Overview

Share price and charges

Series

FNAV

3.00% change

0.67%Management fee

0.72%Operating expenses

0.07%Gross expense ratio

0.79%Net expense ratio

0.79%Fund facts

Fund launch date

31 May 2001

Fund size

$717.0m

Benchmark

MSCI Emerging Markets Index

Current number of holdings

72

Active share

68%**

Annual turnover

18%

Style

Growth

Guideline number of holdings

60-100

** Relative to MSCI Emerging Markets Index.

Source: Baillie Gifford & Co and relevant underlying index provider(s).

Portfolio characteristics

The fund's characteristics compared to the index.

As at 31 March 2025

| Fund | MSCI Emerging Markets Index | |

|---|---|---|

| Market cap (weighted average) | $280.64bn | $228.50bn |

| Price / Book | 2.35 | 1.96 |

| Price / Earnings (12 months forward) | 12.40 | 11.93 |

| Earnings growth (5 year historic) | 9.84% | 9.59% |

| Return on equity (12 months forward) | 18.84% | 15.78% |

| Standard deviation (trailing 3 years) | 17.03% | 14.26% |

| Beta | 1.18 | N/A |

Source: Revolution, MSCI. Canadian dollars.

Index disclaimer

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an ‘as is’ basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the ‘MSCI Parties’) expressly disclaims all warranties (including, without limitation, any warranties or originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com).

Important information

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Baillie Gifford does not currently have any funds that offer securities under a simplified prospectus for general offer or sale within Canada. No securities regulatory authority in Canada has reviewed or in any way passed upon this website or the merits of any investment available, and any representation to the contrary is an offence.

Persons resident or domiciled in Canada should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to trade.

You can read details of our Legal and Important Information here.

Trade Matching Statement

This Trade-Matching Statement is being provided in accordance with National Instrument 24-101 -"Institutional Trade Matching and Settlement" and Companion Policy 24-101 CP (the "National

Instrument"). It applies to all trades that are subject to the National Instrument. View the whole statement.

Fund portfolio holdings

The list of top 10 holdings that this fund invests in.

As at: 31 March 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | TSMC | 11.13 |

| 2 | Tencent | 7.43 |

| 3 | Alibaba | 4.69 |

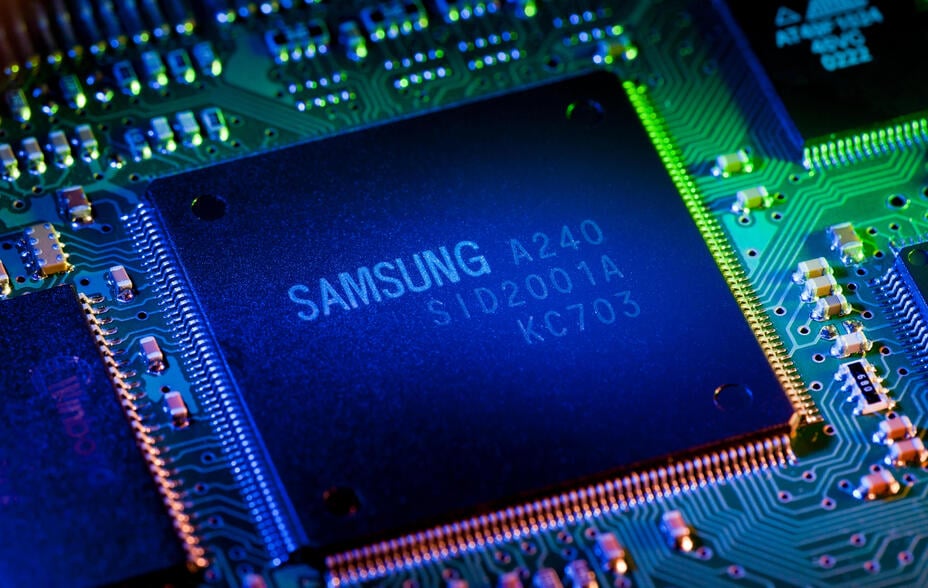

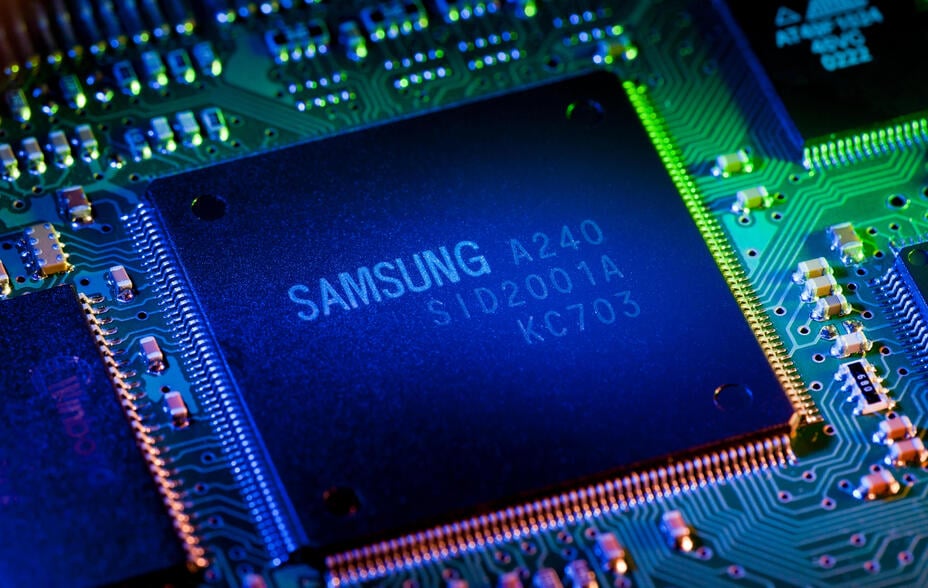

| 4 | Samsung Electronics | 4.50 |

| 5 | MercadoLibre | 4.04 |

| 6 | Petrobras | 3.69 |

| 7 | Reliance Industries | 3.26 |

| 8 | Kweichow Moutai | 2.81 |

| 9 | SK Hynix | 2.23 |

| 10 | Meituan | 2.09 |

Quarterly transactions

Transactions for the three-month period ending 31 March 2025

New purchases

- Globant Sa

- Gongniu Gp 'A' - Stock Connect

- SQM ADR

Complete sales

- Cemex ADR

- Jio Financial Services Ltd

- Lufax Holding Ltd

- PTT Exploration and Production

- Tech Mahindra

Insights

Key articles, videos and podcasts relating to the fund:

Filters

Insights

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Emerging Markets Q1 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Lithium: powering the future

Investing in the Chilean mining company charging the energy transition.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

DeepSeek: disruptive AI

Why investors shouldn’t overlook Chinese innovation

Brazil: an uncomfortable dance?

How our Brazilian holdings are leading with strong growth amid fiscal complexity.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging markets: new opportunities

The evolving landscape of emerging markets, fuelled by AI, energy transition and world-class companies driving growth.

Samsung: chipping away at challenges

How Samsung turns challenges into opportunities for future growth.

The rise of the Global South

Unpacking the BRICS summit's outcomes, the Global South's rise and implications for EM investors.

Emerging Markets Q3 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Travelling Brazil: open for business

We share the trip notes from our time in Brazil, highlighting the energy sector, sustainability and fintech.

The brilliance of Brilliance

Brilliance China Automotive's journey with its partnership, BMW, through governance, engagement, and value.

China’s third plenum: staying the tech course

Unveil China's third plenum resolutions focusing on AI, biotech, and renewable energies amid global challenges.

Emerging Markets Q2 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging markets democracy: better than you think

See what the recent elections in Mexico and India mean for emerging markets investors.

From earth to equity: the platinum opportunity

Platinum's role in health, tech and green energy.

Luckin Coffee: looking forward

How Luckin Coffee is revolutionising China's coffee culture.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

ESG analyst trip notes: India and China

Read more about the unique perspective on the evolving energy landscape and corporate governance in these emerging markets.

BRICS expansion and impact

Unveiling the BRICS expansion's global influence and its effect on trade and geopolitics

Copper's role in emerging markets

Assessing copper's supply challenges and investment potential in emerging markets for 2024.

How do we do what we do

How do we implement our emerging markets equities philosophy in practice?

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Why do we do what we do

Andrew Keiller and John Rae look at why we invest in emerging markets equities in the way that we do.

India's triumph in a turbulent world

Uncover insights on emerging markets, India's economy, and Asia's rising export champions.

South-east Asia's new export champions

Uncovering Asia's rising export stars in Vietnam, Indonesia and Thailand.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

Conversations with Shanghai

Discover the importance of High Bandwidth Memory in AI development and the key players in the market - SK Hynix and Samsung Electronics.

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Beyond the numbers

An analysis of the relationship between GDP growth and stock market returns in emerging markets, with a focus on China.

Brazil's economic landscape

Challenging perceptions: Lula's re-election and Brazil's economic potential

Emerging Markets Q2 update

The Emerging Markets team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q1 update

Emerging Markets Team reflects on recent performance, portfolio changes, and market developments.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Emerging markets in 2050

Trade shifts and underserved populations are among the factors favouring world-class stocks.

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Emerging Markets Q1 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Lithium: powering the future

Investing in the Chilean mining company charging the energy transition.

Moutai: Stock Story

Ben Buckler investigates the Chinese brand dominating the global luxury drinks market.

DeepSeek: disruptive AI

Why investors shouldn’t overlook Chinese innovation

Brazil: an uncomfortable dance?

How our Brazilian holdings are leading with strong growth amid fiscal complexity.

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging Markets Q4 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging markets: new opportunities

The evolving landscape of emerging markets, fuelled by AI, energy transition and world-class companies driving growth.

Samsung: chipping away at challenges

How Samsung turns challenges into opportunities for future growth.

The rise of the Global South

Unpacking the BRICS summit's outcomes, the Global South's rise and implications for EM investors.

Emerging Markets Q3 investor letter

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Travelling Brazil: open for business

We share the trip notes from our time in Brazil, highlighting the energy sector, sustainability and fintech.

The brilliance of Brilliance

Brilliance China Automotive's journey with its partnership, BMW, through governance, engagement, and value.

China’s third plenum: staying the tech course

Unveil China's third plenum resolutions focusing on AI, biotech, and renewable energies amid global challenges.

Emerging Markets Q2 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Emerging markets democracy: better than you think

See what the recent elections in Mexico and India mean for emerging markets investors.

From earth to equity: the platinum opportunity

Platinum's role in health, tech and green energy.

Luckin Coffee: looking forward

How Luckin Coffee is revolutionising China's coffee culture.

30 years of emerging markets

Baillie Gifford’s Will Sutcliffe explains how emerging markets have evolved in the last three decades.

High-calibre emerging markets firms

Why it’s a promising time to invest in exceptional emerging markets companies

Emerging Markets Q1 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

ESG analyst trip notes: India and China

Read more about the unique perspective on the evolving energy landscape and corporate governance in these emerging markets.

BRICS expansion and impact

Unveiling the BRICS expansion's global influence and its effect on trade and geopolitics

Copper's role in emerging markets

Assessing copper's supply challenges and investment potential in emerging markets for 2024.

How do we do what we do

How do we implement our emerging markets equities philosophy in practice?

Emerging Markets Q4 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Why do we do what we do

Andrew Keiller and John Rae look at why we invest in emerging markets equities in the way that we do.

India's triumph in a turbulent world

Uncover insights on emerging markets, India's economy, and Asia's rising export champions.

South-east Asia's new export champions

Uncovering Asia's rising export stars in Vietnam, Indonesia and Thailand.

Emerging markets – why bother?

Emerging markets have underperformed developed ones recently. So, why should we invest in them?

Conversations with Shanghai

Discover the importance of High Bandwidth Memory in AI development and the key players in the market - SK Hynix and Samsung Electronics.

Emerging Markets Q3 update

The Emerging Markets Team reflects on recent performance, portfolio changes and market developments.

Finding China’s A-share jewels

The country’s domestic markets are rich in companies with the know-how to become global leaders.

Beyond the numbers

An analysis of the relationship between GDP growth and stock market returns in emerging markets, with a focus on China.

Brazil's economic landscape

Challenging perceptions: Lula's re-election and Brazil's economic potential

Emerging Markets Q2 update

The Emerging Markets team reflects on recent performance, portfolio changes, and market developments.

Emerging Markets Q1 update

Emerging Markets Team reflects on recent performance, portfolio changes, and market developments.

China’s gen Z+

How the digital natives’ wants and needs create opportunities for forward-thinking Chinese companies.

Tax and distributions

The Fund intends to pay dividends to its unitholders at least annually. Distributions will be automatically reinvested in additional units of the Fund or, if a unitholder requests, paid directly to unitholder.

The distribution date for the Fund shall be the last Valuation Date in each taxation year or such other frequency as may be determined by the Manager. The distribution dates will appear on this page alongside the rates once they become available. For more information on the Funds distributions please see the Offering Memorandum.

Recent distributions

The below table shows the makeup of the most recent distributions paid.

| Series F | Series Z | |

|---|---|---|

| Income dividends | 0.17185 | 0.18025 |

| Capital gain | 0.00000 | 0.00000 |

| Total per share | 0.17185 | 0.18025 |

| Ex-dividend date | 31 Dec 2024 | 31 Dec 2024 |

| Pay date | 31 Dec 2024 | 31 Dec 2024 |

| Status | Final | Final |

Source: CIBC Mellon and Baillie Gifford & Co.

Upcoming distributions

The table below shows the proposed distribution dates for the current tax year. The dates can be changed by the Officers of the Funds.

2025

30 December 2025

31 December 2025

31 December 2025

Source: CIBC Mellon and Baillie Gifford & Co.