Illustrations by Mark Smith

As with any investment, your capital is at risk.

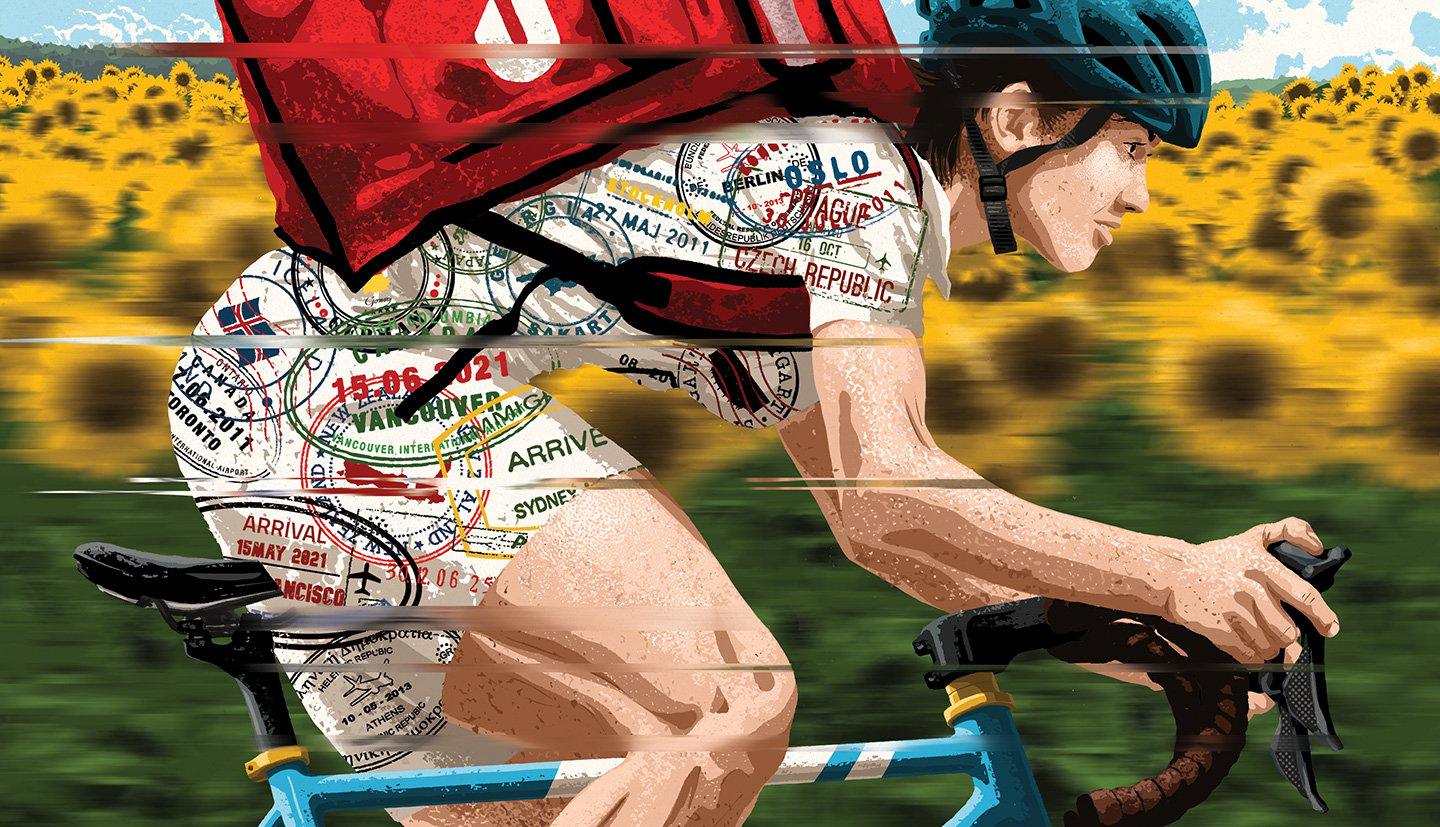

Food-delivery powerhouse DoorDash has already processed nine billion orders, but the vast scale it achieved over its first decade may only be the appetiser.

The San Francisco-based company isn’t a household name in the UK, but its app dominates restaurant takeaway deliveries in the US, accounting for more than two-thirds of the market.

And thanks to a combination of organic growth and the 2022 takeover of Wolt, a Finnish counterpart, the firm is active in 33 other countries, from Australia to Azerbaijan.

Beyond hot food, DoorDash has expanded into groceries, alcoholic drinks and flowers, among other items, and shows related ads in its search results and elsewhere. But to consider the company a hybrid food-and-convenience delivery service is to miss the bigger opportunity.

DoorDash’s long-term mission is to:

- let customers buy nearly anything they want and get it delivered within 20 minutes for about a $5 surcharge

- empower all local brick-and-mortar merchants

- grow local economies

Quite what that would look like is hard to articulate because such a company doesn’t yet exist. But what’s clear is that the ambition is huge, and the company is sweating the smallest of details to achieve it.

In search of an idea

DoorDash traces its origins to 2012 when four Stanford University students were in search of a start-up idea. They knew they wanted to provide a software-based service to small business owners. So they walked into local retailers to ask about the challenges they were facing.

During one conversation in a macaroon shop, the owner started flicking through her order book, and the students spied ‘cancelled’ scribbled next to dozens of the prospective purchases.

Asked why, the owner said she’d sought to expand by offering home deliveries but had struggled to find enough drivers.

Having struck on the idea of delivery-as-a-service, the group tested the concept by creating a website. They uploaded menus from 10 nearby restaurants without consulting them and offered to buy and deliver customers’ orders for a small top-up fee.

Within two hours of PaloAltoDelivery.com going live, the first order came in. And as its popularity grew over the following days, what began as a test laid the foundations of a multi-billion-dollar business.

Today, the firm relies on gig workers, who it calls ‘dashers’, to pick up and drop off orders. And it offers customers unlimited free deliveries and reduced service fees for a monthly DashPass subscription.

Fixation on detail

Of course, DoorDash wasn’t the only one to spot this gap in the market. Uber Eats, Grubhub, Instacart and Deliveroo all compete in a similar space. So what makes DoorDash stand out?

I’d point to three factors. Firstly, while DoorDash is a data-driven business like its challengers, it is also fanatical about operating at the lowest level of detail and obsessing about what it’s missing.

For example, co-founder and chief executive Tony Xu regularly attends the firm’s ‘disaster delivery review’ meetings, looking back at the worst experiences of the past week.

He warns that one bad order might cost the firm a few hundred dollars in refunds, but if a high-spending customer is annoyed, their lost future purchases won’t show up in the numbers.

To address this, DoorDash lets its customers approve potential item swaps in advance and request that dashers text or call them to suggest in-stock alternatives.

Additionally, the firm is working with its third-party store partners to help them better understand what products are available on what shelves at any given time.

This is far from a solved problem, but DoorDash has already become the largest digital partner of two of the US’s eight largest grocers and has a clear roadmap for improving its offering.

Moreover, the category benefits its wider business. Not only has listing groceries helped attract new customers, but DoorDash has found that those shopping across multiple categories tend to spend more, to order more frequently and to be more likely to stick with its platform.

All this isn’t to say that DoorDash doesn’t face challenges. Drones and delivery robots could pose an existential threat to its business in the decades ahead.

But the firm is trialling its own drone delivery service in collaboration with Google’s sister company Wing in Australia and the US, and this could be a lever to further growth.

In the nearer term, the biggest hurdle is likely to be the complexity involved in offering an ever-increasing range of items from a growing number of merchants across a rising number of territories.

However, by focusing intently on improving everyone’s experience in its ecosystem and tirelessly enhancing its own efficiency, DoorDash has a better chance of succeeding than any rival.

Meals on wheels

Takeaways are ancient history. Rome’s thermopolia were antiquity’s fast-food joints, while Korean home deliveries of cold buckwheat noodles date back to the 1700s.

But DoorDash and its competitors draw more directly from the early days of the web. Pizza Hut pioneered electronic orders with its PizzaNet delivery service in 1994. And a year later, World Wide Waiter offered items from a selection of 60 Silicon Valley restaurant menus.

Mobiles made it easier to place orders on the move. In 2008, China’s Ele.me (meaning ‘are you hungry?’) targeted students with a handset-centric service, and Grubhub launched a US iPhone app in 2009. However, smartphones weren’t all that spurred demand.

The normalisation of the gig economy played a major role, allowing operators to build up large delivery networks without hiring a massive workforce. In addition, ever-advancing machine learning algorithms, GPS mapping and payment tools helped assign orders, speed deliveries and smooth online sales.

More adventurous palates and the birth of ‘ghost kitchens’ – food businesses often operating under multiple brands that solely serve the online platforms – have helped expand choices. Covid lockdowns also rocket-boosted the shift in consumer behaviour towards regular food and grocery drop-offs. The result: a rare treat has become almost an everyday event for some households.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

China

Baillie Gifford Investment Management (Shanghai) Limited

柏基投资管理(上海)有限公司(‘BGIMS’) is wholly owned by Baillie Gifford Overseas Limited and may provide investment research to the Baillie Gifford Group pursuant to applicable laws. BGIMS is incorporated in Shanghai in the People’s Republic of China (‘PRC’) as a wholly foreign-owned limited liability company with a unified social credit code of 91310000MA1FL6KQ30. BGIMS is a registered Private Fund Manager with the Asset Management Association of China (‘AMAC’) and manages private security investment fund in the PRC, with a registration code of P1071226.

Baillie Gifford Overseas Investment Fund Management (Shanghai) Limited

柏基海外投资基金管理(上海)有限公司 (‘BGQS’) is a wholly owned subsidiary of BGIMS incorporated in Shanghai as a limited liability company with its unified social credit code of 91310000MA1FL7JFXQ. BGQS is a registered Private Fund Manager with AMAC with a registration code of P1071708. BGQS has been approved by Shanghai Municipal Financial Regulatory Bureau for the Qualified Domestic Limited Partners (QDLP) Pilot Program, under which it may raise funds from PRC investors for making overseas investments.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited

柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755–1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia(Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

142522 10053676