Key points

The Global Alpha Team shares insights on Q1 2025, covering the strategy's recent performance, portfolio adjustments, and market influences.

Your capital is at risk.

Frequency, unambiguity, novelty and negativity are the factors that drive headlines. Fast-developing events are more likely to be reported. Balance is unhelpful and boring, and nuance is complex, so news usually swings from one position to the other depending on where the weight of opinion lands in the moment. Bad news sells better than good news, and in a world of the 24-hour news cycle, speed matters. People are built to worry.

We’ve often been drawn to experiments that look at the effect of reducing the frequency of the news. A publication produced every twenty years would present a very different commentary on what had happened since the last edition. It would surely note China’s rise, perhaps pointing out that its share of global GDP has leapt from under 5% in 2005 to approximately 17% today. It might point out that the USA has retained a similar share throughout, helped by continued technology innovation. It could note the proportion of the world’s population living in extreme poverty has fallen from 29% to 8% , or that CO2 emissions have fallen by 30% per person in the US and are broadly flat globally on the same measure.

Most of the individual headlines pointing one way or the other would have largely cancelled one another out, with a few trends emerging from the back and forth. This underpins our focus on identifying only the emerging important trends and filtering out the associated noise. We have constructed the Global Alpha portfolio so that it can prosper across a wide range of scenarios while positioning it for where we think the biggest shifts in society are likely to take us.

We agree that two of the most reported trends today, the emergence of AI and changing global politics, are among the most important considerations for investors in the years ahead. Our five-year time horizon provides a different perspective, and our stock-picking approach means that we express our views selectively and only where the returns look to be substantially skewed in our client’s favour. Our reward-seeking approach means that we will remain open-minded in casting our net widely in our hunt for companies with the potential to meet our ‘2x in five years’ return hurdle, but our Research Agenda will focus on these two topics and some of the most important strands that extend from them. We will publish it as a series of articles this year that chart our progress.

Responding to the environment

Performance finished behind the MSCI ACWI benchmark in a quarter that saw lots of price movement net out to a broadly neutral outcome in US dollars, and a fall in many other currencies. Increasing question marks about the impact of US economic policy, led to rising caution from investors in US markets in particular, with the S&P 500 falling by more than 5% over the quarter. Rather than focus on trying to divine the future through reading these macro tea leaves, we remain focussed on company fundamentals and taking advantage of the volatility for long-term benefit. We have added more new holdings than usual to the portfolio on the strength of ideas that we have found amidst a wide spread of valuations. Some link directly into these two large topics, while others are deliberately uncorrelated. In a time of relatively narrow stock market focus, we’re building a wide base for growth in your portfolio.

Dispersion in stock market valuations has given us the chance to take money out of successful technology businesses including Netflix, Shopify, The Trade Desk and Mercado Libre and redeploy that into different opportunities. We have moved on completely from two great businesses, Analog Devices and Schibsted, where the valuation more than reflected our enthusiasm. Finally, we sold two others that appeared to have been left behind by change. The Japanese cosmetics business Shiseido seems to be falling out of relevance with its customers, and the lithium producer Albemarle no longer has the hold on supply that we hoped it would retain.

Broadening Artificial Intelligence Beneficiaries

Turning to our first major structural trend, AI, we’re finding ideas at both ends of the AI value chain in our search for great return opportunities. Producing the chips that will power the next generation of computing is a complicated process that requires astonishing levels of precision. This has created a web of materials businesses, equipment manufacturers and fabricators that spans the globe. Looking beyond the headlines of a fragmenting global trade backdrop, we expect pockets of global expertise to persist in this highly specialist area. As a result, we have taken a new holding in the Japanese business, Disco, a manufacturer of dicing, grinding and polishing machines used in the manufacture of semiconductor chips. With a level of precision equivalent to being able to splice a human hair into more than 30 strands, Disco’s machines enable the intricate geometry essential for the manufacture of the most advanced, 3-dimensional, chip architectures.

At the opposite end of the spectrum, we’re finding more companies that are using AI in applications that materially improve their business. During the quarter we took new holdings in the payroll software business Paycom, the advertising platform AppLovin and the customer relationship software business Salesforce. Salesforce is using AI to develop digital assistants that promise to automate large parts of customer relationship roles. Its Agentforce offering is gaining traction and Salesforce can deploy it at a scale and pace that others will struggle to match.

These new holdings have extended our exposure to companies in the AI value chain, which accounts for over a quarter of the portfolio. These range from the technology giants NVIDIA, Microsoft and Amazon to more specialised operators of critical enabling technology and companies that deliver AI-enabled applications to end customers.

Long-term investing in a changing world

While continued advances in AI appear relatively predictable on a long-term time horizon, future geopolitical change seems less foreseeable.

Understanding this important but unpredictable trend requires a multi-layered approach. We assess how different environments are likely to influence holdings, consider thematic concentrations in the portfolio and direct our research to where change looks most meaningful. We aim to construct a portfolio that is advantaged across a wide range of possible outcomes. We have the luxury of being able to view the world from several different vantage points. The world may look like it is deglobalizing from Washington or Berlin, but it doesn’t feel the same from Rio or Mumbai. Perspective matters.

Only a quarter of the USA’s GDP relies on trade, making it far more inward-looking than the rest of the world (the global average is more like 60%). The apparent economic license to experiment with tariffs in the near term comes with trade-offs attached, including the impact of perceived instability. Much has been made of the US trade deficit in goods, but less of the trade surplus in services. The nuance matters. Companies and industries will face radically different dynamics. Some companies will carry on unaffected. New regional champions could spring up in freshly protected competitive environments. We are testing the portfolio against the following hypothesis:

Trade tariffs will be an enduring feature and trade friction with the US in both directions will increase on a timeline that stretches beyond Donald Trump’s time in office.

We have already made changes to the portfolio that reflect our developing thinking. Through our trading so far this year, we have selectively reduced the portfolios US exposure. US companies have benefited from a stable geopolitical and policy environment, but we have questioned the sustainability of a US valuation premium on this basis. We had previously sold holdings that depend on low friction in cross-border trade for profitable growth. Examples include Estee Lauder, Pernod Ricard and Adidas.

At the same time, we are finding individual opportunities that look well-set for growth, scoring well against the criteria below and helping position the portfolio for a changing world.

Insensitivity to the political backdrop

An obvious way to control for political uncertainty is to seek out holdings that can make progress in most scenarios. We already own several great growth holdings that operate primarily in a single market in a single country or region, where the deciding factor will be their ability to attract substantial market share. As well as providing attractive individual return potential, these companies tend to dampen down political risk in the portfolio over a long-enough time frame.

Nubank, the Brazilian online bank and a new purchase during the quarter, will certainly be affected by the health of the Brazilian economy, and the other Latin American economies it operates in, but most of its growth depends on attracting customers to its network and expanding the range of financial services it provides. It has a huge cost advantage over the incumbents and we expect it to grow substantially in the coming years.

More broadly, reversing globalisation could create a larger population of regional businesses with winners in each area. Over the past couple of years, we have already carefully repositioned our Chinese holdings in the portfolio in this light. Our holdings in businesses such as the Latin American retail platform Mercado Libre, the Asian-based e-commerce businesses SEA and Coupang and UK housebuilder Bellway align well with long-term demand trends and a strong domestic or regional focus.

This feature is also evident in our US facing consumer holdings, which depend primarily on new and more efficient ways to reach the consumer (via technology infrastructure and advertising innovation) as well as improving customer experiences. Broader sentiment may at times speed or slow growth for these holdings, but our return potential from this important part of the portfolio depends mostly on where consumers are going, not how much they are spending overall.

Adaptability

Another way to control for political change is to hold companies with fantastic management teams and inherently flexible businesses. The best companies have a wonderful knack for adjusting to the environment they operate in while maintaining ambition. Several positions in the portfolio have navigated generations of challenge, from the likes of Mastercard and S&P Global in the US to the Swedish industrial compressor business Atlas Copco.

Adaptability is expressed in business models, as well as management, as is the case with new holding in Uber. Having successfully navigated the birth of the ride-hailing industry and the development of regulatory frameworks around the world, Uber has now matured into the dominant player in the on-demand transportation market. Uber’s flywheel (where greater demand attracts more drivers, which increases coverage and leads to faster pick-ups and lower prices, which in turn attracts more demand to the platform) leaves it exceptionally well placed to navigate future transformations such as the deployment of autonomous vehicles. The company also continues to invest in newer areas such as freight, logistics, advertising and rentals, all while generating increasing amounts of free cash.

Leaning into uncertainty

Shaky sentiment towards durable trends can provide us with great opportunities to establish new positions. Our new holding in Enphase Energy, which makes equipment for residential solar energy systems, is one example. The political concerns are domestic rather than international in this instance. Enphase’s share price has tumbled on worries about the impact of changing government policy towards renewable energy generation. We think that economic arguments for solar electricity generation to roll out across the USA are strong and Enphase is poised to play a key role in this move.

More widely, we remain enthused about the prospects for profitable growth driven by a US infrastructure upgrade. The rate of decay of existing infrastructure means that Americans will demand improvement. Reshoring will require stronger infrastructure to support rising industrial activity. Technology leadership will depend on the buildout of new essentials attached to data storage, processing and transmission. This leads us to a more specific hypothesis within the US:

US infrastructure spending will survive amendments to the policies of previous administrations.

We have built up a cluster of holdings in companies with strong positions in supply-constrained industries. Utility poles and plastic pipes, already owned in the portfolio via Stella-Jones and Advanced Drainage Systems, might not usually set the pulses of growth investors racing. Our willingness to go looking in unfashionable places plays to our advantages.

These features are behind our new holding in WillScot, a provider of temporary site offices and storage facilities that has amassed a 50% share of modular space through repeated acquisitions. Commercial projects need site services and WillScot is the clear scale provider. A recent acquisition failure cast a cloud over the share price. We viewed this as a great entry point rather than something to worry about and have taken the chance to bring it into the portfolio.

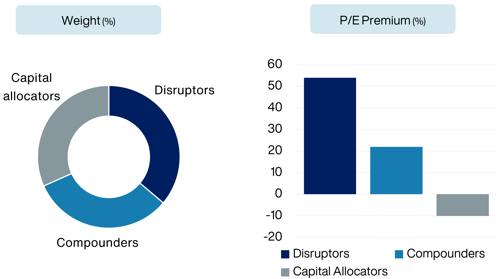

The outcome

The portfolio remains well-balanced across the three growth profiles. We reduced positions where valuation rises have eaten into the upside from here. This has provided us with space to bring new thinking into the portfolio that plays into the most important investment trends of the next several years and provides you with more ways to win.

Source: Baillie Gifford & Co, Factset. Based on a representative portfolio. As at 31 March 2025.

Overall, the portfolio trades at a modest premium to the index while delivering much more, and more varied, growth potential. We are willing to pay up where the scale of growth justifies it, primarily in our Disruptors holdings. Encouragingly we continue to unearth companies that trade at undemanding valuations where the longer-term implications of improving quality and demand growth appear to have been overlooked by the stock market.

We are challenging ourselves from the top down with thematic research and scenario testing and we will report on this in detail as 2025 unfolds. We expect these efforts to highlight yet more uncommon ideas for the portfolio.

We cannot predict exactly when markets will wake up to the attractions of these businesses. Nobody can. But, underpinned by the evident quality of the businesses we own, we have put the portfolio in the best possible position to benefit as the fundamentals are reflected in share prices.

This is a Global Alpha commentary. Not all stocks may be held, but themes of this commentary are also representative of: Responsible Global Alpha, Global Alpha Paris Aligned and Responsible Global Alpha Paris Aligned.

Annual past performance to 31 March each year (net%)

|

|

2021 |

2022 |

2023 |

2024 |

2025 |

|

Global Alpha Composite |

73.0 | -11.4 | -10.5 | 20.2 | -1.4 |

|

MSCI ACWI Index |

55.3 | 7.7 | -7.0 | 23.8 | 7.6 |

|

|

1 year |

5 years |

10 years |

|

Global Alpha Composite |

-1.4 | 10.2 | 8.1 |

|

MSCI ACWI Index |

7.6 | 15.7 | 9.4 |

Source: Revolution, MSCI. US dollars. Returns have been calculated by reducing the gross return by the highest annual management fee for the composite. 1 year figures are not annualised.

Past performance is not a guide to future returns.

Legal notice: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Risk factors

This communication was produced and approved in April 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

144727 10054069