Key points

- Living amid the silicon-driven ‘fourth industrial revolution’, we struggle to grasp the scale, speed and significance of what’s underway

- For Baillie Gifford International Growth and other investors, massive opportunities lie in the ability to spot the companies best positioned to benefit

- Firms such as TSMC and Advantest are providing the key components and ‘picks and shovels’ likely to be indispensable the chip revolution accelerates

Listen to this article

This audio is generated using AI

As with all investments, your capital is at risk

It was much harder to teach a computer to recognise a face than to beat a grandmaster at chess. Now we tut if the AI ‘eye’ on our smartphone doesn’t let us into our online bank in milliseconds – even from an awkward angle in a dimly lit room.

It’s a small example of how quickly we take for granted the astonishing and diverse achievements stemming from the silicon-based revolution we’re living through. Amid such rapid progress, we struggle to comprehend either its scale or its accelerating pace.

From powering the portals in our pockets, to the cloud, to automotive and other transport systems, to the internet-of-things networks that enable how we live, work and play, chip technology increasingly shapes the infrastructure of our lives.

For investors, opportunities lie in understanding this 'fourth industrial revolution'. That means thinking how the world could change and anticipating how the frontiers of chip design and manufacture, artificial intelligence and robotics will push ever forward. Further ahead, although already nearing its first commercial applications, is quantum computing. This technology exploits the quantum world’s ability to exist in more than one state at once to solve complex problems exponentially faster than classical computers.

For Baillie Gifford International Growth, our challenge is to identify the companies either innovating to drive change or benefiting from the strong tailwind of demand for compute – computational performance and functionality – and generative AI.

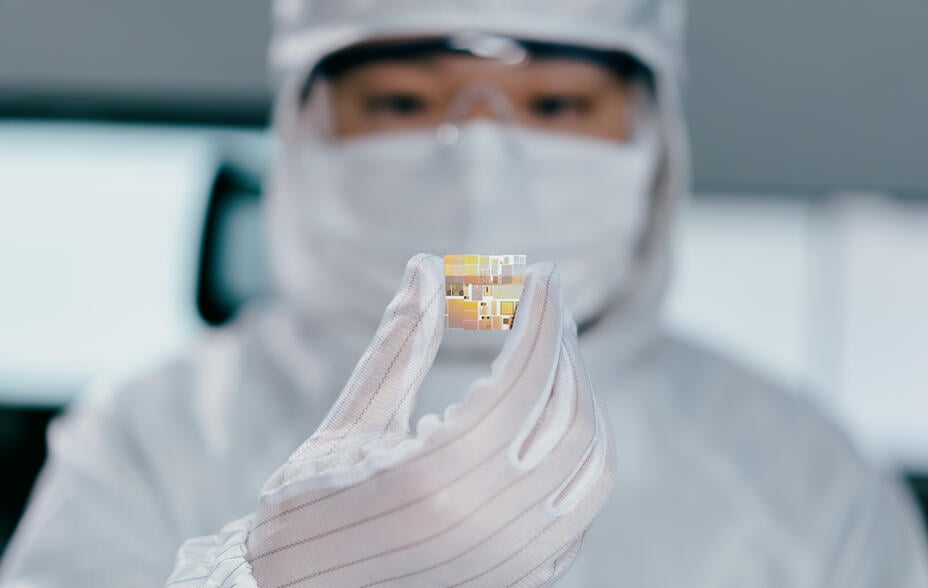

These are companies making themselves indispensable across broad fronts of innovation. They include TSMC, which manufactures the leading-edge advanced chips, and Advantest which tests most of them. These firms best exemplify the attractions of highly specialist businesses with dominant market shares and ‘sticky’ customers, operating in a tight-knit ecosystem where quality is paramount.

Growth from innovation

Figures bear that out. The global semiconductor industry reached $588bn in sales in 2024, a 13 per cent increase from 2023. The amount is expected to nearly double in the next five years, hitting $1tn in 2030.

This expansion is supported by massive investment in research and development (R&D) and in chip foundries. Since 2020, in the US alone, companies have announced nearly $450bn’s worth of manufacturing in over 90 projects spread across half the country’s states.

Much of the demand now is for AI. Long used in applications such as search, commercial and political data analysis, diagnostic medicine and voice/face recognition, AI became newly visible in 2022 through ChatGPT’s ‘generative’ large language model version.

Allowing computers to speak human as never before, it was a foretaste of AI’s potential to blur the boundary of the real and the virtual. It took us closer to a futuristic realm of voice-controlled driverless vehicles and safe co-working with robots on the factory floor.

Essential to these advances are technologies dominated by a handful of key companies. One such is ‘advanced packaging’, one of several led by TSMC. International Growth first invested in the Taiwanese company more than a decade ago. Now it’s the world's largest dedicated semiconductor foundry, manufacturing advanced chips and integrated circuits for Apple, NVIDIA, AMD and many others.

Advanced packaging is the technique of combining multiple chips in a single package, boosting output by packing in more processor, memory, and other components. It’s the technology that’s continuously slimming down your smartphone and allowing each year’s model to include a new set of features.

Homing in closer, a key subset of this advanced packaging is ‘3D stacking’, in which TSMC has invested heavily. It’s now so far ahead of competitors that we believe they will struggle to catch up.

This is an area of almost inconceivable miniaturisation, where progress is measured in fractions of the width of a human hair. It’s about shortening the connections between chips, reducing signal delays and cutting power consumption. TSMC’s 3D stacking goal, set for 2027, is to reduce connections already eleven times thinner than a sheet of paper, into something a third thinner than that.

This kind of capability, combined with commercial acumen, has given TSMC its competitive 'moat', allowing it to increase revenues by an average of 16 per cent per year-over-year in the last decade. In 2024, largely thanks to the increased demands of AI, that increase rose to 33 per cent. The firm expects AI-related products to contribute 15 per cent of total revenue this year, helped by poor performance from Intel, its main US would-be competitor.

Collaborating with Samsung, SK Hynix and others, TSMC is also active in another important area of today’s chip revolution, high-bandwidth memory (HBM). This is the turbocharging of the transfer of data within the chips themselves. It promises to transform established technologies such as video calls, virtual reality and simultaneous speech translation to a quality level that would probably startle us today but, like all such breakthroughs, will be taken for granted soon after.

All these advances are not just improving existing products but are enabling new categories of devices, from autonomous vehicles to augmented reality glasses. These will rely heavily on compact, high-performance chip packages to process vast amounts of data in real time.

Picks and shovels

If TSMC’s R&D programme, range of partnerships and sole focus on semiconductors has made it hard for rival manufacturers to compete, a more recent holding, Advantest, has done the same in testing.

The Tokyo-based company, which International Growth bought in 2024, now produces 58 per cent of the entire global market for semiconductor testing equipment, and exemplifies the ‘picks and shovels’ suppliers’ advantage in a chipmaking upsurge, having strong relationships with nearly all the major semiconductor manufacturers worldwide. It has developed a system that can rapidly analyse data from various stages of the testing process, helping chip manufacturers improve quality and streamline manufacturing.

Called the ACS Real-Time Data Infrastructure system, it acts like an intelligent quality control manager, processing information from multiple points in the chip-making process, helping manufacturers spot and solve problems faster and waste less.

Advantest’s customers tend to be sticky because the processes and expertise they establish during the lifetime of a client’s product are not easily transferrable to other testers.

Looking ahead

The silicon revolution shows no signs of slowing down. With governments worldwide investing in semiconductor manufacturing capabilities and research, we're seeing a fundamental shift in how technology is developed and implemented. Although the industry faces challenges, including talent shortages and geopolitical tensions, it continues to drive innovation across wide areas of modern life.

In other words, this is no ordinary technological advance. Like steam in the 18th century, petrochemicals and electricity in the 19th, and electronics and telecoms in the 20th, the chip age represents a fundamental transformation of our industrial and economic landscape. It promises to deliver smarter, more efficient, and more sustainable answers to the remaining stumbling blocks to human progress.

Risk factors

This communication was produced and approved in March 2025 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important Information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial Intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford.

Europe

Baillie Gifford Investment Management (Europe) Ltd (BGE) is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform Individual Portfolio Management activities. BGE provides investment management and advisory services to European (excluding UK) segregated clients. BGE has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. BGE is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission ('OSC'). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.

Singapore

Baillie Gifford Asia (Singapore) Private Limited is wholly owned by Baillie Gifford Overseas Limited and is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. Baillie Gifford Overseas Limited, as a foreign related corporation of Baillie Gifford Asia (Singapore) Private Limited, has entered into a cross-border business arrangement with Baillie Gifford Asia (Singapore) Private Limited, and shall be relying upon the exemption under regulation 4 of the Securities and Futures (Exemption for Cross-Border Arrangements) (Foreign Related Corporations) Regulations 2021 which enables both Baillie Gifford Overseas Limited and Baillie Gifford Asia (Singapore) Private Limited to market the full range of segregated mandate services to institutional investors and accredited investors in Singapore.

144101 10053795