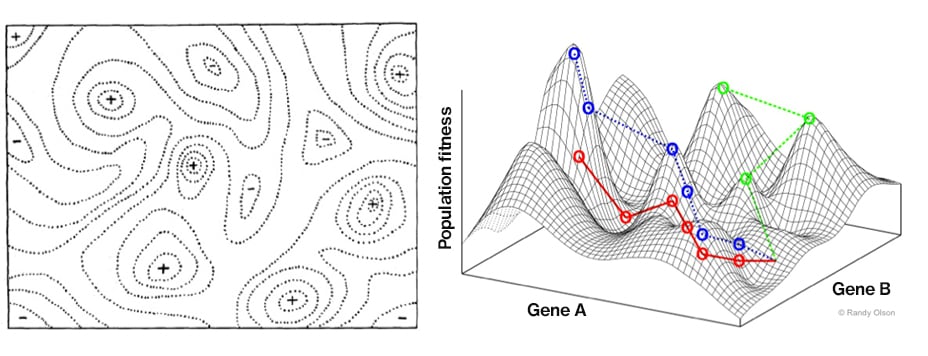

The geneticist Sewall Wright first introduced the concept of a ‘fitness landscape’ in 1932 to explain patterns of evolution. You can think of it as a grid, where each point represents a specific gene combination for a particular species. The corresponding height represents the evolutionary ‘fitness’ of each gene combination, ie the likelihood of a variant surviving and reproducing.

Modelling fitness

The image on the left shows Wright’s original two-dimensional fitness landscape – the dotted lines represent contours with respect to adaptiveness. Today, scientists use software to model three-dimensional models, as seen on the right.

Source: (left) Wright, S. “The roles of mutation, inbreeding, crossbreeding and selection in evolution” Proceedings of the Sixth International Congress of Genetics (1932), p. 358 and (right) ©Randy Olsen, Wikimedia Commons. Axes labels added, see license terms here.

Like a mountain range, fitness landscapes are characterised by lots of peaks and valleys. For a species to maximise its chances of survival, it must ‘explore’ this grid and seek out the peaks or the points of maximum fitness.

In 1991, the biophysicist Stuart Kauffman and biologist Sönke Johnsen built on this model by introducing a time variable with their concept of a ‘dancing fitness landscape’. The pair observed that fitness landscapes are not fixed. That’s because the fitness of an organism is relative: it is determined not only by its own fitness but also by the fitness of the organisms it interacts with. If the fitness of one organism in the ecosystem changes, that alters the fitness landscape for any species that interacts with it.

This echoes the ‘Red Queen effect’, inspired by the race in Lewis Carroll’s Through the Looking-Glass, in which Alice discovers “it takes all the running you can do to keep in the same place”. The point is that it’s insufficient for a species to climb to the top of a peak and sit there. Instead, each species must move, or ‘dance’, to retain its relative fitness against a continuously shifting landscape.

There are parallels between the ecosystems we find in nature and the markets that businesses operate in. Both involve competition between entities (species in the case of ecosystems and companies in the case of business markets), which are constantly evolving (through either genetic changes or shifts in strategy) to try to maximise their fitness (reproductive success rate or profitability).

Adaptive strategies

The economist Eric Beinhocker first applied fitness landscapes to business analysis in a paper he published in 1999. Beinhocker argued that trying to make accurate predictions in a ‘complex adaptive system’ was pointless. He said that companies should avoid singular, focused strategies and instead cultivate populations of multiple, evolving strategies to account for uncertainty.

Business landscapes, just like ecosystems, are not fixed but are constantly being remodelled due to changes in competitors’ strategies and shifts in the external environment. Beinhocker compared the search for the optimal corporate strategy to that of an alpine hiker whose goal is to reach the tallest peak in a mountain range, where food is only available on the highest peaks, you can only see a few feet ahead and earthquakes periodically change the landscape. He proposed a strategy involving three key elements:

- Keep moving

A company that stands still and rests on its laurels is almost guaranteed to go backwards eventually as the environment dynamically shifts. So, the strongest and most resilient businesses ought to be restless, innovative and constantly striving to improve. - Employ parallel strategies

Natural evolution is a massively parallel process, as each organism within a species is genetically distinct. Species that lack genetic diversity are fragile and not resilient to shocks. Companies, therefore, should pursue multiple strategies simultaneously, although not necessarily with equal resources and attention. This parallelism increases the chances that one strategy will work and increases the odds that the company will survive if the environment changes – for example if a punctuated equilibrium event occurs. - Mix short and long jumps

In most fitness landscapes, the peaks and troughs are correlated and clustered. That’s because similar strategies are likely to have similar outcomes in terms of profitability. Consequently, one valuable approach to exploring the landscape is to take incremental upward steps. This is known as an adaptive walk. However, this strategy can result in companies getting stuck in ‘local maxima’ – the highest point in a local region but not in the global region. Beinhocker recommends mixing up an adaptive walk with occasional long jumps to prevent this. That is precisely what happens in nature. Random mutations are the equivalent of the adaptive walk. More radical reshuffling of the genetic deck, or long jumps, happens during sexual reproduction when genetic material is recombined.

Growth initiatives

A study by the management consultancy McKinsey, published in 1999, found that the 30 most successful companies’ business strategies aligned with Beinhocker’s recommendation of mixing short and long jumps. McKinsey called this framework ‘the three horizons of growth’.

Three horizons of growth

Source: McKinsey & Company Growth Initiative

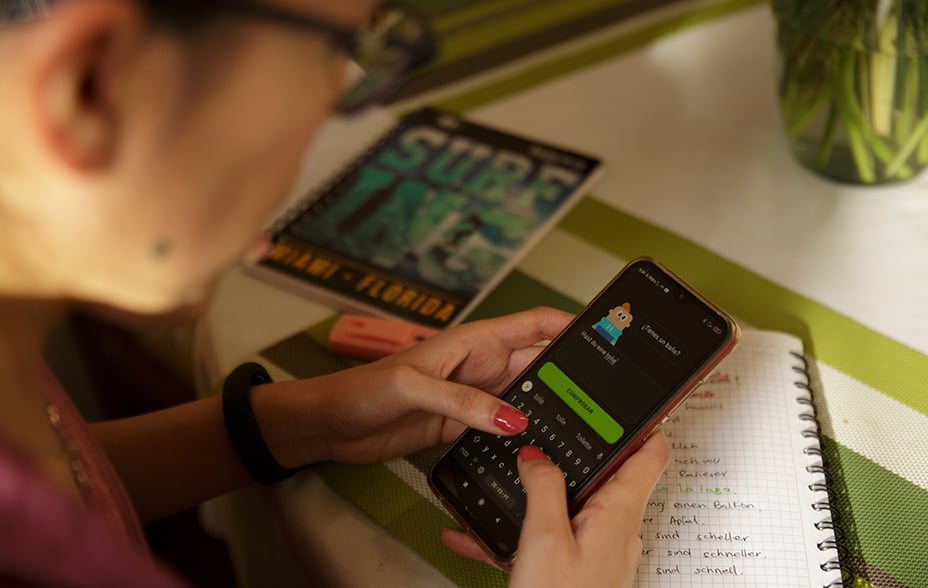

- Horizon One strategies are the short jumps or the adaptive walk. These focus on driving growth by extending the existing core business. An example from our portfolio might be Duolingo adding additional languages to its language learning app, therefore broadening its user base.

- Horizon Two strategies are those which leverage off the core business to create new opportunities. These are medium jumps. Taking Duolingo again, this might be the incorporation of the artificial intelligence model GPT-4 into the application, which has enabled the firm to offer a higher-priced subscription tier with additional features.

- Horizon Three strategies are initiatives to create completely new businesses that do not yet exist. These are the long jumps. In Duolingo’s case, the company’s move into new subjects, including music and maths, might fall into this category.

What was most interesting about the McKinsey work was its finding that the best growth businesses tended to have strategies spread across all three of these categories, whereas average-performing growth companies were more likely to focus on Horizon One efforts.

The relative rarity of the three-pronged approach is not hugely surprising. Horizon One investments are the lowest-risk of the three and are likely to pay off in the shortest time. They are also likely to be popular internally as they strengthen the core of the business, and this is where most of the people and political capital reside within an average organisation.

The founder’s edge

Companies that are run for the short term and that worry about quarterly earnings volatility – which, in our experience, represent a substantial majority of today’s market – are likely to strongly prefer the lower-risk, shorter payoff characteristics of Horizon One.

Branching out to Horizons Two and Three requires companies to extend their timespans and embrace risk. Such an approach may also demand breaking through vested interests that oppose capital being directed away from the core.

In our experience, founder-run companies are more likely than average to pursue a diverse strategy like this. Founders are often mission-driven and are, therefore, more likely to be long-term-orientated. They also have the moral authority required to make the type of bold bets required in Horizon Three.

This may explain our long-standing observation that founder-led firms tend to be more adaptable and durable than average. The landscape that a company operates in will inevitably shift underneath it. As we have seen, the optimal strategy for staying on top in such a seismically unstable environment is a mixture of short and long hops.

We have seen many portfolio companies successfully exploit long jumps in the past. Amazon’s decision to offer cloud services as an external product is an excellent historical example. More recently, the commercial real estate information provider CoStar engaged in a long jump when it acquired Homes.com to enter the residential property listings market and compete with Zillow.

Meta (formerly known as Facebook) is another example of a holding that is not afraid to commit to efforts that may take years to reach fruition. The company’s determination to invest in its virtual and augmented reality business, Reality Labs, in the face of significant opposition from Wall Street highlights the importance of a founder’s conviction and moral authority in making tough and often controversial capital allocation decisions.

We’re looking for the companies that have the vision, patience, and ambition to make such long jumps, and founder-led businesses make up a disproportionate share of these firms.

Risk Factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in January 2024 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲香港有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law

Ref: 86127 10043697