Overview

The Worldwide Long Term Global Growth Fund aims to provide strong returns over the long term by investing primarily in a concentrated, unconstrained global equity portfolio.

Performance & Portfolio

Select currencyCumulative PerformanceRebased to 100 at the start date of this chart.

B Acc USD share class launched on 10 August 2016.

Past performance is not a guide to future returns. The value of your investment may go down as well as up, and you may not get back the amount you invested.

Baillie Gifford operates a single swinging price for the Fund and, therefore, may apply a dilution adjustment to the price to protect long-term investors from the costs associated with buying and selling underlying investments that result from other investors joining or leaving the Fund. This adjustment will affect relative performance, either positively or negatively.

Share class performance converted to chosen currency.

Source: Baillie Gifford & Co, BBH, Revolution, relevant underlying index provider.

Top Ten Holdings - 31/03/2025

Fund % 1 Amazon.com 6.5% 2 Netflix 4.5% 3 NVIDIA 4.4% 4 Spotify 4.1% 5 Meituan 4.1% 6 PDD Holdings 3.9% 7 Sea Limited 3.9% 8 Shopify 3.6% 9 Tencent 3.5% 10 Cloudflare 3.4% Total 41.7% Regional analysis of total assets 31/03/2025Fund %

- 1 North America 47.37

- 2 Emerging Markets 34.22

- 3 Europe (ex UK) 15.78

- 4 Cash 2.63

- Total 100.00

Geographic analysis of total assets 31/03/2025Fund %

- 1 United States 43.81

- 2 China 17.99

- 3 Netherlands 6.39

- 4 Brazil 5.72

- 5 Sweden 4.14

- 6 Singapore 3.86

- 7 Canada 3.57

- 8 South Korea 2.75

- 9 Taiwan 2.39

- 10 France 2.12

- 11 Others 4.65

- 12 Cash 2.63

- Total 100.00

Sector analysis of total assets 31/03/2025Fund %

- 1 Information Technology 30.21

- 2 Consumer Discretionary 26.77

- 3 Communication Services 20.36

- 4 Health Care 8.43

- 5 Financials 5.78

- 6 Consumer Staples 3.14

- 7 Industrials 2.66

- 8 Cash 2.63

- Total 100.00

Totals may not sum due to rounding.

As well as cash in the bank, this balance includes unsettled cash flows arising from both shareholder flows and outstanding trades. Therefore, a negative balance may arise from timing differences between shareholder flows and security trading and does not necessarily represent a bank overdraft.

Insights

View all InsightsHow to Invest

You can invest in a range of our funds via a number of fund platforms and supermarkets. Certain share classes are available for investment via a number of platforms. Please see the links opposite.

Baillie Gifford does not sponsor, maintain or have any control over the content of any other websites.

Therefore, we are not responsible for the adequacy or accuracy of any of the information you may view, nor do we undertake to ensure successful transmission to any linked website.

How to Invest

Professional Investor Enquiries

For further information on the funds, including availability and investment options, please contact our local distributor Volcom Capital.

Professional Investor Enquiries

Mark Urquhart

Mark is head of the Long Term Global Growth Team, which he co-founded in 2003. He joined Baillie Gifford in 1996 and became a partner of the firm in 2004. Prior to his current roles, he worked in the US, UK and Japanese equity teams. Mark graduated BA in Philosophy, Politics and Economics from the University of Oxford in 1992 and spent a year at Harvard as a Kennedy Scholar in 1993 before completing a PhD in Politics at the University of Edinburgh in 1996.

John MacDougall

John is an investment manager and decision maker in the Long Term Global Growth Team. He is also a member of the Discovery Portfolio Construction Group (PCG). John joined Baillie Gifford in 2000 and became a partner of the firm in 2016. Prior to his current roles, he worked in the North American, Japan and Global Discovery teams. John graduated MA in Ancient & Modern History from the University of Oxford in 2000 and is a CFA Charterholder.

Michael Pye

Michael is an investment manager in the Long Term Global Growth Team. He joined Baillie Gifford in 2013. He is also a CFA Charterholder. Michael graduated MA in Classics from the University of Cambridge in 2007 and gained a PhD in International Relations from the University of St Andrews in 2013.

Gemma Barkhuizen

Gemma is an investment manager and decision maker in the Long Term Global Growth Team and co-manager of the Global Outliers Strategy. She is also an advisor to Global Alpha. Gemma joined Baillie Gifford in September 2017, after graduating with a Masters degree in Modern History from Durham University. She also has degrees in History and Philosophy from Rhodes University in South Africa.

Documents

You can access any literature about the Fund here, either by downloading or requesting a copy by post (where available).

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.

Annual reports

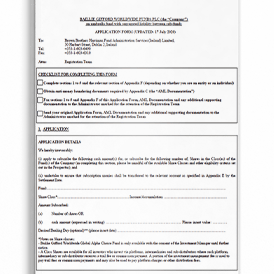

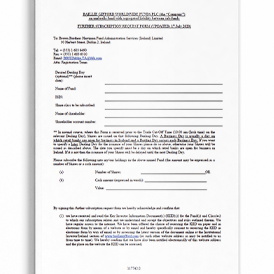

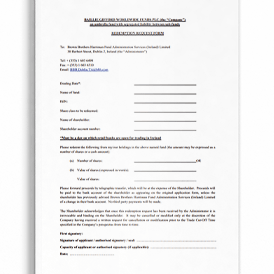

Application forms

Factsheets

Important disclosures

Interim reports

MIFID II ex-ante disclosures

Other fund literature

Philosophy and process documents

Prospectus

Quarterly investor reports

Sustainability-related disclosures and climate reports

PRIIPs key information document

PRIIPs performance disclosures

Further Information

COMPLAINTS CONTACT DETAILS

In the first instance, clients should contact their normal Client Contact with any concerns. Alternatively, or for those clients who do not have a direct client contact assigned, complaints can be emailed to Baillie Gifford’s Compliance Department at: InstitutionalComplaints@bailliegifford.com. A summary document which contains details on Baillie Gifford’s complaints management policy is available upon request. All material complaints are recorded in an in-house incident management system and are escalated to, and dealt with by, members of staff of suitable seniority, independent of the area from which the matter arose.Risks

Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

The specific risks associated with the Fund include:

Custody

Custody of assets, particularly in emerging markets, involves a risk of loss if a custodian becomes insolvent or breaches duties of care.

Emerging Markets

The Fund invests in emerging markets where difficulties in trading could arise, resulting in a negative impact on the value of your investment. The Fund’s investment in frontier markets may increase this risk.

Concentration

The Fund’s concentrated portfolio relative to similar funds may result in large movements in the share price in the short term.

Foreign Currency

The Fund has exposure to foreign currencies and changes in the rates of exchange will cause the value of any investment, and income from it, to fall as well as rise and you may not get back the amount invested.

Environmental, Social and Governance (ESG)

The Fund's approach to Environmental, Social and Governance (ESG) means it cannot invest in certain sectors and companies. The universe of available investments will be more limited than other funds that do not apply such criteria/ exclusions, therefore the Fund may have different returns than a fund which has no such restrictions. Data used to apply the criteria may be provided by third party sources and is based on backward-looking analysis and the subjective nature of non-financial criteria means a wide variety of outcomes are possible. There is a risk that data provided may not adequately address the underlying detail around material non-financial considerations.

Please consider all of the characteristics and objectives of the fund as described in the Key Information Document (KID) and prospectus before making a decision to invest in the Fund. For more information on how sustainability issues, such as climate change are considered, see bailliegifford.com.

Volatility

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Further Details

Further details of the risks associated with investing in the Fund can be found in the Key Information Document (KID), or the Prospectus. Copies of both the KID and Prospectus are available at bailliegifford.com.

Definitions

Active Share: A measure of the Fund's overlap with the benchmark. An active share of 100 indicates no overlap with the benchmark and an active share of zero indicates a portfolio that tracks the benchmark.

Important Information

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. The information in this area is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances should the information in this area be made available to “retail clients” as defined by the Corporations Act.

The information in this area contains general information only. It does not take into account any person’s objectives, financial situation or needs.