Unusual thinking

Conversations with outside experts help our investment managers tap into the flow of new ideas and signpost future developments. They can involve academics whose work we sponsor and authors who come to our attention via the literary festivals that we supports.

Conversations with inspiring minds

Ahead of the game: rethinking play’s importance

Kelly Clancy makes the case for why play is more important than you might think.

Private companies and the Power Law

Author Sebastian Mallaby on the attraction of investing in game-changing firms at an early stage.

A warning on warming

Author John Vaillant’s prize-winning Fire Weather spells out the lessons of a Canadian inferno.

The elements behind everything

Material World author Ed Conway shares insights on six commodities crucial to our progress.

Exposing AI’s costs

Prof Kate Crawford on artificial intelligence’s environmental and social impacts.

Shakespeare: Elizabethan entrepreneur

James Shapiro sheds new light on the life of the Bard.

Nuts and Bolts: engineering progress

How seven small often overlooked inventions shape our lives in remarkable ways.

The future of cybersecurity

Veteran data security expert Mikko Hyppönen on cyberwarfare and AI’s challenge.

AI Superpowers

Renowned investor Kai-Fu Lee revisits his prophetic book, five years on.

Making sense of the metaverse

Author Matthew Ball on the next-generation internet and the companies building its foundations.

Chip War

How semiconductors bring a competitive world together.

Author interview: Closing the gap

Sally Magnusson interviews Mary Ann Sieghart about her argument that bias can undermine professional women.

Frames of mind

Viktor Mayer-Schönberger discusses the human advantage of decision making in the age of big data.

The storyteller: Tony Fadell

After his book on succeeding in tech, the man behind the iPod and Nest is investing to solve climate change.

Study guides

Academic partnerships that generate new ideas

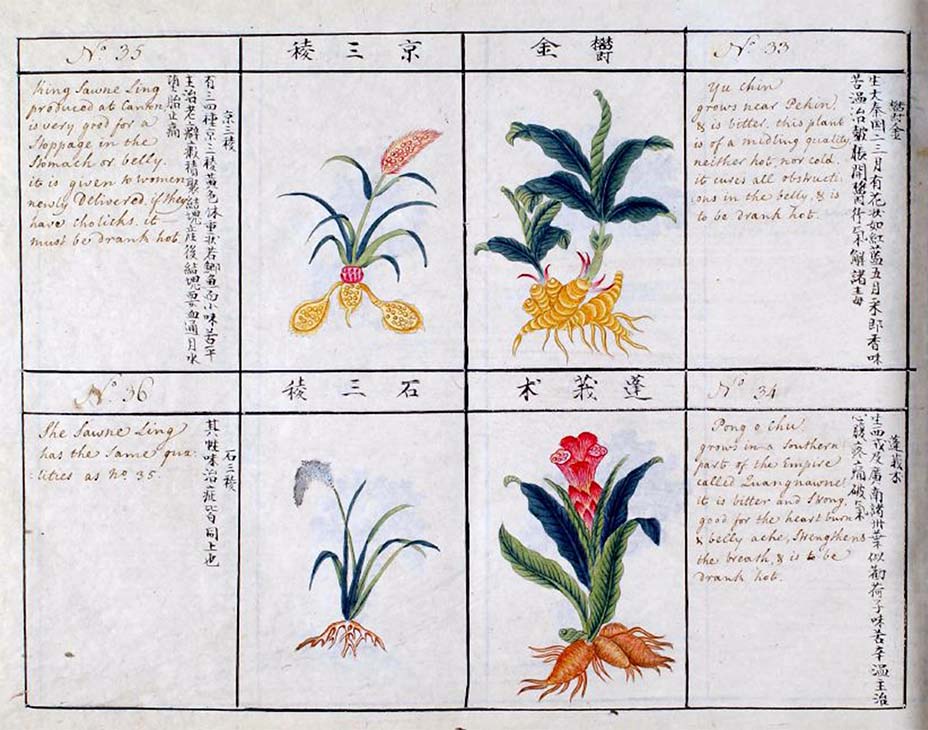

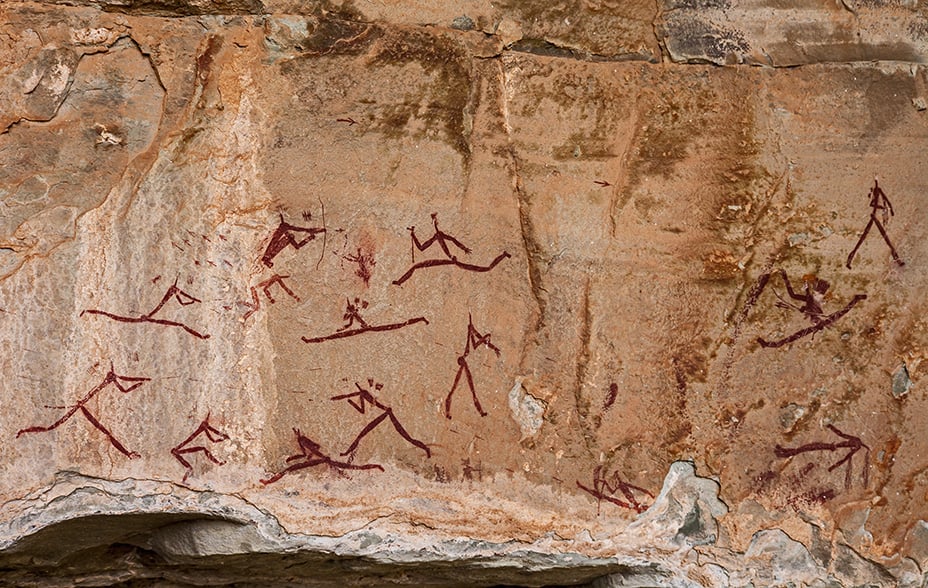

The story of science retold

It's wrong to credit a handful of western geniuses with revealing the secrets of the universe, according to James Poskett. The science historian introduces Alice Ross to the pioneers left out of our history books.

Cogs and monsters

Virtual goods and the value of digital data pose unresolved challenges to economists, investors and regulators.

The OxyContin empire

Tile description: Patrick Radden Keefe charters the rise and fall of the Sackler dynasty.

Tribal knowledge

Companies that hire anthropologists to get inside customers' minds would do better getting them to look at their own corporate behaviour, Gillian Tett tells Pádraig Belton.

Living for the long term

Australian philosopher Roman Krznaric talks about putting our descendants’ best interests above our own instant gratification.

Lessons from Bessembinder

What a US academic taught us about the companies that outperform.

Blurring the boundaries of our identity

The definition of what makes you who you are was once a simple matter. But as Tracey Follows explains to Pádraig Belton, big tech has encroached on our personal space.

Exponential change: minding the gap

Tech advances are outpacing older institutions’ ability to adapt, says author Azeem Azhar.

Important information

The content of this website is intended exclusively for professional investors in accordance with MiFID legislation. ’Professional investors’ are potential investors who are deemed to have the status of “professional clients”, within the meaning of MiFID (2004/39/EC), as transposed in Ireland. It is not intended for retail investors.

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (Reference number C182354) as an Alternative Investment Fund Manager and UCITS Manager to Baillie Gifford Worldwide Funds plc. Its registered office is 4/5 School House Lane East, Dublin 2, D02 N279, Ireland.

This website is informative only and the information provided should not be considered as investment or other advice or a recommendation to buy, sell or hold a particular investment. Read our Legal and regulatory information for further details.

What makes us different?

Being Edinburgh-based gives us stability and perspective, but we are truly global in our investment approach.