Key points

The International All Cap Team shares insights on Q1 2025, covering the strategy's recent performance, portfolio adjustments, and market influences.

Your capital is at risk.

First Quarter Performance

The beginning of 2025 has seen significant geopolitical turbulence and the daily oscillations of stock prices suggest that markets can’t make head nor tail of it. Amidst the uncertainty over the quarter, International equities have outperformed their US peers as economic growth expectations have diverged. Put rather simply, consensus is expecting fiscal spending, on both infrastructure and defence, in Europe, and stimulus in China, while spending is likely being cut in the US. This has led to particularly strong performance from European equities, ostensibly driven by banks and defence, two sectors traditionally associated with the ‘value style’. The outperformance of value, relative to growth is an acceleration of a longer-term trend in International markets, with growth having underperformed value since 2022 in Europe and Japan. The portfolio has underperformed in the context of this value rally given its underweight to both banks and defence, but it has largely kept pace with the ‘growth’ variant of the index.

Geopolitics and near-term share price moves aside, what has been pleasing has been the improvement in the demand environment for portfolio companies and the optimism being conveyed by management teams. Supermarket chain Jeronimo Martins’ results highlighted the end of food deflation in Poland and the company continues to rollout new stores across its markets, while Sysmex, a haematology analysers business, saw robust growth across multiple markets. Meanwhile fast-growing companies like Adyen, in payments, and ASML and Tokyo Electron, in semiconductor capital equipment, have guided for an acceleration in growth over the coming years.

What is required for outperformance?

Most of the news headlines over the first quarter reflected on how the world has changed. Not to be outdone on hyperbole, the investment research providers have inundated us with webinar invitations on the ‘paradigm shift in markets’, and teach-ins on tariffs and defence stocks. There is no doubt we are going through a period of significant change. Fiscal stimulus announcements in Germany and China are a cause for optimism in International investing, while defence spending around Europe should be positive for economic growth. However, not much ink has been spent on what has not changed and given that as growth investors we appear to be the contrarians now, we’ll take the opportunity to devote some writing to this.

What has not changed, in our opinion at least, is what it takes to outperform in equity investing. In our view, there are three key characteristics which form the basis for success over sustained periods of time.

1. Focus on Growth

Superior profit growth leads to superior results. If we slice the international equity universe into quintiles according to earnings growth over five year rolling periods between 1999 and 2023, the companies which grew their earnings the fastest outperformed the most. The median company in the top quintile achieved a relative total return of nine per cent per annum, versus companies in the bottom quintile which underperformed by seven per cent per annum.

Our job is to find the companies with the right blend of characteristics to produce this kind of top quintile growth. In our experience, it’s the companies that achieve this typically combine a large market opportunity, defensible competitive advantages and a strong capital allocation track record. In recent years, a significant part of the portfolio has. Tokyo Electron, for instance, has leading competitive positions in manufacturing high tech etch and deposition equipment which is becoming even more important in semiconductor fabrication as chip shrinkage slows and we pursue advanced semiconductors to power AI. Meanwhile, Ab InBev owns some of the world’s leading beer brands, benefiting from the development of the middle-class consumption habits in emerging markets, as well as premiumisation and the development of new categories like zero alcohol beer. By virtue of this, the company is generating a huge amount of free cash flow which can be deployed to further strengthen its competitive positions in multiple markets.

Over the past year or so, we have sought to diversify the types of growth opportunities we invest in, ranging from banks, like SEB, pharmaceutical companies, like Chugai, to an energy company, TotalEnergies. What has been common across all our investment cases has been that these companies occupy leading market positions and generate high returns on capital. The economic environment has indeed changed and this will have an influence on the future winners in the stock market. Debt financing is more expensive and the costs of running a business, due to tariffs or otherwise, have increased. This will only serve to bifurcate the gap between the winners and losers across industries. It is the type of high return, structurally advantaged businesses that we have been investing in which have the chance to navigate challenging environments and emerge from them stronger.

2. Think differently

Long-term outperformance is not just about finding growth, it’s about finding underappreciated growth. Investment is an expectations game. Our job is to find assets where there is a difference between what consensus expects or the price implies and what you believe the prospects of that asset’s fundamentals are. This applies to growth investment, just as it does to value. This is not new insight. However, it is an important reminder that we believe that “consensus” expectations for our holdings and the portfolio are significantly below our own expectations.

“The single greatest error I have observed among investment professionals is the failure to distinguish between knowledge of a company’s fundamentals and the expectations implied by the company’s stock price.” Michael Mauboussin.

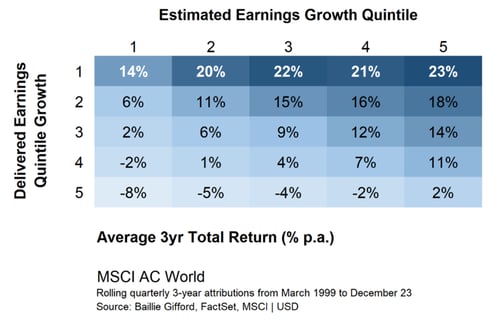

The table below shows the estimated earnings growth quintiles across a global universe on a matrix with the delivered earnings growth quintiles over a three-year period. What this shows is that the highest total returns (as shown by the percentages inside the boxes) were achieved by the companies for which the market had low expectations which they exceeded significantly; meanwhile the lowest returns were achieved by companies for which the market had high expectations which they would go on to disappoint.

That consensus expects the portfolio’s earnings growth to largely track that of the broad index suggests that the majority of the portfolio finds itself in the lower quintiles of growth expectations. When we assess how our view differs to the market’s across our investment cases, there are two common themes: the market is extrapolating based on recency bias and it is underestimating the durability of growth.

Two of the most recent purchases for the portfolio fit this profile. Roche, the Swiss pharmaceutical giant, has struggled with the prospects of a patent cliff for some of its blockbuster drugs and due to pipeline failures. We believe that its prospects are looking up. It is a highly cash generative company, giving the potential to acquire assets in a weaker funding environment for biotechs, while also reinvesting in its own pipeline for long-term success. We believe pipeline success rates are likely to improve thanks to its investments in computational biology and an increased commercial focus. At the time of writing, Roche trades at a discount to the broader index because those growth prospects remain underestimated. This could also be said of another of the new purchases, UK-listed thermal energy and fluid management systems company, Spirax. Its share price has fallen as customer demand has weakened after supernormal growth during the pandemic. However, as industrial spending continues to pick up, something which could be boosted by fiscal stimulus in international economies, we believe growth will normalise and its profit margins will expand. It is the leader in a fragmented market, giving it a long runway to win further share from smaller peers while also growing via acquisition. Both investment cases, like the portfolio, give us the potential to benefit from the return thanks to earnings growth as well as a re-rating in the valuation multiple.

3. Think & act long-term

We all dream of finding perpetual growth machines. The reality, though, is that finding them is hard and the pressure in the investment profession to maximise short-term results makes holding them even harder, particularly when there are shinier alternatives. Companies which can compound their earnings at attractive rates for very long periods are special. Their continued success often feels improbable because it is. Most investors are not incentivised to exhibit the patience required to benefit from their operational performance and appreciating these companies only comes with experience. Understanding why companies like Atlas Copco, Games Workshop, or Danaher, to give a US example, are able to compound for such a long time requires a lot of qualitative inputs, most of which aren’t obvious in a company’s accounts. This makes forecasting growth for long periods very challenging. A disappointing set of results here and there can make investors ignore the technological and cultural advantages or the capital allocation track record that many of these businesses possess and lead them to forecast a much shorter growth runway. This creates opportunities to buy more of the structurally advantaged companies we already own on our clients’ behalf while also presenting us with new opportunities.

The portfolio’s best performer over the past twelve months was Spotify. The audio streaming platform’s shares have endured a rollercoaster ride since it listed in 2018. Its market cap had more than doubled by early 2021, before falling almost 80 per cent over the following year. The debates at the time surrounded the balance of power between Spotify and music labels, whether investments in advertising and podcasting would be productive and whether or not Spotify could ever be profitable. What these debates missed was how Spotify has become synonymous with audio streaming and improved the product offering, granting it immense pricing power and significant margin expansion potential over the long-term. This understanding led to us holding on to the shares and we have been rewarded. Since turning on the profitability taps by reining in operating expenses and wielding its pricing power with several premium subscription price increases, the share price has risen sharply, up over five times from its late 2022 lows. It serves as proof that investors often see information but incorrectly weigh it, providing active, long-term investors with an inefficiency to exploit.

What are the portfolio’s prospects?

We believe the portfolio offers higher growth than the index, it has higher returns on capital and stronger balance sheets than the index and is attractively valued. Understanding how we differ to consensus thinking is a core part of our research framework, while our consistently low turnover shows how we are prepared to both think and act long-term. From that perspective, we think our prospects for outperformance are strong.

With growth underperforming value in parts of International, this potential is not being reflected in share price performance in the near-term. However, signs that growth is accelerating in the portfolio give us cause for optimism. As an investment team, our task is to understand important shifts in the underlying environment, while not being distracted by noise. Above all else, we must be laser-focused on thinking and acting long-term as investors with a healthy respect for what we do not know and cannot predict.

This is an International All Cap commentary based on ACWI ex US All Cap. Not all stocks may be held, but themes of this commentary are representative of: EAFE Plus All Cap and Developed EAFE All Cap.

|

|

2021 |

2022 |

2023 |

2024 |

2025 |

|

ACWI ex US All Cap Composite |

66.6 | -16.4 | -7.9 | 3.9 | 0.5 |

|

MSCI ACWI ex US Index |

50.0 | -1.0 | -4.6 | 13.8 | 6.6 |

|

EAFE Plus All Cap Composite |

60.7 | -15.6 | -6.4 | 2.4 | -0.1 |

|

Developed EAFE All Cap Composite |

61.5 | -13.9 | -7.4 | 2.3 | -1.4 |

|

MSCI EAFE Index |

45.2 | 1.6 | -0.9 | 15.9 | 5.4 |

|

|

1 year |

5 years |

10 years |

|

ACWI ex US All Cap Composite |

0.5 | 6.0 | 4.2 |

|

MSCI ACWI ex US Index |

6.6 | 11.5 | 5.5 |

|

EAFE Plus All Cap Composite |

-0.1 | 5.3 | 3.7 |

|

Developed EAFE All Cap Composite |

-1.4 | 5.4 | 3.7 |

|

MSCI EAFE Index |

5.4 | 12.3 | 5.9 |

The International All Cap Strategy comprises three distinct variants. Overall, the variants are broadly similar, with the key difference being the degree of exposure to emerging markets listed holdings.

Source: Revolution, MSCI. US dollar. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite. 1 year figures are not annualised.

Past performance is not a guide to future returns.

Legal notice: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk factors

This communication was produced and approved in April 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

144730 10054075