Unusual thinking

Conversations with outside experts help our investment managers tap into the flow of new ideas and signpost future developments. They can involve academics whose work we sponsor and authors who come to our attention via the literary festivals that we supports.

Conversations with inspiring minds

Watch this space: Tim Marshall on the future of ‘astropolitics’

Author Tim Marshall explains how space is set to become the new arena for rival powers.

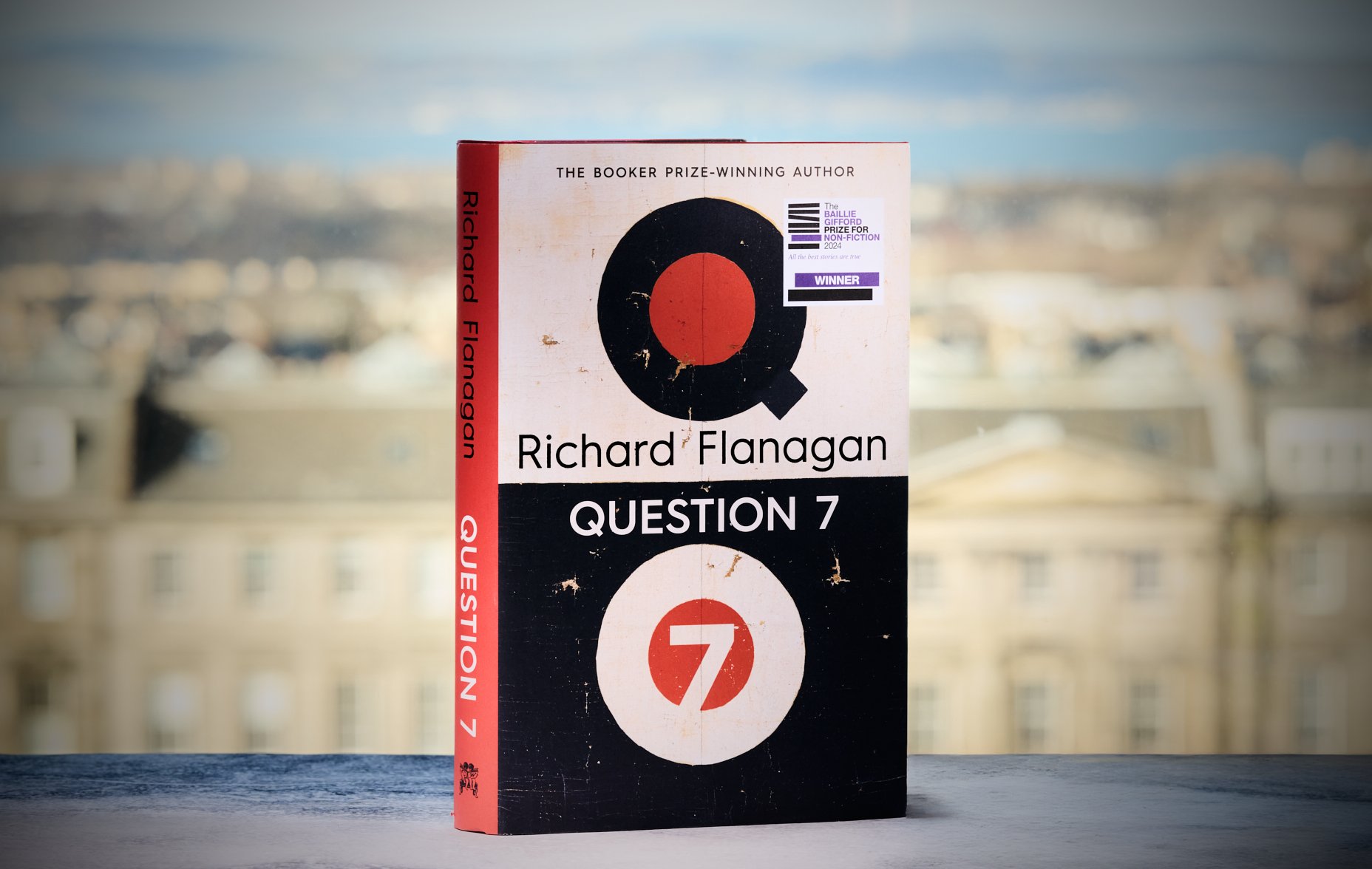

Why Question 7 won the Baillie Gifford Prize

Prize judge Alison Flood describes how Richard Flanagan's book captivated the panel.

Ahead of the game: rethinking play’s importance

Kelly Clancy makes the case for why play is more important than you might think.

Private companies and the Power Law

Author Sebastian Mallaby on the attraction of investing in game-changing firms at an early stage.

A warning on warming

Author John Vaillant’s prize-winning Fire Weather spells out the lessons of a Canadian inferno.

The elements behind everything

Material World author Ed Conway shares insights on six commodities crucial to our progress.

Exposing AI’s costs

Prof Kate Crawford on artificial intelligence’s environmental and social impacts.

Shakespeare: Elizabethan entrepreneur

James Shapiro sheds new light on the life of the Bard.

Nuts and Bolts: engineering progress

How seven small often overlooked inventions shape our lives in remarkable ways.

The future of cybersecurity

Veteran data security expert Mikko Hyppönen on cyberwarfare and AI’s challenge.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Chip War

How semiconductors bring a competitive world together.

Author interview: Closing the gap

Sally Magnusson interviews Mary Ann Sieghart about her argument that bias can undermine professional women.

Frames of mind

Viktor Mayer-Schönberger discusses the human advantage of decision making in the age of big data.

The storyteller: Tony Fadell

After his book on succeeding in tech, the man behind the iPod and Nest is investing to solve climate change.

Important information

Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

The information on this Website is issued by Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (the “Company”) which is licensed by the Securities and Futures Commission of Hong Kong (the “SFC”) under the Securities and Futures Ordinance (“SFO”) for Type 1 (Dealing in Securities) regulated activity with CE Number BGB803. It allows the Company to market and distribute the Baillie Gifford’s range of collective investment schemes to Professional Investors (as defined by the SFO) in Hong Kong.

The information contained in this website has been compiled with considerable care to ensure its accuracy at the date of publication. However, no representation or warranty, express or implied, is made to its accuracy or completeness. Nothing in this information or elsewhere in this website shall exclude, limit or restrict our duties and liabilities to you under the SFO or any conduct of business rules which we are bound to comply with. The information on this website has not been reviewed by the SFC. These Terms and any non-contractual obligations arising from or connected with them shall be governed by, and these Terms shall be construed in accordance with, the laws of Hong Kong.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation or offer to buy, sell or hold a particular investment. You can read details of our Legal and Important Information here. Please remember that all investment strategies have the potential for profit and loss and your or your clients’ capital may be at risk.

This website does not collect personal information. "Cookies" may be stored on your computer for easy navigation. A "cookie" does not allow us to identify you, but stores information about navigation through our website (such as pages already visited, time and date of visit) which we can remember during the user's next visit to our website in order to improve your browsing experience. If you have any enquiries in relation to our data protection policies and procedures, this Website or the information on it, please click here to contact Baillie Gifford.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is incorporated in Hong Kong. The Company’s principal place of business is Suites 2713-2715 Two International Finance Centre, 8 Finance Street, Central, Hong Kong . Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

What makes us different?

Being Edinburgh-based gives us stability and perspective, but we are truly global in our investment approach.