Capital at risk

Responsible Global Alpha

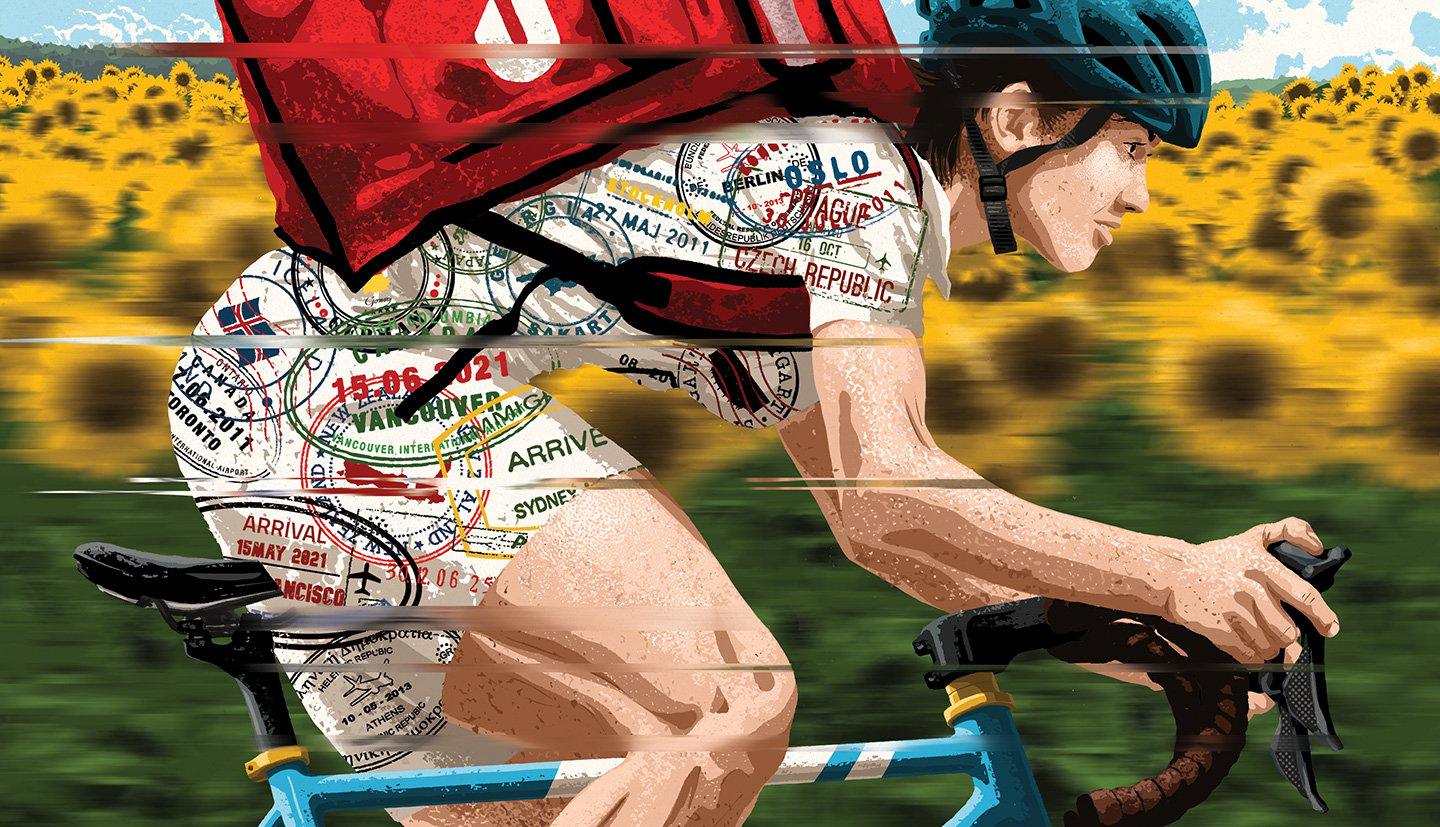

Our core task is the patient, engaged ownership of responsible companies with the potential to deliver superior but underappreciated earnings growth.

A diverse range of responsible companies

An ambitious approach to investing in responsible growth companies from right across the spectrum of opportunity. We are flexible in seeking these opportunities, recognising the valuable diversity of ways in which growth can be achieved.

Global Alpha: our philosophy

Investment manager Helen Xiong introduces Global Alpha, reflecting on the exciting opportunities ahead.

A truly global portfolio

We aim to identify companies which can grow their earnings at a superior rate to the market over sustained periods, where this potential is not reflected in the price.

As share prices are ultimately driven by earnings growth, this approach underpins our objective to deliver returns 2 to 3 per cent per annum ahead of the benchmark over rolling five-year periods before the deduction of fees. The strategy also excludes investment in companies which fail to meet our criteria for responsible behaviour.

Our research draws on the work and insights of the entire Baillie Gifford investment floor.

Attractive opportunities from across the spectrum

Our philosophy is to invest long-term in well-managed businesses with sustainable competitive advantages. We embrace diversity, splitting the portfolio of around 90 holdings across our three growth profiles:

Compounders aim to exploit the power of earnings compounding. Disruptors seek to identify early-stage firms with explosive potential. Capital allocators back skilled management teams, often in cyclical industries.

At the heart of Global Alpha’s patient approach to long-term capital growth lies our belief in diversity. We don’t rely on a single definition of what ‘growth’ means.

Meet the managers

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 March 2025

| # | Company | Fund % |

|---|---|---|

| 1 | Meta Platforms Inc | 4.4% |

| 2 | Amazon.com | 4.0% |

| 3 | Microsoft | 3.9% |

| 4 | Prosus N.V. | 3.7% |

| 5 | NVIDIA | 3.6% |

| 6 | TSMC | 3.1% |

| 7 | Doordash Inc | 3.0% |

| 8 | Elevance Health Inc | 2.9% |

| 9 | Mastercard | 2.6% |

| 10 | Service Corp.Intl. | 2.5% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q1 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

DoorDash: delivering the goods

How DoorDash’s ambitions extend far beyond restaurant deliveries.

Global Alpha Insights: investing in resilience beyond political cycles

Why the Global Alpha Team believes elections don't impact stock market returns.

Global Alpha Q4 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha Q4 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: Rakuten and the 'Dog Shogun'

Richie Vernon, investment specialist, explains why the Global Alpha Team has a different perspective on Rakuten's future market growth.

Global Alpha Q3 investor letter

The Global Alpha Team reflects on recent performance, portfolio changes and market developments

Why growth investors can’t ignore China

China’s electric car, battery and other advanced manufacturers are on the rise.

Global Alpha Q3 update

The Global Alpha Team reflects on recent performance, portfolio changes and market developments.

Global Alpha insights: unlocking the magic of Disney

Why the Global Alpha Team believes there is a magical journey ahead for Disney.

Future Stocks: Our best ideas in the US

Ben James explains why DoorDash, The Trade Desk and CoStar stand out as growth stocks.

Eric Beinhocker: evolutionary economist

How successful companies harness the power of adaptation.

Beyond NVIDIA: investing in semiconductors

Why some of the leading computer chip makers and companies enabling them have room to grow.

China: the new shoots of growth

Why advanced manufacturing and social context are key to investing in tomorrow’s Chinese giants.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

The information provided does not constitute an offer of or solicitation for purchase or sale of securities or provision of any investment services. Baillie Gifford does not currently have any funds that offer securities under a simplified prospectus for general offer or sale within Canada. No securities regulatory authority in Canada has reviewed or in any way passed upon this website or the merits of any investment available, and any representation to the contrary is an offence.

Persons resident or domiciled in Canada should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to trade.

You can read details of our Legal and Important Information here.

Trade Matching Statement

This Trade-Matching Statement is being provided in accordance with National Instrument 24-101 -"Institutional Trade Matching and Settlement" and Companion Policy 24-101 CP (the "National

Instrument"). It applies to all trades that are subject to the National Instrument. View the whole statement.