Overview

The Worldwide Diversified Return Yen Fund aims to provide capital growth over the long term at a lower risk than that of equity markets by investing in a multi-asset portfolio, including, but not limited to, equities and bonds, Eligible Collective Investment Schemes, other transferable securities, money market instruments, cash and cash equivalents and financial derivative instruments.

Performance & Portfolio

Data is not currently available for this share class.Insights

How to Invest

You can invest in a range of our funds via a number of fund platforms and supermarkets. Certain share classes are available for investment via a number of platforms. Please see the links opposite.

Baillie Gifford does not sponsor, maintain or have any control over the content of any other websites.

Therefore, we are not responsible for the adequacy or accuracy of any of the information you may view, nor do we undertake to ensure successful transmission to any linked website.

How to Invest

Managers

James Squires

James is head of the Multi Asset Team and chairs our Multi Asset and Income Leadership Group. He became a partner in 2018. James joined Baillie Gifford in 2006, initially working in our North American Equity and Fixed Income teams. He has been a CFA Charterholder since 2010 and graduated BA in Mathematics and Philosophy from the University of Oxford in 2005.

Felix Amoako-Kwarteng

Felix joined Baillie Gifford in 2011 and is an investment manager in the Multi Asset Team. He is a CFA Charterholder. Felix graduated BComm in Accounting from University of Cape Coast, Ghana, in 2008 and MSc in Investment Analysis from the University of Stirling in 2010.

Scott Lothian

Scott is an investment manager in the Multi Asset Team. He joined Baillie Gifford in 2015. Prior to joining the firm, he worked as a Solutions Strategist for Schroders in London, led a multi-manager team for BEA Union in Hong Kong, and was a senior investment consultant at Towers Watson. Scott is a Fellow of the Institute and Faculty of Actuaries, and graduated BSc (Hons) in Actuarial Mathematics and Statistics from Heriot-Watt University in 1999.

Nicoleta Dumitru

Nicoleta is an investment manager in the Multi Asset Team and part of the Sustainable Income and Multi Asset Income Portfolio Construction Group. She joined Baillie Gifford in 2013 after graduating BSc (Hons) in Management and Marketing from the University of Manchester that same year.

Documents

You can access any literature about the Fund here, either by downloading or requesting a copy by post (where available).

To download any document you will need Adobe Reader. Please note that we can now provide you with Braille and audio transcriptions of our literature on request. It may take up to 10 days for the transcription to be completed dependent on the size of the document.

Annual reports

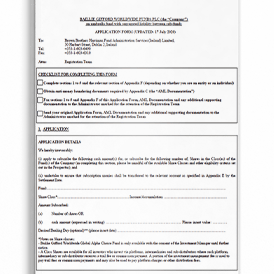

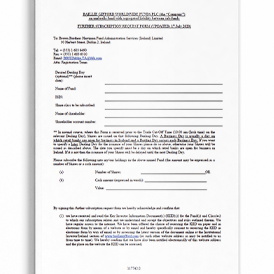

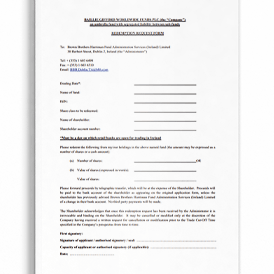

Application forms

Important disclosures

Interim reports

MIFID II ex-ante disclosures

Other fund literature

Philosophy and process documents

Prospectus

Sustainability-related disclosures and climate reports

PRIIPs key information document

Further Information

BAILLIE GIFFORD INVESTMENT MANAGEMENT (EUROPE) LIMITED: REGISTERED OFFICE

Baillie Gifford Investment Management (Europe) Limited is authorised and regulated by the Central Bank of Ireland (No. C182354). Registered office: 4/5 School House Lane East, Dublin 2, D02 N279. Registered in Ireland (No. 625892).COMPLAINTS CONTACT DETAILS

In the first instance, clients should contact their normal Client Contact with any concerns. Alternatively, or for those clients who do not have a direct client contact assigned, complaints can be emailed to Baillie Gifford’s Compliance Department at: InstitutionalComplaints@bailliegifford.com. A summary document which contains details on Baillie Gifford’s complaints management policy is available upon request. All material complaints are recorded in an in-house incident management system and are escalated to, and dealt with by, members of staff of suitable seniority, independent of the area from which the matter arose.Risks

The Fund does not guarantee positive returns. It aims to limit the extent of loss in any short term period to a lower level than equities. Investment markets can go down as well as up and market conditions can change rapidly. The value of an investment in the Fund, and any income from it, can fall as well as rise and investors may not get back the amount invested.

The specific risks associated with the Fund include:

Market Condition

Market values for illiquid securities which are difficult to trade, or value less frequently than the Fund, such as holdings in weekly or monthly dealt funds, may not be readily available. There can be no assurance that any value assigned to them will reflect the price the Fund might receive upon their sale.

Investment in vehicles which themselves invest in a range of assets described previously which may become illiquid may not be easily converted into cash when required.

Custody

Custody of assets, particularly in emerging markets, involves a risk of loss if a custodian becomes insolvent or breaches duties of care.

Emerging Markets

The Fund invests in emerging markets, which includes China, where difficulties with market volatility, political and economic instability including the risk of market shutdown, trading, liquidity, settlement, corporate governance, regulation, legislation and taxation could arise, resulting in a negative impact on the value of your investment.

Bonds & Inflation

Bonds issued by companies and governments may be adversely affected by changes in interest rates, expectations of inflation and a decline in the creditworthiness of the bond issuer. The issuers of bonds in which the Fund invests, particularly in emerging markets, may not be able to pay the bond income as promised or could fail to repay the capital amount.

Alternative Assets

Investments may be made directly in hedge funds or, through specific investment vehicles into property, infrastructure and commodities. Returns from these investments are sensitive to various factors which may include interest and exchange rates, economic growth prospects and inflation, the occurrence of natural disasters, and the cost and availability of gearing (debt finance).

Foreign Currency

The Fund has exposure to foreign currencies and changes in the rates of exchange will cause the value of any investment, and income from it, to fall as well as rise and you may not get back the amount invested.

Derivatives

Derivatives may be used to obtain, increase or reduce exposure to assets and may result in the Fund being leveraged. This may result in greater movements (down or up) in the price of shares in the Fund. It is not our intention that the use of derivatives will significantly alter the overall risk profile of the Fund.

Volatility

The Fund’s share price can be volatile due to movements in the prices of the underlying holdings and the basis on which the Fund is priced.

Further Details

Further details of the risks associated with investing in the Fund can be found in the Key Information Document (KID), or the Prospectus. Copies of both the KID and Prospectus are available at bailliegifford.com.

Definitions

Active Share: A measure of the Fund's overlap with the benchmark. An active share of 100 indicates no overlap with the benchmark and an active share of zero indicates a portfolio that tracks the benchmark.

Important Information

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. The information in this area is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances should the information in this area be made available to “retail clients” as defined by the Corporations Act.

The information in this area contains general information only. It does not take into account any person’s objectives, financial situation or needs.