The value of an investment, and any income from it, can fall as well as rise and investors may not get back the amount invested.

Under the Radar

International Smaller Companies

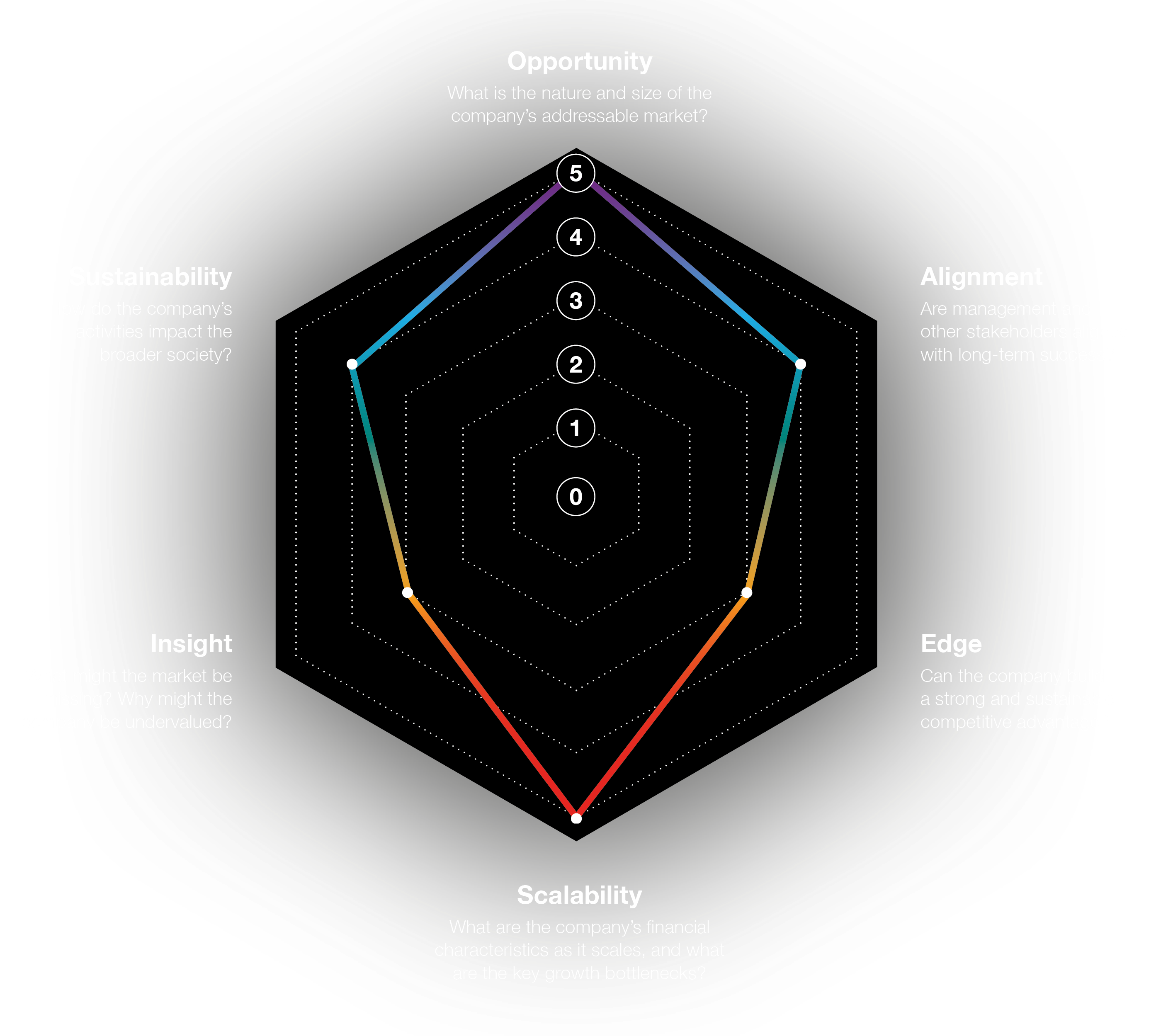

ISC radar: opportunity

In 1980s Canada, three software engineers working for the large telecom supplier Mitel faced a problem. They were responsible for the company’s supply chain planning system. The program ran every weekend, allowing the clunky behemoth the 40 hours it needed to carry out its complex calculations. On more than one occasion a delay or error would bring the software to its knees, forcing a rerun during working hours, leaving business operations in turmoil. The engineers however could see a solution. They’d previously encountered a piece of special purpose hardware that allowed simulations to be run 1,000 times faster than the software equivalent. If done right, this technology could reduce their 40-hour process to under three minutes. In 1984 the three engineers quit their jobs at Mitel to found the business that would become Kinaxis, an important holding in our International Smaller Companies portfolio. Today Kinaxis provides logistics and supply chain planning software to many of the biggest companies in the world. It’s unique technology combines proprietary AI with decades of human experience to help clients make complex decisions in real-time. Unsurprisingly this has provided the business with an exceptional runway for growth over the past decades. The origins of Kinaxis capture the essence of how we think about opportunity. Almost all great investments begin with a problem. Good companies build solutions that address them.

Opportunities come in many shapes and sizes, and one of the joys of looking at small businesses is that more often than not the opportunity they address will be significant relative to their scale today. When a company is seeking to disrupt or transform an industry with a genuinely new solution it is inevitable that progress takes time. Only through time and patience will our clients truly benefit from the small group of companies that ultimately capture the truly remarkable opportunities out there.

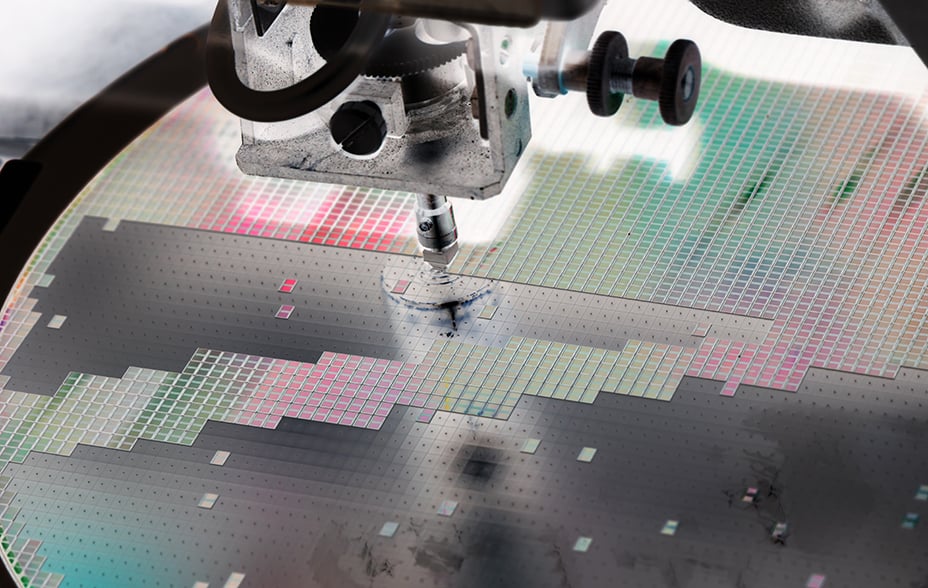

Let us look to Switzerland in 1998. This was the year that two physicists studying at ETH (the Swiss Federal Institute of Technology), started to develop and commercialise the unique sensor technology they had been working on. The company they founded, Sensirion, thus began life as a relatively unremarkable R&D-focused organisation, working to combine environmental sensors alongside analogue and digital circuitry on a single semiconductor chip. It took some time for the business to sell its first product, and even then they were limited to relatively niche humidity and temperature measurements. Over the subsequent two decades however, two super-trends converged to create the perfect demand storm for Sensirion’s unique compact sensor technology – first, the rapid proliferation of ever smaller connected devices and, second, the demand for ever more sensitive data on environmental conditions and air quality, from the likes of the automotive and construction industry. By 2006 the company had delivered 1 million sensors. As of today the number is over one billion.

We first discovered Sensirion in 2019, when the business had only recently begun trading publicly. At the time we felt the structural demand for environmental sensors, as a tool in measuring climate, was becoming increasingly acute, but this is where patience comes into play. An analyst with a one-year time horizon in 2000 might have spent their energy calculating the financial impact of the semiconductor cycle on next year’s demand for Sensirion’s humidity sensors, hypothesising about supply chain hurdles and forecasting the impact of R&D spend on margins. Over a decade, however, these traits simply do not register when compared to the evolving demand for ever smaller sensors to feed the evolution of consumer electronics, and to provide the data that is critical to better understanding environmental impact. So far, this growth has rewarded patient shareholders. Since listing in 2018 revenue has compounded at over 20 per cent per annum, driving the share price up over 130 per cent and demand for their sensors shows no sign of slowing.

This is the challenge we face as long-term investors at Baillie Gifford. Identifying big problems and opportunities is just the first step. For our clients to benefit, we need to find businesses that recognise these opportunities and aren’t afraid to chase them, and then we need to weather the ups and downs that go along with investing over long timeframes. This isn’t always as easy as it sounds. Over recent history, markets have proven themselves less and less patient. The average holding periods of institutional investors has decreased, and a reliance on volatility measures like tracking error has increased. This can create a hostile environment for small businesses trying to capture large opportunities.

Biocartis is a Belgian molecular diagnostic business whose proprietary Idylla system allows laboratories to carry out rapid, highly accurate diagnostic testing across a range of different cancers and infectious diseases. We first got to know the business in 2018, following several years of successful growth in Europe, during which it increased both its range of tests and hardware. The opportunity was clear: install more machines, develop more tests, and expand globally (notably in the US which makes up half the world’s testing market). In 2019, however, Biocartis was hit with growing pains. Its go-to-market strategy in the US was taking longer than expected. They split with their distribution partner, forcing them to lower short-term guidance and restructure sales efforts. Markets were quick to express their displeasure, with the shares falling more than 75 per cent from their 2018 peak.

It doesn’t matter that the number of Idylla machines has grown from around 650 machines in 2017 to over 1,700 in 2021. Nor does it matter that, despite the slow start, the business has shown notable progress in developing its US business, which today makes up 36 per cent of revenue. The market wanted Biocartis to offer smooth short-term results and chose to punish any sign of a struggle, even if that struggle was a result of a bold attempt to tackle a massive opportunity. All small businesses carry an inherent risk of failure. However, when the opportunity is sufficient, and the business shows signs of being special, overweighting downside and punishing short term setbacks is both irrational and counterproductive. Focusing on opportunities and supporting the companies addressing them should, over long periods, generate far more value for shareholders than worrying about the bumps along the way. There are still 16,000 pathology labs up for grabs for Biocartis, and plenty of new disease markers to chase. In the context of this opportunity, the shaky start in the US should fade in importance. If Biocartis can maintain its technical lead and if its investment in moving overseas and expanding its test menu pays off, then the effect on their business will be transformational.

Big opportunities offer the potential for big rewards. However, when thinking about growth over longer timeframes, we often need to go a step further. Good companies address problems facing their customers. Great companies address problems the customers don’t even know they have yet. We get excited when we find a business expanding into an opportunity while continually investing to uncover the next opportunity. An excellent example here would be Raksul, a business launched by its founder/CEO Yasukane Matsumoto in 2009 to bring efficiency to Japan’s print industry. Raksul began life as an online marketplace. Clients looking for printing services could place orders, and Raksul would automatically route them to one of Japan’s 20,000 small printing businesses to fulfil based on their capacity/utilisation. In little more than a decade this business grew from a tiny start-up to an industry leader with over a million users and over 10 per cent share of market volumes.

Instead of resting on their laurels, the young, dynamic team at Raksul asked themselves where their unique expertise might create new opportunity. They believe that Raksul’s edge is in building platforms that connect large fragmented suppliers running at low utilisation with customers looking for their services. In 2015 they launched Hacobell, a logistics business copying the print playbook, but instead connecting customers requiring delivery of an item with underutilised regional logistics businesses. Then in 2020, the company again applied those same core skills to launch a marketplace to sell advertising spaces in small regional TV stations, allowing companies cheap access to customer-facing TV slots that would otherwise go unused. Despite their immaturity, together these businesses now account for more than 25 per cent of Raksul’s revenues. More importantly, they’ve taken the business’ legacy $26bn print opportunity and added the $121bn logistics market and the $14bn Japanese TV advertising market.

We are constantly looking for businesses that, like Raksul, are growing their addressable markets in new and imaginative ways. Assuming we have faith in management’s ambition and competence, we are more than happy to support their efforts to reinvent themselves. Indeed, as investors the most exciting part is that in these situations many of the new opportunities that an ambitious business will chase remain hypothetical. Industry analysts can’t fit them into financial models, and markets can’t effectively price them. This then is a fruitful hunting ground for patient, long-term investors comfortable with uncertainty.

The relationship between uncertainty and opportunity is difficult. Often an opportunity is clear, but the probability of a company successfully seizing it is low, or at very least hard to measure. This is perhaps most explicit in medical science. When developing treatments for cancer, no one would question the size of the potential rewards (both for the business involved and for humanity). However, history tells us that the probability of getting an oncology drug from Phase 1 trials through to the marketplace is under 5 per cent. This means that most companies developing new cancer treatments will fail. One method we rely on when facing uncertainty like this is to focus on the incredible asymmetry of returns in equity markets. In any investment the maximum downside is 100 per cent, whereas the maximum upside is theoretically uncapped. Many oncology businesses can fail, and yet it can still be a fruitful area in which to invest if the occasional winner can emerge and take share in a $170bn-plus market. Our process purposefully focuses on potential upside and looks for ways to improve our odds of spotting the winners. When the opportunity is large enough, the success of the handful of winners should more than outweigh our inevitable mistakes along the way.

To be long-term growth investors we need to find management teams brave enough to go after large opportunities, and ambitious enough to keep searching for new ones. In the same way that the three pioneering founders of Kinaxis were willing to risk their careers in pursuit of a solution to a problem and in doing so unlocked a global opportunity, we are looking for businesses we think have the drive and ambition to both seize today’s opportunity and then invest and adapt to seize the opportunities of the future. Often the odds are stacked against them but given the potentially vast rewards on offer we believe that, as investors, we should work to cultivate bravery in the face of this uncertainty. Our process is designed with this at its core. Of course, our radar methodology includes a number of additional tools that we believe increase our odds of success, and we look forward to exploring these with you further.

Risk factors

The views expressed in this article are those of the International Smaller Companies Team and should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect personal opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in March 2022 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for Profit and Loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

Stock Examples

Any stock examples and images used in this article are not intended to represent recommendations to buy or sell, neither is it implied that they will prove profitable in the future. It is not known whether they will feature in any future portfolio produced by us. Any individual examples will represent only a small part of the overall portfolio and are inserted purely to help illustrate our investment style.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this article are for illustrative purposes only.

| 2020 | 2021 | |

| Annual Past Performance to 31 December Each Year (Net %) | 46.1 | 9.1 |

| MSCI ACWI ex US Small Cap Index | 14.7 | 13.4 |

| 1 year | Since Inception p.a. | |

| International Smaller Companies Composite | 9.1 | 22.8 |

| MSCI ACWI ex US Small Cap Index | 13.4 | 14.0 |

International Smaller Companies was launched on 28 February 2019. Past performance is only available from this date.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018 and is authorised by the Central Bank of Ireland. Through its MiFID passport, it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (‘FinIA’). It does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. It is the intention to ask for the authorisation by the Swiss Financial Market Supervisory Authority (FINMA) to maintain this representative office of a foreign asset manager of collective assets in Switzerland pursuant to the applicable transitional provisions of FinIA. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites

2713–2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a ‘wholesale client’ within the meaning of section 761G of the Corporations Act 2001 (Cth) (‘Corporations Act’). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a ‘retail client’ within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Oman

Baillie Gifford Overseas Limited (‘BGO’) neither has a registered business presence nor a representative office in Oman and does not undertake banking business or provide financial services in Oman. Consequently, BGO is not regulated by either the Central Bank of Oman or Oman’s Capital Market Authority. No authorization, licence or approval has been received from the Capital Market Authority of Oman or any other regulatory authority in Oman, to provide such advice or service within Oman. BGO does not solicit business in Oman and does not market, offer, sell or distribute any financial or investment products or services in Oman and no subscription to any securities, products or financial services may or will be consummated within Oman. The recipient of this material represents that it is a financial institution or a sophisticated investor (as described in Article 139 of the Executive Regulations of the Capital Market Law) and that its officers/employees have such experience in business and financial matters that they are capable of evaluating the merits and risks of investments.

Qatar

The materials contained herein are not intended to constitute an offer or provision of investment management, investment and advisory services or other financial services under the laws of Qatar. The services have not been and will not be authorised by the Qatar Financial Markets Authority, the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank in accordance with their regulations or any other regulations in Qatar.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Ref: 19849 10009618