As with any investment, your capital is at risk.

Culture really matters

When ants search for food, most follow the pheromone trails of those before them. Over time, these pheromone trails become increasingly reinforced because ants leaving the nest tend to follow the trails they know will lead to food.

But not every ant. Others will take less established paths. And a few ants break out in search of ant glory. We can call these ants the stewards, followers and explorers.

But we could say the same of companies.

The stewards are about protecting and maintaining their existing operations. The followers are about trying new things but not necessarily being the first to do so. And the explorers are the wanderers, the dreamers, the ‘oh, what if we did that’ kind of company.

Ultimately, though the companies and ants are deploying different tactics, they all have the same objective: to survive and thrive.

The role of culture in organisational success

Surviving and thriving are key to any successful investment. And the company’s culture, the unwritten rules and behaviours that shape its operations, can significantly drive long-term success.

All three company types – the stewards, followers and explorers – can be good investments, but they must be managed differently, which is why understanding culture matters. Nobody wants an explorer chief executive such as Elon Musk running a steward-style company such as Hèrmes.

What problem a company looks to solve and how it does that, how it develops its competitive advantage, allocates capital, and incentivises its employees, all come down to culture.

It is the foundation upon which a company builds its strategies and operations. It influences how employees interact, decisions are made and how the company adapts to changes in the market.

A strong culture can foster innovation, creativity and resilience, enabling a company to adapt and thrive long-term.

Adaptability: The key to long-term success

Returning to a concept we discuss in more detail in The long view: lessons from evolutionary biology, geneticist Sewall Wright speaks of a ‘fitness landscape,’ which shows the likelihood of genetic variants continuing to survive and reproduce.

A company's fitness is relative to the industry in which it operates. Incumbents and new entrants mean the environment constantly changes, and companies must adapt to survive and thrive.

That leads to the core foundation of any great company culture and thus of the company itself, whether it is a steward, follower, or explorer: adaptability.

As companies mature, their growth rates can slow. To maintain consistent growth, companies must attend to their existing business while considering how to adapt and grow for the future.

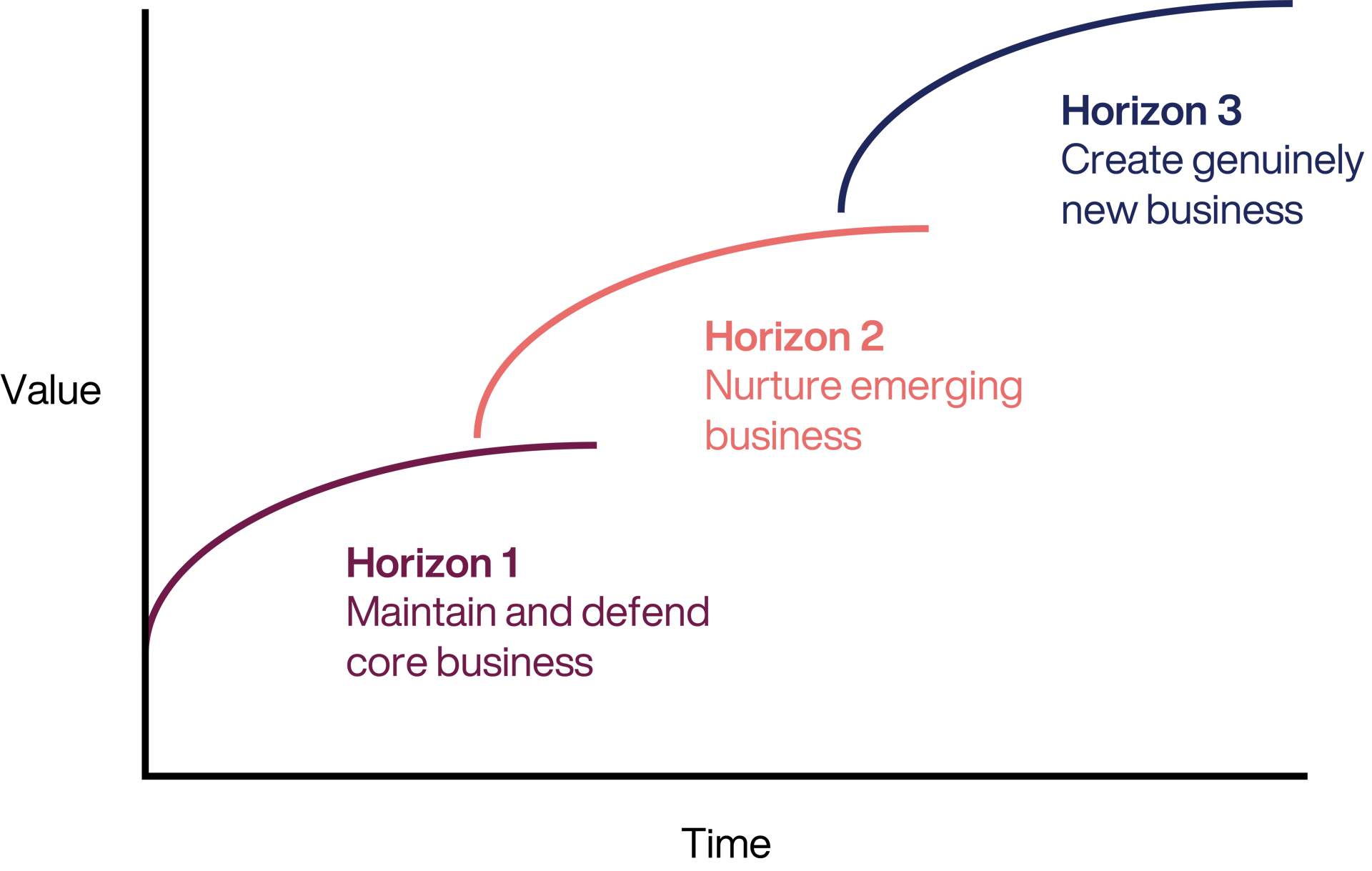

Management consultancy McKinsey's ‘Three Horizons of Growth’ framework helps conceptualise adaptability.

Horizon 1 focuses on the existing core business that currently delivers the most significant profitability or free cash flow levels and seeks to improve it and maximise its remaining value.

A classic example of this would be Amazon. From its origins as an online bookseller, it’s first jump was expanding its produce range and geographies within ecommerce.

Horizon 2 involves new business opportunities that leverage the existing business but usually require more time or significant investment to succeed.

Amazon’s next leap was the huge investments it made in logistics, its Prime delivery service and the introduction of white-label goods (Amazon-branded goods manufactured by third parties).

Horizon 3 is the long jumps that plant the seeds for businesses that don’t exist yet.

In Amazon’s case, this has taken it in new directions, including Amazon Web Services (AWS), Prime Video and advertising, among others. These services have taken a long time to build out and we are only in the early stages of revenue generation.

The McKinsey study demonstrated that successful growth companies invest in strategies spanning all three horizons, balancing short-term moves with long-term ambitions.

This makes sense. If you only ever make the same-sized leap, you lose the foundation of any great company: an adaptable culture nimble enough to make any-sized leap.

Scaffolding

Borrowing from another biological concept, companies need the right ‘scaffolding’ to foster adaptability and enable them to flex their jump size.

Scaffolding refers to the core processes that support an organism, or in this case, an organisation, in trying new things while ensuring it retains its core purpose.

Management teams are responsible for choosing and maintaining this scaffolding, which defines what the company can and cannot do.

So, how does scaffolding relate to a company’s culture? It is scaffolding that gives me insight into a business’s cultural DNA and how it may deal with situations or make decisions in the future.

Therefore, I’m interested in the company’s vision. This is the overarching ‘foundational culture’, which develops over time from its chief executive or founder's deeply held beliefs and life experiences.

The second aspect of culture defines the problem you seek to solve, how you approach it, and how the big decisions are made within the organisation. This is the ‘created culture’.

While the company’s foundational culture influences this, it is more specific to the task or time. Created culture is how you come together as a team, incentivise your employees, and, most importantly, how employees act when a management team is not directly supervising them.

While the foundational culture is slow to change, the created culture is much nimbler. It adapts and evolves to help a company unlock its long-run ambitions.

Much as a management team might like to, it cannot directly control how the culture manifests. Instead, it must establish the scaffolding and cultural guiderails that ensure what it believes are the core tenants permeate the organisation.

Cultural foundations

Netflix is known for its high-performance scaffolding. It describes itself as a sports team, not a family, emphasising the importance of having ‘the right person in the right role at the right time.’

Managers regularly use a ‘keeper test’ to evaluate employees – “If anyone in my team were to say they were leaving tomorrow, how hard would I fight to keep them?” – and adequate performance results in a generous severance package.

This high-performance culture distils into the company’s created culture. Staff give one another regular and frank feedback.

Because the cultural guiderails are well understood, the company has been able to adopt a context-over-controls approach. For example, Netflix does not track employees' vacation days, and employees can take unlimited vacation time.

Closer to home, Baillie Gifford’s foundational culture is centred on long-termism.

We emphasise the importance of long-term thinking, from our partnership structure to our investment strategies. This culture enables us to make investments that may not pay off immediately but have the potential for significant long-term returns.

Evaluating culture in investment decisions

When evaluating a company's culture, investors should consider its effectiveness. A simple formula can help: alignment of motivation, the timescale of ambition and its ability to execute.

Intrinsic motivation, where the management team is driven to solve long-term problems, creates alignment with investors' time horizons.

The scale of ambition indicates whether the management team wants to build a big business, and the ability to execute reflects the chief executive's and their team's skill set.

Culture is a critical factor in investment decisions. It shapes how a company operates, adapts and grows.

By understanding and evaluating a company's culture, investors can gain valuable insights and make more informed decisions. Culture matters, and it can be a significant source of competitive advantage.

Listen to the summary

This audio is generated using AI

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in March 2025 and has not been updated subsequently. It represents views held at the time of writing and may not reflect current thinking.

Potential for profit and loss

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited 柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司(‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 licence from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

142708 10053737