Capital at risk

UK Core

The UK Equity Core Strategy invests in a collection of tremendously exciting UK businesses. Many may not be household names, but they are typically leaders in their fields with attractive competitive positions.

We pride ourselves on the strength of our relationships with companies and the level of corporate access and insight this affords us.

Investing in Britain’s best

The UK Equity Core Strategy invests for at least five years in a range of carefully selected, high-quality British businesses which we believe have the potential to deliver superior earnings growth.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Seeking out superior potential

We aim to outperform the FTSE All-Share Index by at least 1 per cent per annum over rolling five-year periods.

To achieve this, we aim to identify well-managed, high-quality growth companies which enjoy sustainable competitive advantages. We seek out businesses that have the potential to deliver superior earnings growth over many years and hold onto them long enough for their strengths to emerge as the dominant influence on share prices.

We also take stewardship seriously, meeting with management and boards regularly, voting thoughtfully at general meetings and advocating for change where needed.

A diverse blend of growth companies

The portfolio has between 45-65 holdings. Therefore, it looks different to the broader UK equity index and has a high active share.

This is because we believe that to add value over the long term, we need to take a differentiated approach.

Given this is a core portfolio, it has a diverse blend of exposure to different types of growth companies – some will grow very rapidly, others will compound over time. Though we can group our holdings into several exciting themes, we aim to have a broad exposure to all.

Meet the manager

Iain McCombie

Iain is the head of our UK Equity Team and lead manager of the UK Core Strategy. He is also the joint manager on our flagship Managed Strategy, which he has been involved in since 2000. Iain joined Baillie Gifford in 1994 and became a partner of the firm in 2005. He has previously spent time on the US Equities Team. Iain graduated MA in Accountancy from the University of Aberdeen and subsequently qualified as a Chartered Accountant.

Documents

Philosophy and process

Explore our investment philosophy and the processes around how the team constructs the portfolio.

Stewardship report

Find out about our conversations with portfolio companies, shareholder vote activity and consideration of environmental, social and governance matters.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 31 January 2025

| # | Holding | % of portfolio |

|---|---|---|

| 1 | AstraZeneca | 4.4% |

| 2 | Bunzl | 4.0% |

| 3 | RELX | 3.9% |

| 4 | Standard Chartered | 3.7% |

| 5 | Unilever | 3.6% |

| 6 | Just Group | 3.6% |

| 7 | Rio Tinto | 3.5% |

| 8 | Marks and Spencer Group | 3.5% |

| 9 | Legal & General | 3.3% |

| 10 | Auto Trader | 3.1% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Saving when sending abroad: a Wise move

With international payments a profitable afterthought for the banks, it’s been left to a newcomer to build the best way of moving money around the world.

Wise: Money Without Borders

Co-founder and CEO of digital payments platform Wise explains how a customer-centric approach is helping revolutionise global money movement.

UK Core Q3 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Stock story: Diploma

Iain McCombie explores Diploma's journey to distribution excellence

UK Core Q2 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Core Q1 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Ashtead: hiding in plain sight

This little-known equipment rental company is one of the UK’s most exciting growth stories.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

UK equities: growth on our doorstep

Our specialist approach is well-placed to take advantage of early-stage British businesses.

The case for UK equities

Baillie Gifford’s Iain McCombie discusses UK equities on Hymans Robertson’s investment podcast.

Joiners’ mate

Iain McCombie on how Howdens’ kitchens won the building trade’s trust.

UK Equity Core Q2 update

The UK Equity Core team reflects on recent performance, portfolio changes, and market developments.

UK equities: Home focus

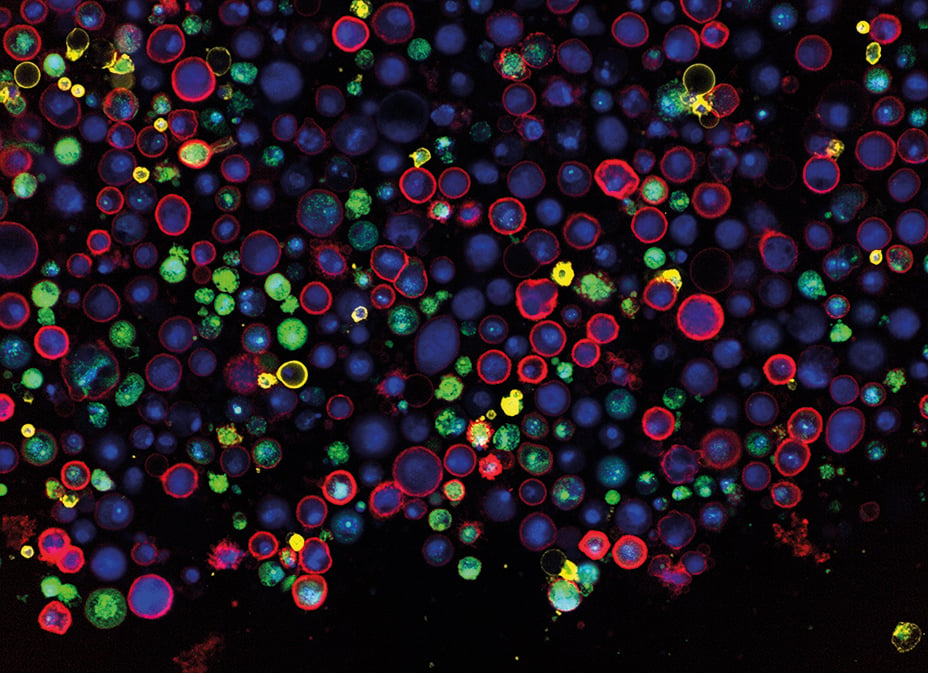

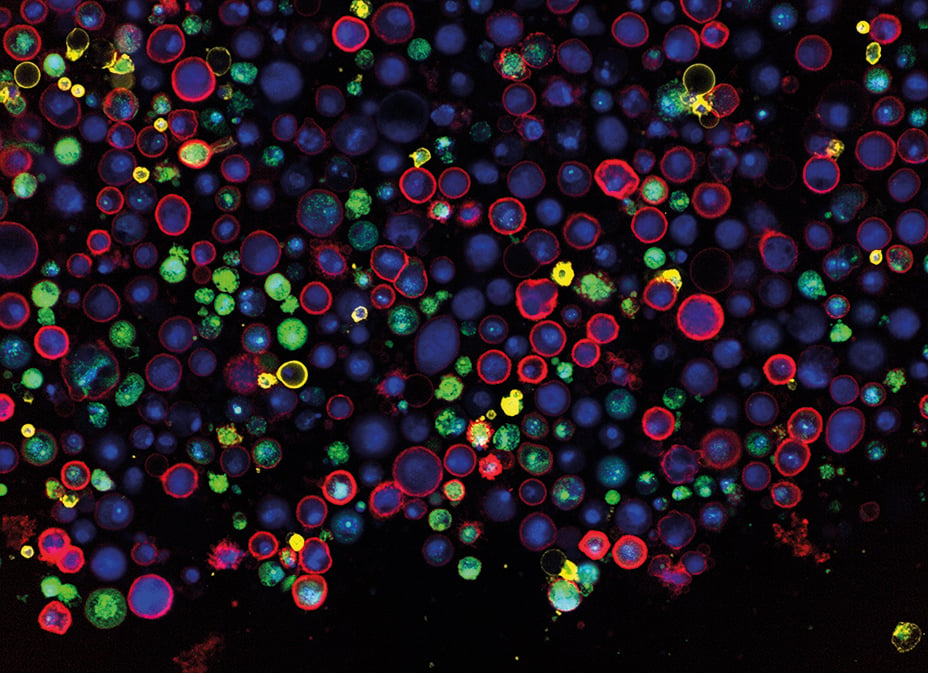

Companies solving big problems in healthcare, fintech and AI, are proving the UK is an exciting place to invest.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Saving when sending abroad: a Wise move

With international payments a profitable afterthought for the banks, it’s been left to a newcomer to build the best way of moving money around the world.

Wise: Money Without Borders

Co-founder and CEO of digital payments platform Wise explains how a customer-centric approach is helping revolutionise global money movement.

UK Core Q3 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Stock story: Diploma

Iain McCombie explores Diploma's journey to distribution excellence

UK Core Q2 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Core Q1 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

UK Core Q4 update

The UK Core Team reflects on recent performance, portfolio changes and market developments.

Ashtead: hiding in plain sight

This little-known equipment rental company is one of the UK’s most exciting growth stories.

Why growth, why now?

Tough times play to the partnership’s strengths: analysing what enables us to adapt and thrive amid rapid change.

UK equities: growth on our doorstep

Our specialist approach is well-placed to take advantage of early-stage British businesses.

The case for UK equities

Baillie Gifford’s Iain McCombie discusses UK equities on Hymans Robertson’s investment podcast.

Joiners’ mate

Iain McCombie on how Howdens’ kitchens won the building trade’s trust.

UK Equity Core Q2 update

The UK Equity Core team reflects on recent performance, portfolio changes, and market developments.

UK equities: Home focus

Companies solving big problems in healthcare, fintech and AI, are proving the UK is an exciting place to invest.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. The information in this area is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances should the information in this area be made available to “retail clients” as defined by the Corporations Act.

The information in this area contains general information only. It does not take into account any person’s objectives, financial situation or needs.