Capital at risk

Defensive Growth

We look to generate attractive returns over cash with low volatility, investing within a tight carbon budget in line with the Paris Agreement.

Our wide opportunity set and diverse asset mix allow us to create flexible portfolios prepared for different economic conditions.

Limiting carbon, not growth

We offer a breadth of opportunity across a diverse range of asset classes, aiming to deliver attractive returns with lower volatility than equity markets and within a decreasing carbon budget.

Multi Asset Q3 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Emphasising diversification

We seek to provide a diverse, actively managed portfolio with three equally weighted objectives of return, climate and risk.

We take a broad opportunity set and turn it into a single fund which offers clients an effective way to achieve diversification at lower volatility levels than equity markets.

Our objectives:

- a return of 3.5 per cent more than UK base rate over rolling five-year periods and a positive return over rolling three-year periods

- a carbon footprint maintained below a budget which declines at 7 per cent per annum

- volatility of returns below 10 per cent over rolling five-year periods

Looking to the future, not the past

We’ve been investing in multi-asset portfolios since 2009. We combine our macro views with themes that will drive markets in the long term to find the best opportunities.

We also ask, "is this investment compatible with a sustainable economy?" and apply our expertise to construct a portfolio that incorporates:

- macroeconomic views

- long-term return expectations

- risk and near-term scenario analysis

- a sustainability assessment framework

The result is a research-led portfolio that seeks to generate value for clients throughout economic cycles.

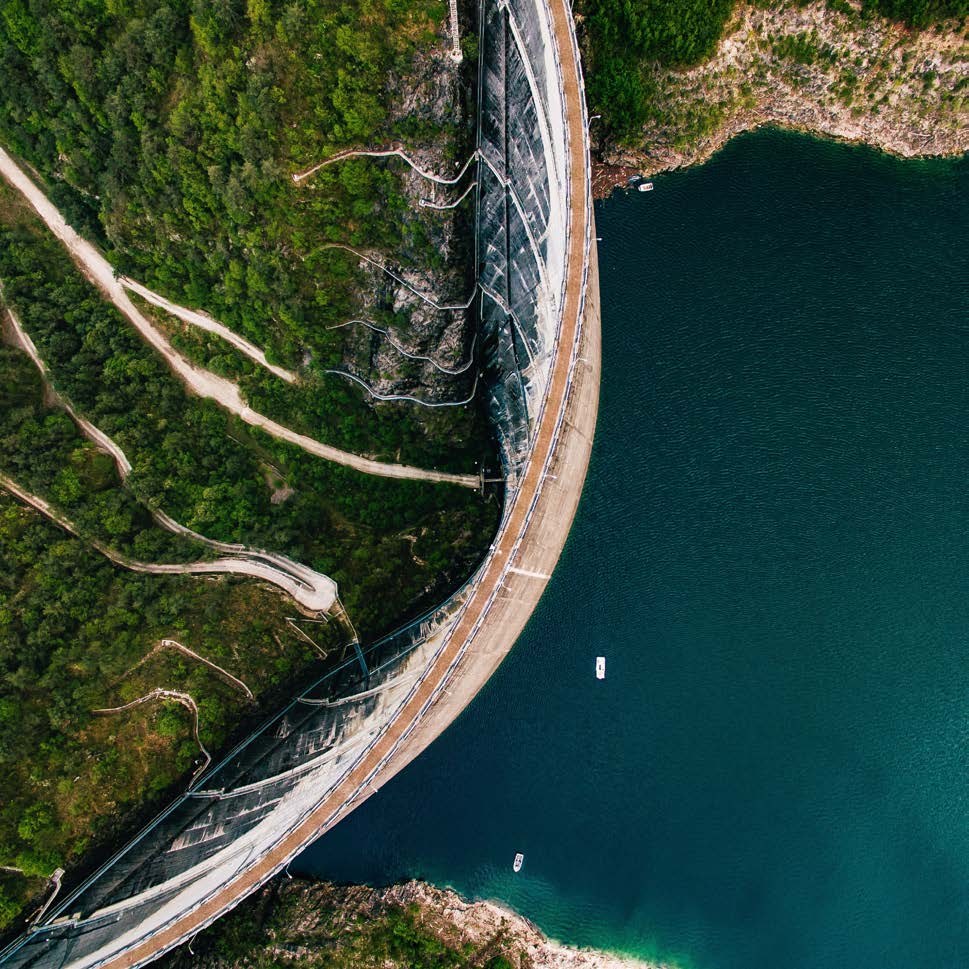

Change brings opportunities. Short-term changes can be as unpredictable as a river’s meander, but by focusing on long-term trends we think it’s possible to figure out the likely destination.

Meet the managers

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Strategy portfolio holdings

A list of the top 10 holdings that the representative portfolio invests in.

All figures up to: 30 November 2024

| # | Holding | % of portfolio |

|---|---|---|

| 1 | Australia 4.25% (Green Bond) 21/06/2034 | 5.0% |

| 2 | Blackrock GBP LEAF Fund | 4.7% |

| 3 | Citi/BG EM Equity ETN | 4.3% |

| 4 | Leadenhall UCITS ILS Fund | 3.3% |

| 5 | Baillie Gifford Responsible Global Equity Income Fund | 2.9% |

| 6 | 3i Infrastructure | 2.7% |

| 7 | Baillie Gifford Positive Change Fund | 2.7% |

| 8 | Galene Fund | 2.6% |

| 9 | Aegon ABS Opportunity Fund Acc | 2.5% |

| 10 | Citi/BG Value Equity ETN | 2.1% |

Please note

The information contained on this page is intended as a guide only and should not be relied upon when making investment decisions. All holdings information is unaudited. Source Baillie Gifford & Co. Please note that totals may not add due to rounding.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Insights

Key articles, videos and podcasts relating to the strategy:

Filters

Insights

The Plutus CLO Fund: seizing market opportunities

How leveraging opportunities in the European CLO market enhanced our structured finance solutions.

Too long to drive, too short to fly

Meet the rail company reshaping high-speed intercity travel across the US.

The clean energy election

Will the US election result affect investors in US renewables? Felix Amoako-Kwarteng finds out.

Multi Asset Q3 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The Climate Scenarios Project: part 2

The impact of Disorderly Transition scenarios on macro indicators and market outcomes.

The rate cut conundrum: Multi Asset’s LTRE

Insights on economic growth, inflation trends, and investment opportunities in bonds, equities, and more for the next decade.

Multi Asset Q2 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments.

The case for UK water investments

Uncover the resilient UK water companies showcasing their growth prospects in the face of regulatory and environmental hurdles.

Japan: the land of the rising yield

How Japan's changing economy is reshaping the Multi Asset investment landscape.

Multi Asset investment update

An update on performance, portfolio developments and where we see new opportunities.

Where are the opportunities?

The Multi Asset Team’s forecast for growth, bonds, equities and other assets over the decade.

Multi Asset investment update

An update on the portfolio, market environment and outlook for the year ahead.

Multi Asset: Investment process evolution

Focusing on the central pillars of our multi-asset investment process has sparked an evolution.

Multi Asset Q3 investment update

How is the portfolio adapting to risks and opportunities? Scott Lothian explains.

Multi Asset quarterly update

James Squires reflects on the current environment influencing Multi Asset portfolios.

Why now for multi-asset investing

Who benefits from the new macro environment? Why multi-asset investing remains a viable option.

Multi Asset quarterly update

Scott Lothian explains how Multi Asset is riding out the ups and downs of market volatility.

Productivity’s slowdown unravelled

Casting fresh light on why productivity growth lost steam and why it might be about to pick up.

Why excess global savings matter

The savings surplus affects companies that want to issue financial assets to fund investment.

The robots are coming

Robots won’t take all our jobs, but they will affect labour markets and, with them, inflation.

The inflation debate

A temporary blip or a structural shift? The Multi Asset Team debates inflation’s ups and downs.

The productivity surge of the 2020s

Are the days of productivity growth over? The Multi Asset Team does not think so.

Multi Asset Q3 update

The Multi Asset Team reflects on recent performance, portfolio changes and market developments over the last quarter.

Explore further

Curious to learn more about our products and what we can offer you? Please get in touch.

Important information

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. The information in this area is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances should the information in this area be made available to “retail clients” as defined by the Corporations Act.

The information in this area contains general information only. It does not take into account any person’s objectives, financial situation or needs.